Investment banking behemoth Goldman Sachs is considering introducing a new trading operation for Bitcoin and other major cryptocurrencies, according to anonymous sources cited by The Wall Street Journal.

Goldman's currency trading and strategic investment divisions are said to be involved in the venture, but the project is still at a very early stage and isn't guaranteed to go through, the sources added.

The bank is figuring out how to respond to growing client interest in cryptocurrencies.A Goldman spokesperson told the WSJ that the bank is investigating how to best meet intensifying "client interest in digital currencies." Goldman is still predominantly an investment bank, and most of its clients are corporations, financial institutions, governments, and individuals. As such, it is likely exploring how to both facilitate these groups' exposure to Bitcoin et al., as well as determine whether it wants to move into areas like market making, or even offer trading and clearing services for cryptocurrencies.

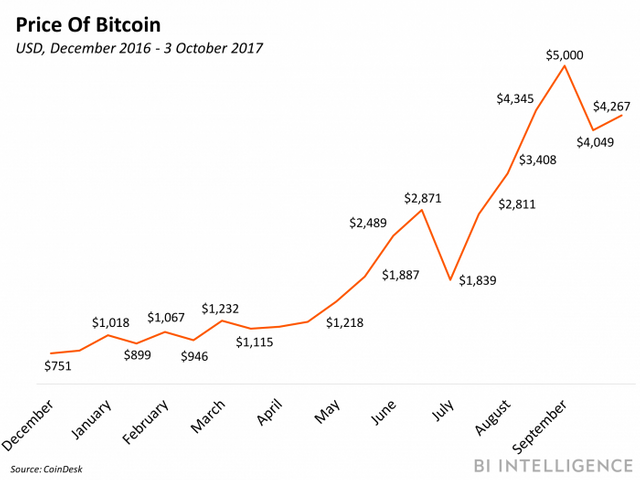

Goldman Sachs will likely be an early provider of cryptocurrency services among investment banks. The firm already has a track record of enthusiasm toward Bitcoin, as illustrated by moves including the establishment of an elaborate educational webpage on blockchain (the technology underpinning Bitcoin), and several analyst reports on the predicted rise of Bitcoin prices. That suggests whatever shape Goldman's final move in this area ends up taking, it will happen relatively soon. In turn, that will likely put pressure on other Wall Street players to move into the space, possibly pushing even those vocally opposed to Bitcoin, like JPMorgan Chase's Jamie Dimon, to address the market.

Nearly every global bank is experimenting with blockchain technology as they try to unleash the cost savings and operational efficiencies it promises to deliver.

Banks are exploring the technology in a number of ways, including through partnerships with fintechs, membership in global consortia, and via the building of their own in-house solutions.

Sarah Kocianski, senior research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on blockchain in banking that:

- Outlines banks' experiments with blockchain technology.

- Details blockchain projects at three major banks — UBS, Credit Suisse, and Banco Santander — based on in-depth interviews.

- Discusses the likely trends that will emerge in the technology over the next several years.

- Highlights the factors that will be critical to the success of banks implementing blockchain-based solutions.

Congratulations @princeali! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit