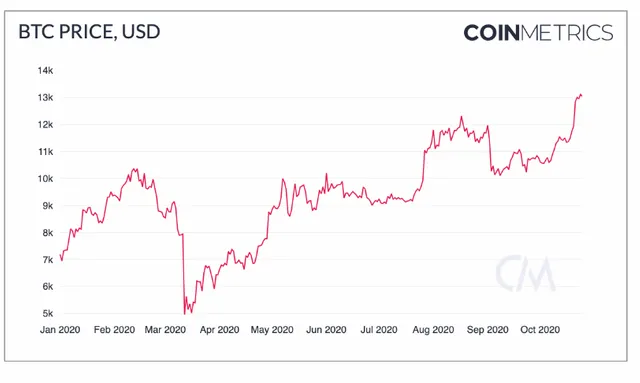

A recent Coinmetrics report says that the basics produce a series of bitcoin. The report says that bitcoin is already showing signs of this following its rise to about $ 1,000 in one day on October 21. The digital asset then sets a whole new year.

New introduction

While acknowledging the difficulty in predicting the future value of bitcoin due to its volatility, the authors insist that there is a difference between the previous bulls and the current bulls. According to their report, "BTC has been growing in ways we have not seen in previous bull games."

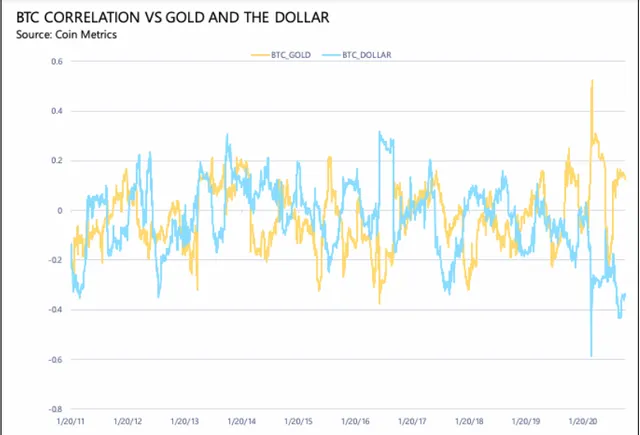

To clarify their position, the authors point to the growing alignment of bitcoin and gold as one of the reasons for their promotion. In the report, the authors say that bitcoin, which had a low correlation with gold and the US dollar throughout its history, was changed after March 12. The authors say:

"As panic over the fast-paced Covid-19, equities around the world were disrupted. Crypto is down with other markets, with the price of BTC and ETH both falling by about 50%. Since then, the BTC and gold alliances have been close to high points while the alignment with the dollar has been constant."

According to the data, the exchange rate for bitcoin and gold has been good (above 0) by most of 2020 while the balance of digital assets and the US dollar remains poor at the same time. This growing relationship with gold has to tout bitcoin as a kind of digital gold.

Companies such as Microstrategy and Square Inc have recently announced their acquisition and further acquisition of bitcoin as a financial asset.

Currently, the report also points to another important indicator, "the percentage of supply stored for one year (or in other words, the percentage of supply that has not been removed from the chain as part of a transaction)." According to Coinmetrics, "as of October 25, about 62.5% of BTC supply has been withheld for at least one year.

As in the previous demonstration, "the percentage of uninterrupted supply for at least one year has risen at a time when prices have been low."

The report adds:

"The BTC rate has been consistently lower since 2011. Higher speed means higher income. The recession suggests that BTC continues to be used as a repository against the exchange."

Another metric suggesting that suggests a pending bitcoin breakout is the "number of addresses at least $ 100 BTC (which) hit a new all-time high of 9.74m on October 22."

In conclusion, the report says that historically, "Bitcoin price has hit a local peak in 1.5 years from each previous halving." As increasing activities and the "halving less than six months in the Riverview, all signs signal that BTC is ready for takeoff."