The New York Attorney General's office claims that cryptocurrency exchange Bitfinex lost 850 million dollars, and used funds from the affiliated stablecoin Tether (USDT) to secretly cover it all up. Now iFinex, which owns both Bitfinex and Tether, is being ordered to stop violating New York law and defrauding New York residents, according to a press release on Thursday.

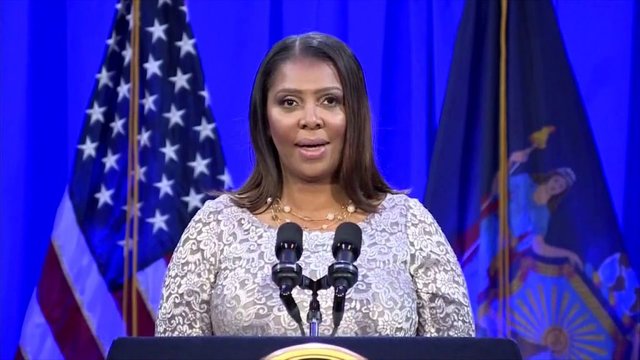

New York Attorney General Letitia James said that her department 'led the way in requiring virtual currency businesses to operate according to the law'. They 'seek justice' on behalf of those who have been 'misled or cheated by any of these companies'.

According to the statement from the Attorney General's office Bitfinex sent 850 million dollars of customer and corporate funds to Crypto Capital Corp. This is a payment processor that holds funds for other exchanges as well, including recently headlining QuadrigaCX exchange from Canada. Tether's reserves were used to make up the shortfall, but neither the loss nor the moving of Tether's funds were reported or disclosed to customers.

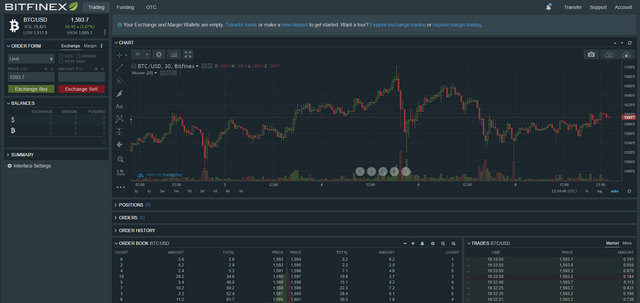

The reasons for the investigations were that Bitfinex apparently still allowed New York-based individuals to deposit, trade and withdraw virtual currencies on the Bitfinex trading platform. By law, that should not be allowed. The Attorney General makes clear that trading on Bitfinex can continue without issues as they are not seeking to 'prevent legitimate trading on Bitfinex'.

It's not the first time Bitfinex and Tether hit the spotlight in a negative way. USDT hit the news late last year, when its solvency and backing by actual dollars were doubted. Ultimately Tether Ltd. announced that its stablecoin may not be entirely backed by dollars only, suggesting the coin is backed by fiat, cryptocurrency and perhaps other valuables like gold or real estate.

The news of the investigations into Bitfinex hit the crypto market. Bitcoin, Ethereum, Litecoin, Ripple and EOS are all down in value, slowly recovering again. The value of the USDT token also lost its one dollar value, as it dropped sharply to $0.98, after which it slowly recovered to $0.99.

Just hours before the New York Attorney General made its intentions public, Tether had issued 300 million new USDT tokens into the market. Probably to cater the needs of the Chinese market, where investors are using USDT to circumvent certain legal constructions. This brought the market cap of Tether to a new all-time high of 2.8 billion dollars.

Posted from my blog: https://www.nederob.nl/2019/04/26/bitfinex-used-tether-funds-to-cover-850-million-loss/