Buying Bitcoin and cryptocurrencies has become a hot topic among the community over the last year. With an explosion of both interest and price, many people believe that it is too late to buy bitcoin in 2018. What do I think? Well let’s find out shall we.

Quick history:

Bitcoin was first released in 2009 by an unknown person/group residing under the alias SATOSHI NAKAMOTO. At the time of its release and the year which followed, bitcoin and blockchain was a hugely undiscovered concept, being traded for just fractions of a cent. Over the next 5 years it would grow to be work over $1000USD but in early 2014, the major bitcoin exchange known as Mt Gox was hacked for 850,000BTC ($600M at the time, around $7B today). It was around this time that Cryptocurrencies faced a long bear market, with bitcoin going to around $250 and not recovering until early 2017. In the following years, there were a small number of cryptos developed, but nothing in comparison to the amount we have today. After the creation of Ethereum, the biggest blockchain for developing Decentralised applications (Dapps), the concept of ICO’s gradually lead to an explosion in the number of cryptocurrencies. In 2017, Bitcoin went from just under $1000 in January, to a high of just under $20K in December. Today Bitcoin is sitting at around $7K USD.

How many people use bitcoin?

To start off my analysis on whether or not it is too late to buy bitcoin in 2018, we need to have a look at some stats.

According to bitinfocharts.com, there are currently around 5 million bitcoin wallets with more than $100USD being used worldwide. So are there 5 million people using bitcoin? Not exactly. The reason for this is 1. The majority of those people do not use their addresses actively; with only 480,000 wallets being used in the past 24 hours, and 2. Many bitcoin users have multiple wallets to store their bitcoin in. Me personally, I use 5-10 bitcoin wallets depending on what I am using it for. Another article on the bitcoinmarketjournal stated that Coinbase had over 13 Million accounts on its exchange. As I just mentioned, the amount of people buying, let alone using bitcoin is just a small fraction of that. I have spoken with a few of the people that I know in the cryptocurrency community who do affiliate marketing for different exchanges like Coinbase. They all told me the same thing, for every 100 people they get to sign up for exchanges, only on average 5-10 of those people will actually buy any cryptocurrency at all. So the number of people flocking to buy bitcoin is not as many as everyone seems to think. In comparison to the potential number of people who use bitcoin, only a fraction of the population have bought any.

Bitcoin vs other markets:

For this next section I want to reference another article written on the same topic I am writing about today. I am using their figures as they are useful for comparison and have a similar viewpoint on the subject. Some of the numbers are a little off as it was written in late 2017, but the exact numbers do not confuse the point I am trying to make here. At the time of writing this article, the market cap of crypto is around $270B and bitcoin $110B.

The link to that article can be found here: https://masterthecrypto.com/too-late-buy-bitcoin-invest-cryptocurrency/

Bitcoin as a worldwide investment:

I find all too often that people compare the size of bitcoin to different stock markets, however I believe that this is an inadequate comparison as bitcoin is an asset, in the asset class of cryptocurrencies. Therefore it makes much more sense to compare cryptocurrencies to the whole stock market/s, and bitcoin to individual stocks within them.

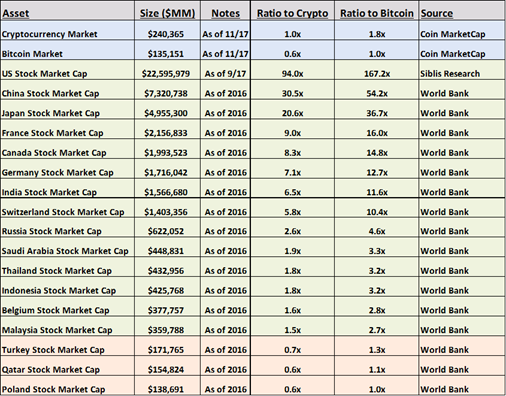

As we can see here, by comparing the market cap of the cryptocurrency market to national stock exchanges worldwide, we can see that crypto is still just a small fraction of some stock markets. Currently the cryptocurrency market is worth less than the Malaysia stock market, and is 84x smaller than the U.S stock market, but what is the significance of this? Well, first off I think it is important to remember that crypto is a worldwide asset class, meaning it can be bought and traded anywhere, anytime. So I guess the most fair way of comparing crypto as an asset class is to compare the market cap to the combined worth of all stock markets. In late 2017, the combined worth of all major stock markets in the world rose above 80 Trillion Dollars, nearly 300x the size of the crypto market!!! One of the many reasons that makes crypto and blockchain so powerful is that It is a worldwide asset and that means the potential is absolutely huge.

In comparing to particular stocks I will use bitcoin for this example as it is the crypto equivalent of a stock. Looking at some of the stocks on the New York stock exchange, we can see that bitcoin is only a mere fraction of some of these stocks, currently sitting at $110B, bitcoin is currently around 1/7th of the amazon stock market cap as of June 2018. Just like with the previous comparison, bitcoin is an asset which can be bought by anyone, with ever-increasing accessibility. Bitcoin is giving young people a reason to invest their money like no other asset before, with the investing demographic usually being an older one. This new influx of investors who will be the likely everyday users of this technology will create huge demand as popularity grows. Also, the introduction of other classes such as ETF’s, Mutual funds and futures again lowers the barrier of entry for people to invest in cryptocurrency but also helps to bring in more institutional players who have deep pockets. This is an extremely underestimated step for cryptocurrencies and I believe as these are rolled out, interesting things will begin to happen.

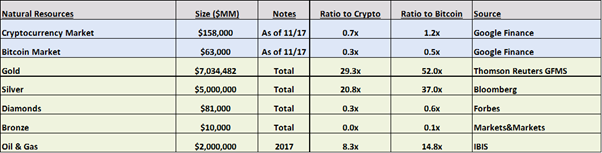

Another asset class which bitcoin is compared to is that of natural resources, particularly gold. Many people have given bitcoin the name of digital gold as they believe it could be an excellent store of value in the future. Whilst I do think that by definition bitcoin is not a store of value yet, it could be in the future as it grows. The gold market is worth around 65x that of bitcoin, so bitcoin has some growing room to fill in if it wants to even get close to gold. This aspect of bitcoin and cryptocurrencies is not the most important today as like I said bitcoin is not a textbook store of value yet, but as it grows, the volatility will diminish and it could become a viable option for those who invest in stores of value such as gold.

Bitcoin as a Currency:

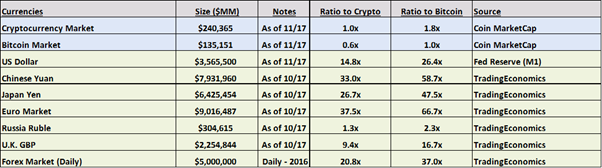

The intended use of bitcoin was to be a decentralised digital currency, so I have to compare it to fiat currencies in order to create a fair argument. Looking at the size of the major fiat markets, we can see that bitcoin is only a very small fraction of all the major markets listed. Not to mention again that bitcoin is an international asset with a much lower barrier to entry than many of these assets I have mentioned today.

From looking at all these comparisons it can be seen that bitcoin and crypto are not only international assets, but they are also dynamic assets which can serve different purposes, with those purposes evolving over time. Even if only a small portion of each of these asset markets were to make their way into crypto, the results for early investors like you and I will be phenomenal.

Crypto as a major industry:

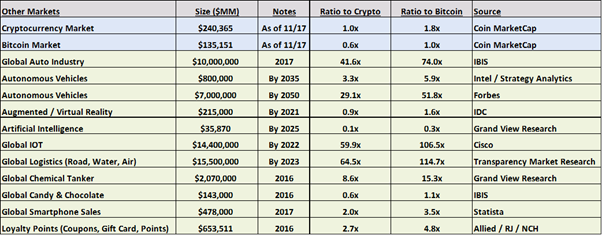

Up until this point I have talked about the use of cryptocurrencies in assets and currencies, but one of the most overlooked things for the potential growth of crypto is the role of blockchain in major industries. Blockchain is the revolutionary behind bitcoin and most cryptocurrencies and has the potential to create major industries itself. We can see small hints of this in the mining space, as crypto grows, more countries e.g. Russia are investing more time and money into mining cryptocurrencies and I believe this will be one of the things which slowly replaces industries with finite resources e.g. coal/oil. This is just one application of blockchain and I am sure there will be many more in the future. The most important point however is that blockchain has the power to support basically any industry on the planet. Whether it be in automotive, AI, IOT or simply loyalty points, blockchain and cryptocurrencies can be utilised in a big way in order to reimagine the way we use technology. The use of blockchain and crypto by these industries will also place pressure on every day people to use these technologies and over time (Not rapidly), crypto and blockchain will integrate into many industries without much effort.

The verdict:

After reading this article, you should already have a fair idea about what my answer to this question is. Is it too late to buy bitcoin in 2018? Hell No! Now I want to remind you guys that I’m not a financial advisor in any way and this is all just for education, but taking into account all the factors I have within this article, I think there is still plenty of time to buy bitcoin and I would go as far to say that we are still only at the start of the bell curve. However that is just my opinion and I encourage you to go out, research more and validate yours. Do you agree with my answer? Let me know in the comments why you do/don’t.

Thank you for taking the time to read this blog post! If you haven’t already I would appreciate if you could upvote and Re-Steem this blog and subscribe to my YouTube channel for more cryptocurrency related content. Have a nice day :)