Not only Bitcoin, the entire crypto-ecosystem is currently quite turbulent - how should we behave now and in case of a possible price drop?

Maybe one or two readers were similar this summer: the Bitcoin and Altcoin courses went up and up in June and there was no end to it. When the "big" price crash came, some were almost relieved, but offered this opportunity to buy. In the wake of Chinese prohibitions and negative remarks by Dimon, the situation was repeated at the end of August.

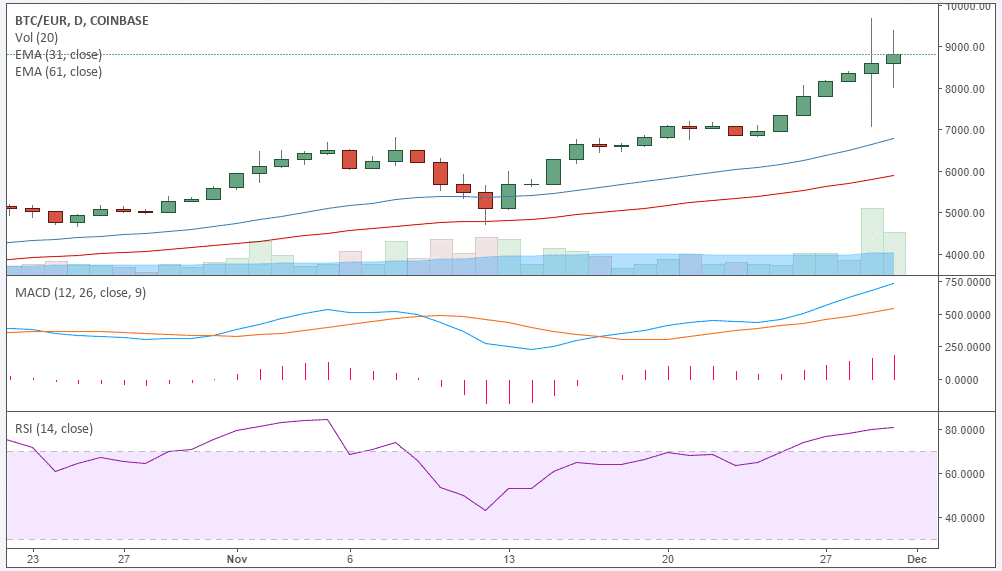

In the current price collapse, many are wondering how to behave. The Bitcoin price has risen to over $ 10,000 and almost reached the $ 10,000 mark. Even in the flash crash, the price has not fallen below 7,000 euros, a value that seemed unattainable just a few weeks ago and is currently around 8,000 euros.

This recent, slight course correction made many nervous - by the way, not much has happened in the long run:

That's just mentioned by the way. Motivated by the price fluctuations, one requested instructions from different sources on how to behave now in order to make as much profit as possible. To be perfectly honest, we at BTC-ECHO do not have the recipe for making incredible profits in the current price situation and consolidation afterwards. Of course, in price analysis, market analysis and crypto compasses, we give estimates about price behavior, but we do not take action from anyone. In this series of articles, however, I would like to give some basic pointers regarding this action.

Trading and investing - decide!

One question to ask is: am I planning a long-term investment or am I a trader?

Not a few tend to both. You can do this controllably, but you should strictly separate these two approaches, ie have a pot for the long-term investment, another for trading. If you do not do that, you tend to just pursue trading half-heartedly and emotionally. That's a good way to lose money. You then jump emotionally into trades without any real strategy, leave it there and in the end you are disappointed that the price has fallen by 20% - if you had left your money in Bitcoin!

To clarify the question, which you can easily call "Trader vs Holder", for yourself, one more question must first be answered: How much time do I have? For professionals, the long-term investor's approach is often better; You regularly invest money and enjoy the accumulation. Should it come to the seven lean years, you are pleased that you can buy cheap at the moment.

As a trader, you have to realize that trading is a full-time job as long as you hold positions. Sure, you can control a lot about stop losses and targets, but if you do not want to do algorithmic trading , you have to do something, at least when choosing a good entry moment and updating the stop loss and target.

It is a Mindset - How to Keep a Course on Cryptocurrency Trading

I have the impression that many simply do not have the right mindset. "It's a mindset" not only roars Eric Bugenhagen , but applies both in trading as well as long-term investment.

First and foremost, this mindset requires one thing: control over one's own feelings. If you have them under control, you will also be able to develop good money and risk management.

Greed and fear are in the way of many. It is annoying: If you had sold everything in time and you had put everything back in time in crypto! You would be a millionaire!

The problem is that these perfect moments are usually recognizable only in Rüchschau. Of course, trends, indicators and patterns, support and resistance can provide guidance, but often it's your own emotional state that keeps you from selling or shopping. You wait for the dip to go deeper, then you will invest in Bitcoin. You wait until the end of the rally to sell at the maximum. If you act then you are often dissatisfied - if you had sold / bought earlier!

Worse yet, if you act impulsively - you get Bitcoin Cash rising dramatically, you're selling all your Bitcoin in favor of Bitcoin Cash - and the price is falling.

In both cases, in addition to any losses above all one striking: The investor is ruining his day.

Therefore, it should be emphasized once again that one should adjust his mindset first, so that the feelings fear and greed do not control one. The classic advice "Invest no more than you can handle" is not just a tip to prevent a private bankruptcy, but rather a tip to avoid exactly these pitfalls. You should therefore think about what you could get over.

The mindset is that you do not sell easily. The rule may be slightly different as a trader than in the case of the long-term investor, but if the price plummets dramatically, one does not sell nervously in either case. You see, if there is a fundamental reason for the case or if it is the usual fluctuations. Otherwise, you sell when you want to exchange cryptocurrencies in Fiat or spend them on goods - say: if you want to treat yourself or (in the case of the trader) means that you have reached his trading goal.

In terms of mindset, you will also gradually notice that the perception of profit and loss changes: price gains are of course something pleasant, but in the case of price losses, you will see not only the dwindling portfolio, but above all buying opportunities. This view should be cultivated, as it gives you a certain peace in times of price fall.

So far, some thoughts on the mindset. In further articles the way of the investor and the trader should be illuminated even more exactly.