Old money is trying to suffocate new money. This is not happening all time and by everybody, but it's happening all around us. Institutions and governments trying to regulate or even destroy something they consider a threat. The funny thing is, it's all natural. Growth and evolution never happen smoothly. These changes often come with lots of hurdles, like resistance from those who benefit the most from the old ways and those who don't yet understand the new. While new ideas and progress create a revolution, a wave that can not be stopped.

Digital money is the future of our financial system.

Whether that's going to be bitcoin, a variety of cryptocurrencies or a central bank digital currency remains to be seen. Like I said, not everybody is happy with this evolution. Those sitting on the Iron Throne don't want the world to change, and they will try to influence this new threat to their own benefit. Depending on the size of the incoming threat and the power of those on the throne the changes will be severe, or slightly. It will be the difference between bitcoin or a central bank digital currency. However, change is coming.

New crypto money woke up old money

Ever since Bitcoin launched on January 3rd 2009 the cryptocurrency grew its power, hiding in plain sight on the internet. Hardly anybody card about cryptocurrencies until the market had a major bull run that caught the attention of mainstream media in 2017. Governments and regulatory institutes started thinking about anti-money laundering and know-your-customer procedures that would move crypto trading out of its grey area. Yet, with just a couple of million users the cryptocurrency space can hardly be considered a threat.

This was the general consensus until Facebook announced its idea for a stablecoin called Libra in the summer of 2019. Suddenly governments all over the world were on high alert, because Facebook would have the reach to provide financial services to approximately three billion people all around the world. This would undermine the financial system imposed by countries thinking in borders, passports and markets. The U.S. Federal Reserve, the European Central Bank, the members of the European Union and many others called for strict regulations, anti money laundering systems or even strict bans on crypto currencies that pose a threat to a national currency. Some of them even consider to launch their own digital money in order to compete with the rise of cryptocurrencies.

We've seen it before...

Defending the old ways

Change is scary. Of course. Those we're used to the ways of the old don't want things to change. Those who are benefiting from those old ways definitely don't want things to change. This is the case with many inventions, from horse carriages criticizing the invention of automobiles to the telegraph business turning down the invention of the telephone.

“Printed books will never be the equivalent of handwritten codices, especially since printed books are often deficient in spelling and appearance.”

Johannes Trithemius (In Praise of Scribes, 1492)

Inventions like the telephone, the Sony Walkman, and the cellphone were criticized. Sometimes even the people creating them didn't really believe in their potential. On top of that there's a long history of journalists overlooking or underestimating the impact of inventions. TechCrunch was among the publications that predicted that the iPhone and its lack of buttons would fail horribly.

That virtual keyboard will be about as useful for tapping out emails and text messages as a rotary phone.

Seth Porges, TechCrunch - The Futurist: We Predict the iPhone Will Bomb (2007)

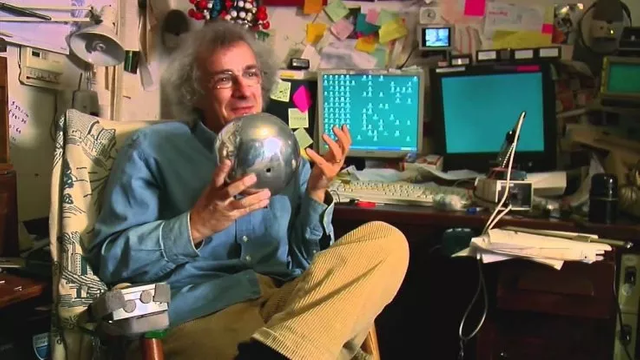

In 1995 Clifford Stoll wrote a column for Newsweek that's still online today. He didn't believe in a future with people working online, interactive libraries, multimedia classrooms, web shops, and daily newspaper would never be replaced by online databases. "Baloney", he said.

People need to open their mind to even process the concept the change and what it would mean for society as a whole. That, my friend, is one difficult thing to process. And of course there's the concept of power. You don't want a new technology to take away your power right? Old money desperately wants to stop new money.

Banks and governments be like

The European Union and the European Central Bank are enforcing new anti-money laundering directives in order to regulate cryptocurrency and blockchain businesses. The latest is called AMLD5. As a result blockchain companies need to know who their customers are, while also keeping an eye on transactions and possible criminal activities. This has already meant the end of smaller crypto companies who don't have the capabilities to deal with the additional amount of work. For example Bottle Pay in the United Kingdom has seized its operations because the regulations would alter their business too much.

In The Netherlands a secret memo between the Dutch Central Bank and the Minister of Finance leaked. This document indicated that crypto companies might face additional rules beyond what is outlined in AMLD5. Like obtaining a special license. Mining pool Simplecoin, crypto exchange Coingarden, Post a Coin, and other companies have already closed their doors. While Deribit, probably the biggest exchange in The Netherlands, is moving to Panama in order to keep operating.

Many of the companies closing or fleeing from the regulations state that money is the biggest issue. In order to comply with AMLD5 it's estimated to require anywhere between 50 and 100 thousand euro. This is a tremendous amount of money for any startup. On top of that companies are under constant financial supervision from the central bank, as part of Dutch law. One of the complains is that the Dutch central bank says it's a registration system, while it actually works more like a permit.

Old money is trying to stop new money from changing the seats of power.

The Crypto Revolution

No matter where you are in the debate, one can't deny the influence of cryptocurrencies on world. Blockchain technology is changing the way businesses are run and supply chains are organized. Decentralized Finance (DeFi) is one of the latest innovations that's gaining lots of traction. No matter whether digital money and bitcoin will push away coins and paper money, the banking system will need to change. Financial services will become more secure and transparent. Above all blockchain will make these services more cost effective and efficient.

Whether bitcoin will ever become a mainstream money of the internet age, remains to be seen. But this digital currency is causing waves of changes that will leave their mark on society for decades to come. Bitcoin is empowering, blockchain is empowering, and in the end it will be up to the people. Yet, old money is trying to stop new money.

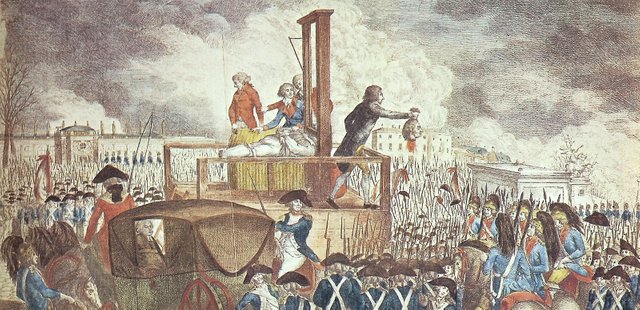

Funny thing is, this all happened before. A ruling class to clumsy to see change in society, world leaders that are causing so much depth and inflation, costly wars that lead to revolt among the population, and people who wanted change. During the French Revolution the people had overthrown those in power, and the concept of representational democracy and property rights originated here.

Currently banks are slowly introducing negative interest rates. Governments want to ban cryptocurrencies or keep them under complete control. At the same time the national depth of the United States and many other countries is higher than ever before. Inflation is making the people's hard earned money less valuable over time. Using the old banking system is no longer useful to retain your wealth, and therefore alternatives need to be found.

Bitcoin? Crypto? Change is scary. They will try to stop change from happening. That's how it's always been.

Posted from my blog: https://www.nederob.nl/2020/01/15/when-old-money-wants-to-suppress-new-money/