.png)

If you already have confidence in the cryptocurrency sphere, planning on holding digital assets, want to avoid unfavorable tax events, or just want to make some solid gains in Q1, then there is quite a ripe opportunity in investing in Secured Automated Lending Technology (SALT).

SALT is an ERC20 token used to pay down principal and interest on loans taken through the SALT platform, paying for membership to the loan platform(1-100 SALT/yr), and showing PoA (Proof-of-Access). Proof-of-Access allows for a borrower to receive better loan terms based on locking down an amount SALT until their loan is paid back.

PoA Blog: https://blog.saltlending.com/salt-looking-back-looking-forward-37614ba14755

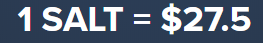

All these use cases eat away at the supply of the SALT token available in secondary markets, eventually pushing the market price closer to the redemption price offered by the platform. Why this token is so enticing at the current moment is because of its price discrepancy between exchange prices(~$13: https://coinmarketcap.com/currencies/salt/) and the platform's redemption price ($27.5).

At first glance, the arbitrage opportunity is immense, with gains nearing 100% of one's initial investment.

For those unfamiliar with the term "arbitrage".

"Arbitrage"- The simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

TL:DR: buy low here, sell higher there

BUT WAIT... If it seems too good to be true, then it probably is.

So, why isn't this price gap closing?

The largest arguable factor is that you cannot immediately pay back your loan with the SALT token at the platform redemption price. Each individual loan has parameters set by the lender on how fast the loan can be paid back. This is reasonable seeing as it would be rather unfavorable for lenders to be paid back with significantly lower interest. With this being said, the entirety of your loan can be paid back using the SALT token at the platform redemption price, just over a longer time-period depending on the loan terms you agree to at the time of funding.

Whales are probably holding down the price to be able to buy SALT cheaply when the time comes to pay off loans they have yet to have funded.

The platform has only been up and running for less than 2 weeks. The SALT team is approaching this space with a relatively slow roll-out until automation of their platform can be achieved.

Only $7,159,000 in loans have been funded. But there is over $550,000,000 in loans that are already requested through their platform.

Only Enterprise-level memberships are being given loan terms at this current moment. Enterprise memberships cost 100 SALT per year.

This is a fully collateralized loan, meaning you need to provide 125% of the loan value in ETH or BTC. This can be an extremely powerful tool for those looking to hodl their coins and still have fiat to work with.

A few questions to ask yourself before getting involved.

Do you already hold a considerable amount of BTC or ETH and are looking for a loan for a business, house, car, or any other large fiat-based purchase?

Are you looking for short-term gains or a long-term hodl?

SALT could be a good vehicle for both, depending on your unique time frame. Take a look at this 4hr chart showing good consolidation, volume, and accumulation.

Do you want an instrument that locks you into hodling long-term?

Are you swimming in USD, looking to lend fiat through a secured instrument?

(How to become a lender) https://saltlending.zendesk.com/hc/en-us/articles/115009447628-How-do-I-become-a-lender-

What are the risks associated with this kind of investment?

Volatility: The obvious one here is a large correction of BTC and ETH which would result in margin calls, allowing the borrower to increase their collateral or have their collateral transferred to protect the lender. This type of event is highly speculative, but not improbable.

What is the appeal for this type of platform for both the Lender and the Borrower.

Lender:

This is a secured, fully collateralized loan, protecting the lender from a borrower's inability to pay and massive price corrections within the cryptospace.

Lenders will most likely not have any idea of how the borrower pays down the loan, through the SALT token or otherwise. The SALT platform acts as an intermediary paying back the lender in fiat. Lenders put in USD, they receive USD in repayment with interest.

In the event of a large correction, the transferring of collateral will happen at a very low market price, leading to lenders to, essentially, buy the bottom of the correction through receiving their borrower's collateral.

Borrowers:

Receiving a loan through the SALT platform is not considered in the same regards as simply selling your cryptocurrency assets through normal avenues. This can be a considerably more favorable tax event.

You have both fiat to move around and your cryptocurrency assets potentially gaining value as well.

Borrowers are able to buy the SALT token at a significantly reduced price than it is redeemed at to pay back the loans which then leads to a net arbitrage-like effect.

Forces the borrower to hodl their assets until the loan is paid back in full where then they will receive their initial investment in full.

Interested to estimate how much you can make just using this platform?

Check out this arbitrage calculator: https://saltarbitrage.com/

SALT PLATFORM MEMBERSHIP SIGN UP: Where you get your loan from.

https://membership.saltlending.com/register?r=mbHLt

BINANCE ACCOUNT REGISTRATION: Where you buy cheap SALT.

https://www.binance.com/?ref=11379226

Invest carefully my friends, do your own research, and hodl hard.

I hope this information was a helpful introduction to the potential of the SALT platform.

Sounds salty :) I watch salt since that video by @cryptovestor appeared.

Did you write the article on your own?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea, i've been following the project since before the platform launch, doing research as new developments have been announced and condensed most of thoughts into this post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @qauz! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Round of 16 - Day 4

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit