Hi! I’m Will, a Bitcoin enthusiast and a finance student. I have previously worked in research at a top brokerage firm in Paris and am currently a blockchain analyst for a consultancy company. This post is part of a series concerning bitcoin's growing acceptance as a financial tool and its uses.

Since a lot of people wonder about how to include Bitcoin in their portfolio, we will tackle the use of Bitcoin as a hedging instrument. Hope you enjoy the read.

Bitcoin has become more mainstream in the past few years and one trend seems to stick out about its price: it goes up whenever something goes wrong. Because of this Bitcoin has been likened to gold: a somewhat safe haven for your money, away from the turmoil of financial markets.

Hedging is defined as ‘reducing the risk of adverse price movement in an asset or a portfolio’. The best way to understand it is to see it as an insurance against a negative event. For example, if you buy insurance for your house, you are ‘hedging’ yourself against risks such as fires or beak-ins.

So can Bitcoin be as successful as gold to hedge your investments? Let’s take a closer look.

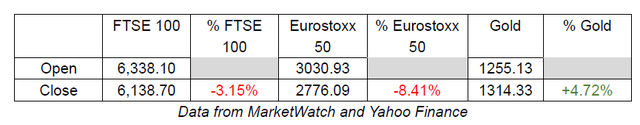

Usually when hedging, you most of all want to be protected from huge swings in prices, so let us take one of the most recent examples. You guessed it, Brexit!

As we expected from such an event, stocks tumbled the next day, while gold experienced a phenomenal move to the upside.

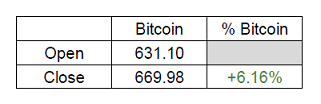

By now, you must be wondering what happened with Bitcoin?

Well, if it really worked as a hedging instrument, its price should have gone up, just like gold and… It actually did! But it ended up being nothing special compared to its usual behaviour.

Daily Chart – Bitcoin Wisdom, using Coinbase prices

Intraday Chart – Bitcoin Wisdom, using Coinbase prices

It then seems Bitcoin does not perform well as a hedging instrument. A few reasons come to mind:

- Bitcoin’s volatility

- The existing variety of existing hedging products among which futures and options

- Gold is the go-to standard to hedge against potential downside

That’s all for now folks! I hope you enjoyed this short introduction to bitcoin’s worth as a hedging product. We will go into more details and follow a more statistical approach in a future post.

Have any question? Let me know in the comments! :)

Congratulations @novelty! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Perfectly!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @novelty! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The semi-finals are coming. Be ready!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @novelty! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit