4 years ago when bitcoin was trading at $3,698 I reminded readers that the true frauds in our system are the banks and the banksters like Jamie Dimon.

Below are some of the things he was saying at the time:

“Bitcoin is backed by nothing“

“Bitcoin is a horrible store of value”

“Bitcoin will not survive”

“Bitcoin is going nowhere”

“My daughter bought bitcoin and it went up and she thinks she’s a genius”

“Bitcoin is a fraud”

Truly a pathetic individual.

US debt had just hit a record $20 trillion and spending had topped $428 billion setting an all-time monthly record. Bitcoin was just 0.0035% of US debt and less than 1% of the globe owned it. We clearly stated "BITCOIN IS NO WHERE CLOSE TO A BUBBLE."

Boy were we right, Bitcoin just hit $66,997 after approval of first US Bitcoin ETF this week by the SEC, ProShares Bitcoin Strategy ETF (BITO). Bitcoin adoption and financialization continues to grow and multiple indicators show that crypto adoption is growing faster than the internet did. We believe this will continue and more institutions and people will continue to adopt bitcoin increasing its network effect and market value even further.

We also predicted that there would be another global recession and that "bitcoin will likely be a black hole for dollars around the globe looking to find a safe haven". Sure enough in 2020 we experienced COVID Pandemic Recession around the globe with markets crashing including Bitcoin. As markets started to recover Bitcoin sure enough became the black hole for capital decoupling from markets and taking off from Covid low of $4,106 on 3/13/20 to over $30k by the end of the year. We expect Bitcoin to continue to be a black hole for capital as central banks continue to print trillions yearly.

Here we are in Q4 2021 and US national debt has just hit $28.9T from $20T in just 4 short years for an increase of 44.5%. This is not sustainable and we expect global debt to continue to rise at even faster pace. Biden administration has proved to be a disaster and nothing seems to be working or getting better. We expect another period of negative growth in the near future and will only be more rocket fuel for Bitcoin.

The marketcap of Bitcoin is now 4.37% of US National Debt rising from 0.0035% just 4 years ago for an increase of 1,247%!!! Will Bitcoin marketcap pass US National debt in years to come???

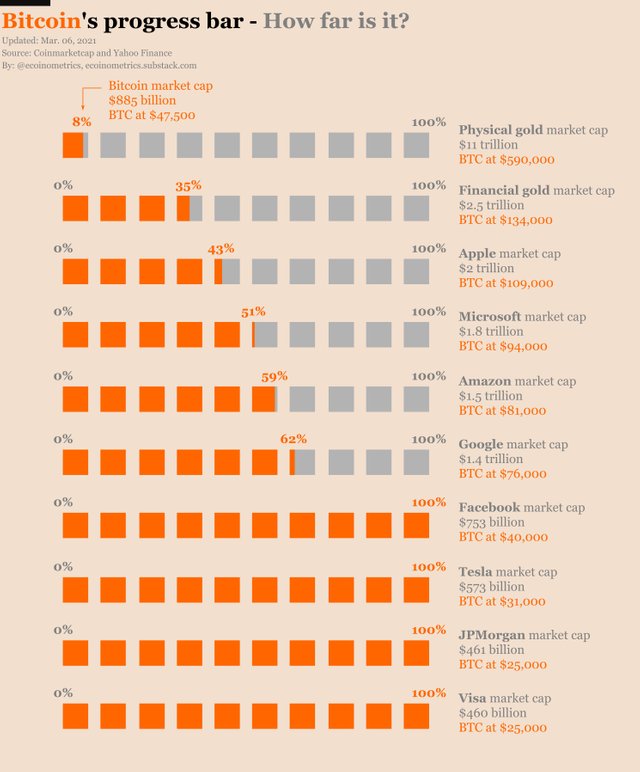

It was too easy to predict and all but a certainty in our minds but Bitcoin passed JPMorgan in marketcap at $25,000. Bitcoin is now 2.51 JPMorgan's which is largest US bank pretty impressive and Jamie Dimon is still a fraud.

BTC is larger than Visa, JPMorgan, Facebook and Tesla. BTC is now 72% of Amazon and I expect Bitcoin to be larger than AMZN in the very near future. Next targets Apple, Microsoft and Gold.

It is exciting to see that crypto adoption continues to grow, we fully expect layer 2 solutions to continue to to be created and improve adding value to bitcoin but most importantly have a day in the near future when you no longer have to use a traditional bank and transact in the marketplace directly with people and businesses. That's the day we can tell Jamie to F*CK OFF and send him into retirement where he belongs.

We expect Bitcoin price to continue to rise into next year and have set a price target of $200,000 by end of 2022.

Bitcoin (BTC) price at time of writing $66,997.

Disclaimer: You should perform your own research and make your own investment decisions, this is not investment advice. I own or may plan to own cryptocurrencies mentioned above.