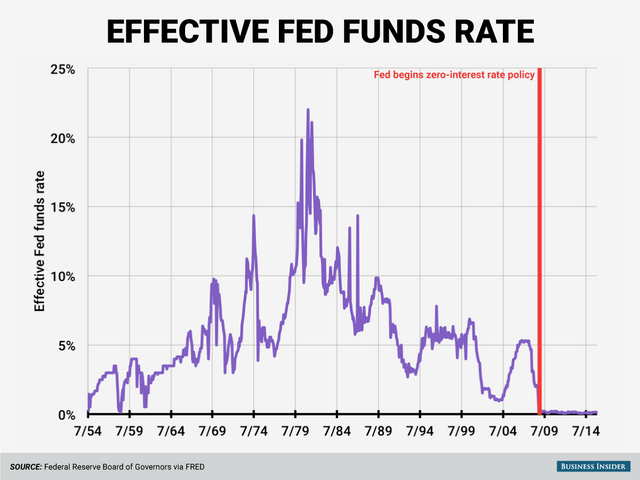

While Bitcoin and the crypto-world are facing a massive devaluing, traditional asset markets have been enjoying great performance: rising commodities, euphoria in the stock markets... However, many voices are arising to warn against such an euphoria while the global economic climate is not particularly excellent. Actually, the very fact that FED governor Janet Yellen has decided to tighten the monetary policy by gradually rising the interest rates is compelling evidence that a crash on the traditional markets may occur in the next few weeks.

Indeed, the loose monetary policy waged after the 2008 financial crisis whereby the FED “printed banknotes” to stem a climate of fear has been fostering the credit cycle. As the interest rates were and still remain very low, consumers and investors have found it easy to run into debt. The main goal was to stop the credit crunch (situation where banks are not willing to lend money as they are not confident in the future). But simply put, the so-called loose monetary policy carried out by the FED may bring about another financial crisis due to an over-indebtedness. For instance, let’s have a look at the student loan debt. It went from roughly $500 billion to $1300 billion. Former PayPal CEO Peter Thiel even talked about “higher education bubble”. People succeed in paying back their loan only after 25 if not 30 years. With a rising interest rate and the current economic climate, the households could no longer pay back their loans.

Remember in 2005 when Alan Greenspan implemented a tighter monetary policy. The over-indebtedness led to the rise of the non-payment rate (from 5% to 15% in 2007), which eventually brought about the financial crisis.

Thus, it could be highly profitable for Bitcoin and crypto-currencies by extension. Should a market crash occur, the climate of fear entailed by the crash would push many investors to focus on non-traditional assets such as Bitcoin or Ethereum, all the more so as crypto-currencies have gained momentum for the last few months in term of media coverage.

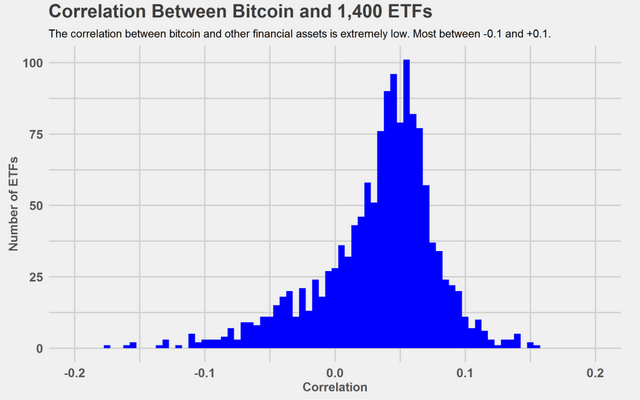

But, why would investors invest in Bitcoin? Because it is absolutely non-correlated to other financial traditional assets. Here is a study led by SignalPlot showing the correlation between Bitcoin and 1400 ETFs (traditional investment vehicle that allows you to invest in stocks). You can find the details of the used method by clicking on the link below. As you can see in the plot, the correlation is roughly between -0.1 and 0.1 which shows just how low-correlated Bitcoin and stocks are.

Seeing the stocks plummet would encourage many investors to study and analyze non-traditional assets. This would generate a massive move from traditional markets to Bitcoin, increasing the market cap by possibly doubling it within a few months. Yet the key-issue in current slow-down of Bitcoin is its market cap. As it lowers, the volume decreases, hence the demand and finally the price. Hosting this massive influx of demand and money coming from traditional markets could lead the price to new heights. And this is emphasized by the implementation by the end of July of SegWit technology in Bitcoin’s blockchain protocol. It can’t be denied that lower transaction fees, faster transaction time and increasing transaction volume per block are very attractive cases that could seduce investors. As always, implementing a new technology entails a speculative climate which would be very beneficial to Bitcoin.

Thus, if considered a store of value, Bitcoin could surge as high as $4000, as it has been already predicted by some analysis, such as Goldman Sachs’. While the current bubble is popping and could see the Bitcoin go as low as $1900, another rally starting from a price that reflects the fundamental value of BTC in September could bring Bitcoin to a new all time high before the end of 2017.

NOTE: This article is neither an incentive nor a financial advice of any kind to buy or sell Bitcoin or any other assets.

Twitter : https://twitter.com/RFTexasTrade

Sources

What is BTC’s correlation with other financial assets : http://www.signalplot.com/what-is-bitcoins-correlation-with-other-financial-assets/

Odey says drunken markets ready to topple as bearish bets pay : https://www.bloomberg.com/news/articles/2017-07-10/odey-says-drunken-markets-ready-to-topple-as-bearish-bets-pay

Congratulations @rftexastrade! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit