What are the best tips if you want to start setting up masternodes? Good question, and one that needs some explanation. Because, why are Proof-of-Stake masternodes so interesting? Mining is in decline due to the lower value of the cryptocurrency market. It's hard to make a profit in that field. When it comes to the Proof-of-Stake consensus, it's much cheaper to set things up and make a profit. However, the market is filled with scams, empty promises and teams not capable of delivering a product. Simply put, it's a minefield.

You will be scammed

In the past 12 months I have seen a decent amount of scams, and obviously experienced a couple as well. These were hard lessons, but once that are needed to fully understand the market. If you are very interested in Proof-of-Stake and masternode projects, and you want to invest, just know it's very likely you'll be scammed at least once.

I've learned some valuable lessons along the way, and will pass them along to you. Everything in this article requires you to do your own research (DYOR), as that's key to becoming a wise investor! Maybe, just maybe, you won't make the same mistakes I did. If this article is helpful to you, please share it, clap it, upvote it, or gift me a crypto coffee.

High ROI

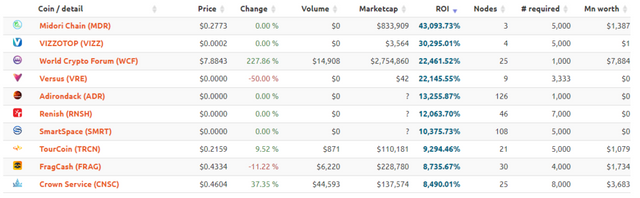

Websites like Masternodes.Online and Masternodes.Pro do a great job in giving you an overview of many masternodes projects out there. But these websites also do a terrible job, because they are good for promoting scams. Their lists are mainly aimed at the Return-of-Investment (ROI) for each project.

Most scams make insane promises. But if you look closely at these projects, you will notice it's impossible to keep value over a six month time period. These projects are made to give early investors an incredible amount of coins as fast as possible. Early in the project the coin will still have a decent amount of value. If you buy a masternode worth $1000, and can get 1000$ worth of coins within a week you'd be stupid not to jump in, right?

The more masternodes there are in a network, the more spread out the rewards will be. Your earnings will half with each doubling of the amount of nodes. The worst part is that there's no utility for the coins yet. Insane amounts of coins get generated with the purpose of trading to create more masternodes, or cash out when you're the scamming project leader.

An insanely high ROI can certainly be a death sentence to a project, so keep your eyes open and don't invest anything you can't miss.

In short:

- Does the ROI sound to good to be true? Than it probably is a scam!

- Don't rely on Masternodes.Online, but do research into the project!

- Never invest in a project based on ROI alone

- If a project is promoting itself based on its ROI, you should be very careful!

Reward structure

A key source of information for a masternode project, is the reward structure. Based on the amount of blocks processed by the blockchain, a masternode project is in a certain phase. Generally rewards start slow, than increase significantly and after that slow down. It's the size and length of that increase, and the speed of the slow down that are crucial parts of a masternode project. It's very delicate, because as a project you want to get as many nodes in your network as possible, but you also don't want to devalue your coin by flooding the market with rewards from the masternodes.

There are projects that increase the collateral needed to run a masternode, as a way to lock away more coins. This can work. I also believe it's key to make the moments of high rewards as short as possible. There will always be a decrease in value when a project isn't finished, but there's no reason to completely devaluate your project by giving out to many rewards. Keeping high reward cycles short, will create enough coins to keep trades going, but not enough to completely destroy the market.

In short:

- Are most of the rewards given out very early in the life cycle? Scam!

Pre-mine

Before a masternode project is launched, developers often do a pre-mine. Generally this pre-mine should be used for payments to developers, marketing purposes and other things that serve the project. What often happens is that scammers immediately sell their premine as soon as a coin hits the market. This way to generate the most revenue when the value of the project is still untouched by the influence of their scam.

It's rather difficult to know how and when developers will use their pre-mined coins. But as an investor you can always ask yourself some basic questions. For example, the pre-mine should not be ridiculously large, dwarfing the rewards of investors for months to come.

In short:

- If the pre-mine is too big, it's a scam!

- Keep an eye on the pre-mine project address, as soon as large sums of coins start moving be sure to track them. When they hit an exchange, start worrying!

Utility

One of the main questions you should always as yourself, is 'why does this coin exist?'. Creating a coin for the sake of a coin is not reason enough to succeed. The developers need to have a reason, and the project needs to solve a problem. Utility for the network and the coin is the most important thing. On top of that, it's crucial to do some market research. With thousands of crypto projects on the market, it's likely that there are several projects working on the same problem. So be sure to check out the competition.

Another problem with utility is that projects often over-promise, just to paint their picture even more beautiful. Sending rockets to the moon, curing cancer, making all poor people wealthy. It's a way to convince you to invest your hard earned cash into their scam. Crypto project that promise to work with General Motors, Booking.com, Unilever or any other established company, is probably a scam. Especially when the people behind the project are anonymous.

In short:

- Does the project serve an utility purpose? No? Then it's a scam!

- Are other teams already working on the same problem? Forget about this one!

- Does the project promise you the world and more? Too ambitious.

- If a coin has no purpose besides staking, privacy payments and instant transactions, it serves no added purpose. Avoid!

Team

When you buy stocks in a company, you know who is in the board of directors, you know who's the CEO, and you can find out plenty of details about the company's financial status. In the world of crypto this type of information is almost non-existent.

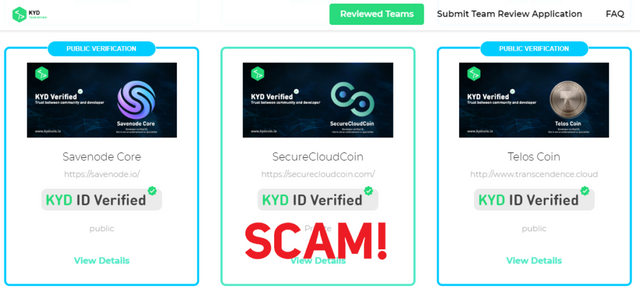

I think it's important for a blockchain project to reveal at least the leadership figures behind the scenes. Know Your Developer (KYD) is one way to do this. Unfortunately KYD has been proven to fall short on multiple occasions. Even though some projects had confirmed their identity through the KYD platform, they still turned out to be scams.

It's important to know who's working on the project. In the past few months I've seen several masternode projects register themselves as companies at the chamber of commerce. That means the names of the company owners are public domain. This already adds some legitimacy to the project.

On top of that I believe it's important that the team is active on social media. They rely on investors to build their network, and therefore the team needs to communicate. Currently Discord is one of the most popular communication tools, but also online services to track product development progress and active social media channels on YouTube and Twitter can help in their favor.

The more anonymous the team wants to be, the more alarm bells there should be ringing. Especially if the project wants to solve a problem in a field where major companies are active. Names are needed in this game! Oh, and the project needs a website, without a website there can't be a deal.

In short:

- Is the team anonymous? Be careful!

- Does the team hardly communicate? Scam!

- Is the team very actively promoting the sale of masternodes? Be warned, likely that this is a scam!

- The project needs a website!

Whitepaper

The whitepaper is basically a mission statement from the developers. In this document, that generally consists out of a couple of pages, the developers explain the problem and how their product will solve it. The whitepaper also gives details about the network specifications, the roadmap for the next 12 months (and beyond), and perhaps some details about the team. Personally I want all these elements to be there, as the bare minimum.

As soon as you read a whitepaper full of grammar and spelling mistakes, avoid the project. If people seek investors and can't even take the time to write a proper whitepaper, they are not worth investing in. Besides, if they can't write a whitepaper how can they write code?

Keep in mind, a whitepaper is really about the project and its impact on the world. It should not be a guide on how to setup a masternode. Also, I believe a whitepaper should not be about explaining what a blockchain network is, nor should it explain masternodes. They should just use a foot note to refer to a source.

In short:

- Whitepaper needs to be well written. If it's full of grammar mistakes, avoid it!

- The whitepaper needs to about the project and nothing else.

- If there is no whitepaper, well... why not play Russian roulette, shall we?

Github

Most blockchain development teams use the source code from other projects the build their own. Bitcoin, Dash, PIVX, these all have blockchains that have been copied by a variety of projects. Even though you're not super technical, it's important to check out Github. Because here you can see what changes have been made to the blockchain source code. Here you can also see when the last updates took place.

This is important, because when a team just blatantly copies a source code and reuses it with a different name tag on it, it's likely you're looking at a scam. When a project copies the source code, makes a change and after that never touches its code again, it's also likely that the project will fail.

Github is a great way to get some insight in the development behind the blockchain source code. You can find out more about the amount of work the team has put into their project. If it's too little, you might know what time it is.

In short:

- Does the team actively work on the project, and can you see that work on Github or another project management website? Interesting!

- No activity on Github? Be warned, likely a scam!

Social media

We live in a world where social media is key. A project without any active presence on social media might as well be dead. There needs to be a steady flow of information on their social media platforms. Twitter, Facebook, YouTube, Discord, whatever they are using, it needs to be active. YouTube not being active is not the end of the world, but a medium like Twitter is easy to keep producing content for. If there's initial activity and after a few days it became quiet, you can avoid the project as a whole. If they opened a Discord channel, but aren't interacting with their (potential) investors, than there's no reason to stick around.

Discord is a very good indicator for the teams involvement. How quickly do the developers respond? Do they help solving problems? Or are they only promoting their masternodes? A team needs to be active, when communication is lacking then there's probably a reason for it.

In short:

- Do they have social media channels that became inactive? Avoid!

- Are their social media channels ONLY used for shameless self promotion? be careful!

I just hope this article will be helpful to you, and you dive into the world of cryptocurrencies and masternodes. The world of masternodes is evolving, as these projects are introducing tiers and Cross-Chain Proof-of-Stake (CCPOS), and exiting Proof-of-Work coins like Ethereum are considering to add POS as a feature. The market for masternodes is maturing, service like Know Your Developer are proof of that, but for now it's still a minefield full of dangers, and these dangers can - at least for a part - be avoided by following the tips provided in this article.

If you liked this article, please share it on your social media, upvote, or clap. Donations are also greatly appreciated. Thank you, and as always be sure to DYOR!

Donations:

BTC | 34CpoxRwJzEzBg7D6DtXTbkUVvzPXyTbKQ

XRP | rD3tSCiBXP1dXbGptreX1VBenoH6oaec1W

LTC | LV2CaMFL7LszxSXTgvrroaebXTFgkEf3Kz

TRX | TKKZvEr8VvrX27jQa52635Xq7SafJAdRCu

ETH | 0x4ccadb03b6d53273e565732f0a472dde82365201

Posted from my blog: https://www.nederob.nl/2018/12/20/20-tips-before-you-invest-in-proof-of-stake-masternodes/