If you are into cryptocurrencies, you must have noticed a $400 billion market cap decrease in the past few days. Do you wonder why it happened? You’ve asked yourself whether or not you want to HODL based on the explanations below.

If you bought into crypto at the top, do not have a weak hand. If you sell now, the value of your coins will be lost. If you had bought into cryptocurrencies at the bottom or at least a year ago, you will find this crash a normal phenomenon. People who have invested over a year ago are happy to this healthy pullback. Who is to stop them from investing more when they see the new bottom? This provides a boost to investor confidence in the long run.

In January 2017, the market cap was around $16 billion but skyrocketed to $830 billion earlier this month. The growth represents 95% of the new investors coming into the crypto space just 2017 alone! This means the emerging crypto market is penetrating to an existing economy and making the cryptocurrency market extremely bullish. It’s a revolution for the people, having money decentralized from government organization and financial institutions.

If you bought into crypto at the top, do not have a weak hand. If you sell now, the value of your coins will be lost.

In this article, we will be focusing on the six factors that contributed to the market crash.

Bitcoin Scaling

Bitcoin Core development team has experienced sluggish growth and improvement. Because development has been lagging, many altcoins had the opportunity to rise, causing a bullish market in the altcoin market. Ripple, RaiBlocks, and privacy coins such as Monero and Verge, for example, saw substantial increases in value because they provide faster transaction times, increased privacy, and security. They have captured their opportunity to grow as they get listed in multiple exchanges.

The problem with Bitcoin right now is centered on scalability issues.

The problem with Bitcoin right now is centered on scalability issues. Unconfirmed transactions numbered between 150,000 to 200,000 lead to the delay of transfers between wallets and exchanges, thus lowering the demand for Bitcoin. In turn, Bitcoin has become a store of value for cryptocurrencies rather than a coin to transact with.

SegWit was created as a temporary solution as a process by which the block size limit on a block chain is increased by removing signature data from Bitcoin transactions (https://www.investopedia.com/terms/s/segwit-segregated-witness.asp). Bitcoin SegWit is still under development, however, and is separately stored in crypto wallets.

Exchanges, such as Coinbase, were not able to implement SegWit into their platform wallet, creating block chain network congestion Until Bitcoin Core merges SegWit into wallets the congestion issue will continue to be severe.

Adjacently, until Bitcoin releases their lightning network, it would be difficult to see the Bitcoin value to rise to a new level.

To learn more check out the Lightning Network

Bitcoin Futures Market

Bitcoin Futures Market

Bitcoin Futures came in 2017 in separate waves. CBOE came in mid-October followed by CME Futures in December 2017. More Bitcoin Futures are on underdevelopment from the NYSE while others are being implemented into the cryptocurrency market.

But you ask, what exactly are futures or futures contract? Futures contracts do not directly purchase Bitcoin. It is an agreement traded on an exchange to buy or sell Bitcoin at a fixed price but to be delivered and paid for later. In short, it allows investors to lock down specific buy or sell prices at a later date. For example, if an investor wants to sell Bitcoin at $14,000 by the end of January and at the date of exercise of the futures contract the price of Bitcoin is $10,000, the investor will earn $4,000 profit per bitcoin sold.

Wall Street can short Bitcoin prices to be able to buy Bitcoin for a lower price when they want to come into the market with a Bitcoin backed ETF

With the release of Bitcoin Futures, it created a scenario that will squeeze the Bitcoin price to a lower level. This predictive feature allows Wall Street to short Bitcoin prices to be able to buy Bitcoin for a lower price when they want to come into the market with a Bitcoin backed ETF (Exchange-Traded Fund). But due to the limited supply of BTC, it is not strategic for financial institutions to back Bitcoin-based futures. However, through futures contracts, they can buy Bitcoin at a lower price.

Wall Street won their first ordeal when the price of Bitcoin dropped from $19,000 to $10,000 in late December 2017.

Bitcoin Futures Contracts alone have decreased the value of Bitcoin and consolidated the price between value and future value. Hence, Bitcoin valuation has been suppressed in the past few months.

Chinese Government Crackdown on Crypto Miners

The latest crackdown by the Chinese government started with crypto miners. Miners were leveraging cheap electricity in rural and remote areas to mine. This presented concerning issues for the Chinese government because miners were not paying the proper taxes and utilities for electricity. The government stated people not only need to pay taxes on exchanges, but on profits earned from mining. This is not the final blow from China, 2018 will be the year of global regulation on cryptocurrencies; more will come.

Chinese governments concerning issues come from miners not paying the proper taxes and utilities for electricity

Major crypto mining companies such as BitMain are moving their facilities into other countries that will allow them to utilize cheap electricity to continue their operation. Currently, Bitcoin miners in China use up to 4 gigawatts of electricity, equivalent to three nuclear reactors’ production levels (https://www.forbes.com/sites/sarahsu/2018/01/15/chinas-shutdown-of-bitcoin-miners-isnt-just-about-electricity/#24fc3ec6369b). They represent 70% of the mining power in the block chain network (https://www.buybitcoinworldwide.com/mining/china)

In the next few weeks or coming months, you may experience a decrease in hash rates in the short term until Bitmain is fully situated.

South Korea Government Crackdown on Crypto Exchanges for Alleged Tax Evasion

The South Korean crypto market has been extremely hot. In the past few years, the adoption and acceptance of block chain technology has penetrated the general population more than anywhere else in the world. Because many people in the Korean government saw crypto investors as gamblers, the government sought to step in to prevent economic corruption.

The Korean government saw crypto investors as gamblers, the government sought to step in to prevent economic corruption

If you want to want to arbitrage the Korean market because of the cryptocurrency premiums, also called “Kimchi Premium,” which is a roughly 50% market for a single coin like Ripple, the crypto trader must provide legitimate reasons to transmit money overseas in order for the money to leave the Korea. On top of that, the government faces bigger challenges against Korean crypto investors abusing the unregulated market in such a way they do not pay taxes on capital gains (tax evasion). Arbitraging the market could have jeopardized the Korean economy.

The Korean government mandated implementations of KYC (Know Your Customer) platforms so Bitcoin exchanges can validate users to tax capital gains and prevent money laundering.

Just last week on January 11, 2018, the government raided and shut down exchanges that required no validation. The biggest exchange shut down in South Korea was Bitthumb, representing $6 to $10 billion in daily trading volume. http://fortune.com/2018/01/10/south-korea-cryptocurrency-exchanges-raided/.

During the raids, exchanges were order to prevent users from deposit money any money into their platforms, which caused the global market to panic.

This factor alone contributed to the massive fear that started the downward trend of the global market cap.

In recent days, many global markets excluded the Korean market cap leading to fear and doubt because newly joined investors were not educated on the isolation of the Korean market.

BitConnect

Many of you may have unfortunately invested in Bitconnect Coin (BCC). It has long suspected by many in the crypto community of being a Ponzi scheme. Bitconnect even made it to the Top 10 Coinmarketcap in late October 2017. The reason BCC experienced an increase in value was because users were not able to withdraw their bitcoin from the Bitconnect exchange. Once it was put in, the bitcoin was locked in up to 299 days. Upon completion of 299 days of investment, you will be paid back in fiat for the price of bitcoin you’ve locked in from day one.

BitConnect is long suspected by many in the crypto community of being a Ponzi scheme

On January 16, 2018, attributing to “continuous bad press” surrounding the platform, two cease and desist letters from both Texas and North Carolina’s securities boards, and continuous DDos attacks, Bitconnect announced the shutdown of their operation (https://bitconnect.co/system-news/94/changes-coming-for-the-bitconnect-system-halt-of-lending-and-exchange-platform).

While Bitconnect says they’re refunding all outstanding loans at BCC rate of $300, the BCC value dropped by 95% on the day of announcement. The shady part of the operation was users having to deposit bitcoin and Bitconnect paying the users out in fiat currency. In order for Bitconnect to give investors money, they had to sell massive amounts of bitcoin owned to pay back what was owed to investors. On other exchanges, BCC was only able to sell at a tiny fraction of the price.

This massive sell-off was the last straw on the camel’s back that decreased the bitcoin price even further.

Holiday Sell-Offs

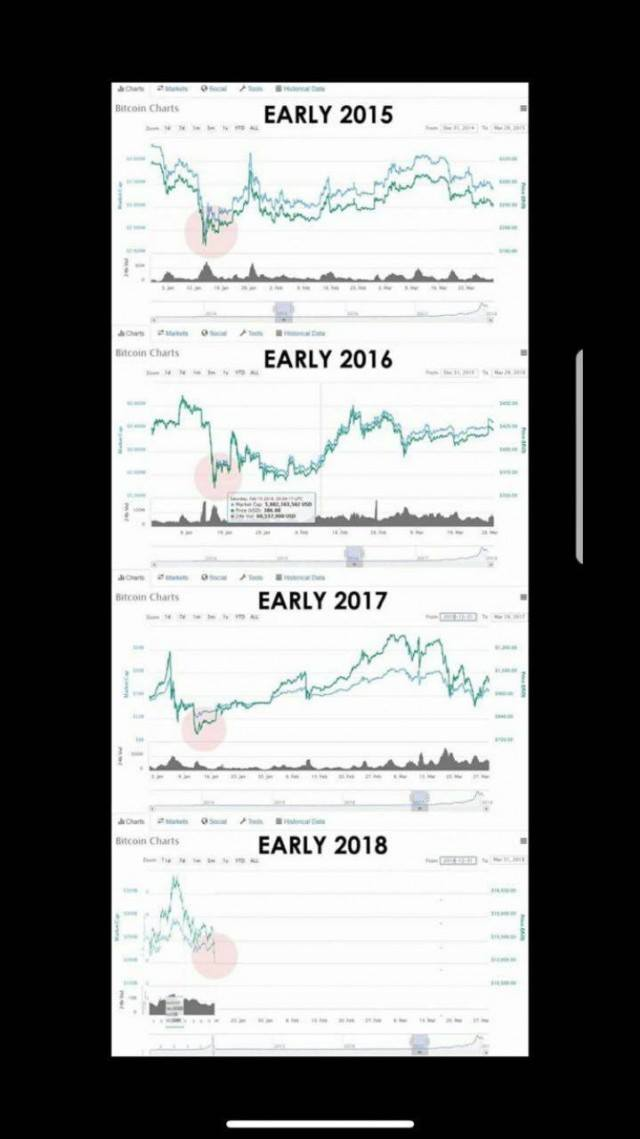

Just last month in December, there was a massive sell-off of cryptocurrencies. Many people in Western countries were cashing out for the holidays causing the market cap to drop. However when January came around, prices of crypto continued to increase. This anomaly called the January Effect, which also occurs in the stock market.

See left for comparison for the last three years:

We will see a similar event take place in Asian markets when the Lunar New Year approaches in February.

In conclusion, governments worldwide have been cracking down on people abusing the unregulated market of cryptocurrencies. As we enter 2018, it will be the Year of Regulation, which will move the market forward by brining qualified investors and ICOs into the market and steer clear of fear and uncertainty. A healthy pullback is nothing to worry about because it is a normal phenomenon in the cryptocurrency market. Though reduces the gains many have experienced over the past few months. This should not be seen as a crash, but more like a correction. This is unavoidable in order for the cryptocurrency market to continue growing.

So HODL!

If you enjoyed reading this article, please CLAP, SHARE and follow our page. We will provide coin analysis at the request of the community. News articles will be released weekly to discuss current events in the Crypto world.

If you have any questions, please leave a reply in the comments section, email us at [email protected] or send us a tweet at @CryptoThrones

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@CryptoThrones/crypto-market-crash-what-you-need-to-know-9323d2c4fe46

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello, I am the same creator for the content on medium as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @noobpudge0! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @noobpudge0! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit