The question on every crypto traders mind right now is.... Are we there yet?

For the last month, traders have sweated it out as the market has drifted, often slowly, back down to levels previously seen in November before the fast run up to 20k.

So, are we there yet?

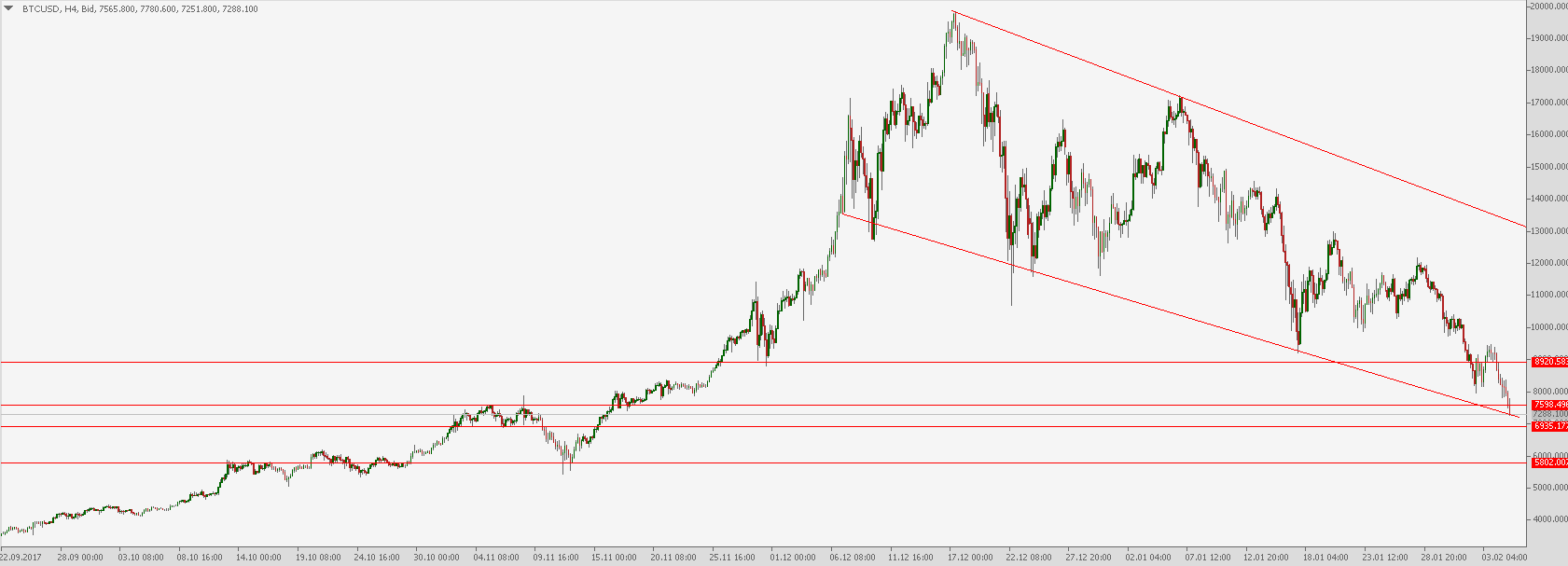

If we look at the chart we can see that BTC/USD has now reached a fairly important demand area for buyers to re-enter the market. A lot of the weaker hands have already sold their coins and the more institutional and long term investors have started to accumulate. Buy volumes are starting to increase at discount and so we now look at what is next.

From a technical point of view the downside risk iss limited to $6000 which isn't much further to go however, we see this as being a bit of an overstretch given the congestion on the way down.

A more likely scenario is a rebound back up to $12,000 in the near term and a market decision on the trend going into northern hemisphere summer to be determined from there. Upside levels are at $12,000 $14,500 $17,000 and $20,000 give or take a few pennies.

Currently there are no real fundamental reasons to suggest an even longer term downtrend with the exception of surprise regulations from the US or EU which could occur at any moment, so pay attention to these possibilities.

We favor the upside potential of bitcoin and will keep you updated as things progress.

You can follow us on social media:

Twitter: https://www.twitter.com/omicrex_crypto

Facebook: https://www.facebook.com/omicrex

Telegram: https://t.me/omicrexanalytics

website: https://www.omicrex.com

Which events should boost the Bitcoin in the next weeks or months? If there is no fundamental further utilization of Bitcoin in specific countries (which is not realistic) there is no real bottom for the Bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Japan has a significant adoption of BTC. But ultimately the fuel for BTC will most likely be the interest in other projects as the majority of coins are traded against BTC. I think a lot of the newer coins are taking adoption a bit more seriously than BTC right now as BTC has been focusing on upgrading tech rather than adoption mechansims. As more coins adopt fiat/coin pairings BTC will start to stumble but until then I am bullish long term.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Any certainty, even if it means strict world wide regulation from G20, would be a boost. Uncertainty drives the weak out of this market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My bet is that we still are not at the rock bottom and should curve up from around 4700 level.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its a possibility but I think there is a lot of buy side traffic to get below $6000. Anything is possible, if it does continue to go down it won't be as fast as it has been, it will be a very slow, painful drift.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wouldn't be surprised if it jumped back 1 or 2 times with about 10% increases but would sink for the rest of February until mentioned level, before curving up on March.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep bottom out on the 6800 I feel....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it will continue to fall as people sell of from fear. bitcoin is not really useful in anyway. other cryptos have use beyond the "value" of their coin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit