( )

)

So I’ve been in this space for 4 years, and have traded on over a dozen exchanges since my inception into this space. I have traded tens of thousands of orders spread across: Bitstamp, BTC-e, Bitfinex, Okcoin futures, 796, Mintpal, Cryptsy, Poloniex, BTER, Vircurex, GDAX, Bittrex, 1broker and Simplefx. I’ve examined and played around with the interfaces of several others too, including Mtgox, Huobi, Bitmex and Bitflyer and several others.

I don’t think I’m the best person to be a final decider of what is right\wrong when it comes to the user interface and performance of an exchange because at the end of the day it is rather subjective. I just hope you can understand where I’m coming from with the problems on GDAX as I think they are broad enough to seriously dampen their competitive advantage vs. other companies providing similar products.

That being said, the following are the issues I’ve come to see over the last year on GDAX:

Placing\canceling orders can lag badly. When you cancel an existing limit order, your account balance doesn’t update accordingly. You force me to F5 every time I cancel an order so the website will actually refresh my account balance and allow me to place a new order. This single-handedly is one of the most serious issues.

Awful awful lag on their exchange recently with the website real-time data going down all the time. They have been having extreme difficulty scaling the platform to the new user growth of the last few months so to a degree this is understandable… but Gemini, Bitfinex, Bitstamp, BTC-e and many of the other major long-standing exchanges have not had this issue. The only other honorable laggy mention is Poloniex.

Interface is horrible and has not been updated\upgraded or addressed at all since their launch 2 1\2 years ago.

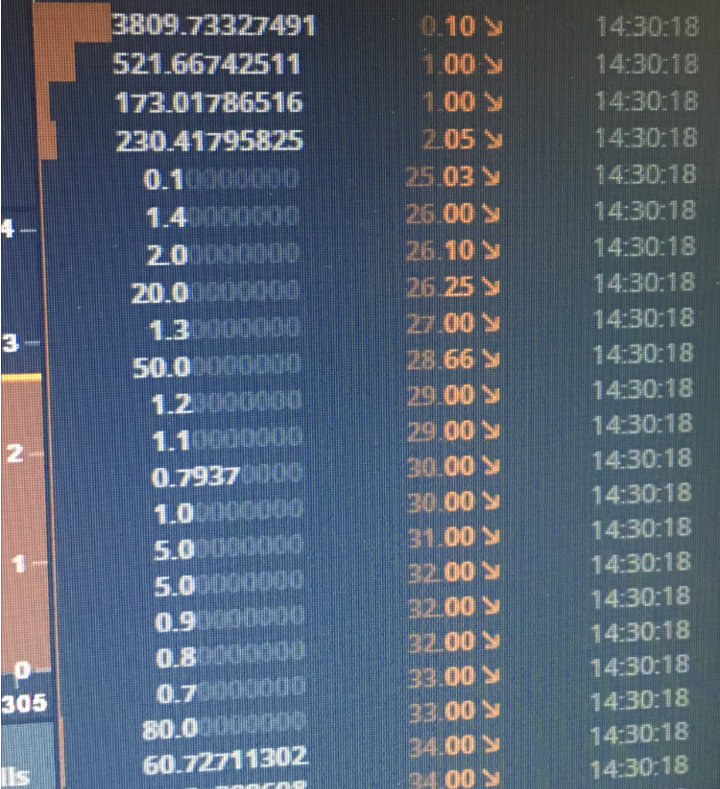

2.1) Very poor use of space for order books\chart\ticker.

2.2) Integrated chart is probably the worst I’ve ever seen on any exchange in this space.

2.3) Liquidation\stop engine is horrible resulting in the flash crash to 10 cents we saw last week. Bitfinex and BTC-e solved this problem YEARS ago by staggering stops\liquidations during major moves to prevent cascading margin calls. I touch more on this below.

2.4) Order entry form is horribly setup. Not intuitive at all to use, I shouldn’t still be making mistakes after using the platform for over a year.

2.5) Order entry auto fill doesn’t work. It does not take into account fees when executing market orders, so it’s “autofill” will say you have insufficient funds and you have to manually lower the value so the order will actually execute. I’ve never seen such an oversight on any other exchange.

Liquidity is decent, but for the amount of traders and activity they have it isn’t as good as I would expect.

Limit-stop orders are difficult to find because of the “advanced” drop down box, 99% of people probably don’t know how to find them, much less use them. Bitfinex and Okcoin integrate advanced order types in a much more professional way IMO.

No order book grouping, just about all of the best exchanges have this feature. Cryptowat.ch and Bitcoinwisdom also both have it.

There have been no upgrades to the exchange since they launched at the end of January 2015. It looks identical to day one. They have zero development outside of new trading pairs and margin trading. E.G these problems I’m listing have existed for months or years:

No advanced order types (trailing stop, iceberg, TWAP, etc). Limit-stop is a step… but there are so many more that can be done.

Inability to customize the UI which is becoming more and more common (E.g able to hide certain elements you don’t want to maximize the use of space from the ones you do want).

No statistics of either your trade history, or the market in general. What trade history is available is in a very poor format, difficult to consume\analyze, and doesn’t offer many data points. Many exchanges provide additional information about their market (swap stats for Bitfinex, open interest and premium for Okcoin futures, p\l trade history on poloniex, etc, etc).

API to Cryptowatch and in general is horrible, the order book represented on Cryptowatch is very glitchy and shows very little bearing to what liquidity is actually on the book.

No volume discount on execution fees like so many mature exchanges have (see Bitfinex fee structure for example)

Refusal to address any of these problems, as I have emailed some of these concerns to them around a year ago ago suggesting on how they can fix some of these glaring problems.

Overall as an day-trading exchange experience, I’d rate them among the worst in the Cryptocurrency space. As an entrance\exit to the Cryptocurrency space, they do that well.

The icing on the cake, or the straw that broke the camels back was how their trading engine handled liquidations. Last week a large market order caused a cascade, ETHUSD hit $0.10 in a fraction of a second. Stop losses and margin calls blew it up. If it was a “small” move from $330’s to $200 or $100 I would be more understanding; but the fact that their trading engine allowed complete execution of almost the entire order book shows a deep flaw in their margin trading risk management system. I believe Bitfinex runs the right mindset in how to handle this. They introduce speed bumps; similar to limit down on traditional stock markets. This prevents egregious mispricing events by allowing the order book to recover for a short period of time - preventing gigantic margin\stoploss cascades in the asset.

Coinbase, Brian, please. You guys have the biggest venture investment in the Cryptocurrency space I know of. You can hire the best talent. You structured your company properly to bring yourselves to the forefront of the interface between the traditional banking system and Cryptocurrency through your broker system. You have the skills to execute a good exchange. But judging by your actions, you aren’t listening at all. You don’t learn from what other exchanges do right. You aren’t continually trying to improve the experience — like I said earlier, it is almost entirely unchanged from when you launched 2.5 years ago. You guys can do better.

And now I suppose it wouldn’t be a bad idea to place my review of the major exchanges in the Cryptocurrency space.

Bitfinex: 8\10. One of the best user interfaces, but banking problems of the last several months, the hack last year, and the lawsuit against Wells Fargo institutes high counter-party risk for having your funds on there. Venture at your own risk, they aren’t as rock solid as other exchanges, but technically the platform is quite good:

Gemini: 7/10 One of the worst user interfaces (separate page for buy\sell? wtf?), but run by the Winklevii twins so it is a highly trustworthy and prestigious exchange. Almost a 10/10 company if you aren’t planning on day-trading.

Bitstamp: 7.5/10 The old guard. Trustworthy and regulated with SEPA transfers, but they lack features. Interface is decent. Only just now adding more trading pairs outside of BTCUSD and Ripple.

Okcoin: 9/10. They used to be the gold standard in user interface, but this gap has been closed drastically by Bitmex and Bitfinex. Not as trustworthy to western citizens as they are China-centrist.

Huobi: 7/10. Worse UI, fundamentals same as Okcoin.

Bitmex: 9/10. First to offer fully customization UI which is among the best in the space. Volume has exploded over the last 6 months. Fundamentally the company is strong, if you want to gamble they may be better than Okcoin futures.

BTC-e: 5/10 or 8/10 depending who you are. Another of the old-guard from the Gox days. Very shady operators, shady wire transfers. However, they are rock-solid reliable. Almost no downtime. No glitches. Lots of trading pairs though liquidity is sparce.

Kraken: 4/10. Very glitchy, laggy, horrible UI, but fundamentally a trustworthy company. Would only recommend as entrance\exit from bank account with SEPA. Not good for day-trading.

Poloniex: 3/10 to 7/10. Very glitchy and laggy as well, some problems are worse than GDAX or Kraken. Major exponential growing pains, I don’t envy their ops or support team. Major regulation hurdles with margin trading considering they’re in the USA. I’m also amazed they haven't been hacked considering they have dozens and dozens of different Cryptocurrency wallets to manage and mitigate attacks from.

There are dozens of others, but I simply don’t have experience enough to comment on them in this manner!

Produced and Written with @lowstrife

https://twitter.com/lowstrife?lang=en