Cryptocurrencies and digital money have the potential to replace banknotes and coins in the next decade. According to research from Deutsche Bank the current money system is fragile. This is a trend mainly driven by decades of low labor costs and inflation. Before digital currencies can take over, governments and regulators need to legalize it as a payment method.

The German bank wrote a research called Imagine 2030. In this report Deutsche Bank says that cryptocurrencies are currently just additions to the current money payment system. However, in the next decade they could be replacements.

Cryptocurrencies need to overcome three main hurdles to become widespread. First, they must become legitimate in the eyes of governments and regulators. That means bringing stability to the price and bringing advantages to both merchants and consumers. They must also allow for global reach in the payment market. To do this, alliances must be forged with key stakeholders – mobile apps such as Apple Pay, Google Pay, card providers such as Visa and Mastercard, and retailers, such as Amazon and Walmart. If these challenges can be overcome, the eventual future of cash is at risk.

Deutsche Bank Research (December 2019)

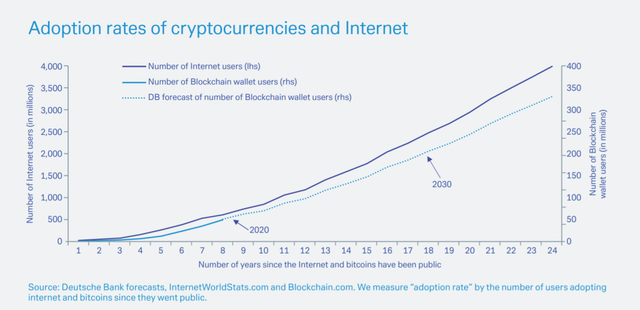

Deutsche Bank predicts that the amount of users will quadruple in the next ten years to 200 million people. This would almost be the same speed of growth as the internet had in its first twenty years.

Cards will disappear first

Even though many in the cryptocurrency space talk about how crypto can destroy fiat, Deutsche Bank thinks there's a different victim. The rise of mobile payments through WeChat Pay, AliPay and Paypal makes debit and credit cards redundant. China is almost a cashless society, while only 8 percent of the European consumers use digital payments like Apple Pay or Google Pay. However, retailers are accepting these payments more often, and the technological advancement over classic card systems like PIN are obvious. Deutsche Bank considers it 'a matter of time before smartphones make plastic cards an obsolete tool'.

Even though cryptocurrencies are on the rise, there's still the problem of technology. Natural disasters could cripple a blockchain, while electricity shutdowns or cyber attacks are other examples of potential threats.

German banks want crypto

Next year Germany is very likely to accept a law that will make it possible for institutional banks to offer crypto services, including bitcoin custodial wallets. The law is already approved by the Bundestag, and is now awaiting approval from the sixteen states of the Bundesrat. The law would implement the 5th Money Laundering Directive of the European Union. Members of the EU have until January 10th 2020 to implement the directive.

At the same time German banks want a digital euro. The digital system should fit within a state-determined system, where the state has the responsibility for the monetary system. Even though the German bank association claims that the digital euro will gain importance, they also state that the existing system should not be abandoned. They want a state-owned cryptocurrency, because a private global digital currency like Facebook’s Libra will only cause economic and political conflict.

Posted from my blog: https://www.nederob.nl/2019/12/10/cryptocurrencies-could-replace-money-within-10-years/