bitseven.com - A drop in the bitcoin price’s daily moves has lowered the market’s expectations of reclaiming a five-figure valuation anytime soon.

Options Traders Not Bullish on Bitcoin

Skew — a crypto analysis blog authored by two London-based derivative traders — claimed that bitcoin has only a 19 percent chance of breaching the $10,000-mark by June 2019. The report rested their analysis on the expected outcomes of bitcoin futures that are expiring by the third week of the last Q3 month, explaining that the volatility embedded in the price of these crypto options has come down enormously, as CCN has previously reported.

Uncertainty in an options market traditionally pushes the odds of an outcome. If the volatility of an underlying asset increases, it allows speculators to achieve their options targets before the contract expiration date. Therefore, higher volatility translates into a more significant price of an option. The year-long volatility meltdown in the bitcoin options market threatens to spread into the next year, with the asset currently moving only 1.5 percent on average per day. It ultimately has led options investors to reduce their bullish probabilities of reaching $10,000 in the mid-term.

“Investors are now expecting the current period of calm will extend well into next year,” the report explained. “Prices of bitcoin options expiring in June 2019 have come down significantly – in particular the upside strikes. The market assigns a 19 percent probability of bitcoin being above $10,000 by end of June next year versus 27 percent at the start of October.”

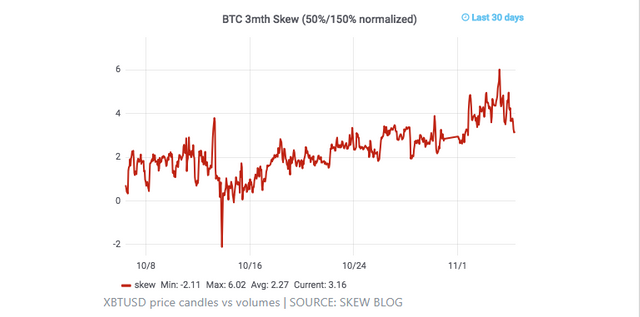

Calls Sold during October Rally

Skew found that investors’ expectations from their bitcoin options were relatively higher in October than in any month this year. The month saw the digital currency rising unexpectedly during the mid sessions, a rally later credited to the fall of a so-called stablecoin tether. As a result, the price of options — or implied volatility — surged, leading to many investors exiting profitable positions before the expiry date.

“The ratio of option buyers to sellers has been on average 84 percent with four occurrences below 50 percent,” Skew said. October is one such month.

“The sell-off in vol is interesting in the light of the coming catalysts in Q1 next year (bitcoin 10 years anniversary, CBOE, ETFs approval by the SEC, institutional inflows with Bakkt & other exchange ventures starting operations). The 29Mar19 $10,000 call costs 125 USD per bitcoin option, less than 2 percent of current spot,” the blog added.

At the same time, another call has a 4 percent probability of bitcoin being above $20,000 by Q2 2019.

bitseven.comBitcoin leveraged trade at 100x leverage maximum, 100% profit at 1% price raise

Make a profit whether the bitcoin price rises or falls

BITCOIN LEVERAGE TRADING YOU CAN TRUST