Anybody who has used Bitcoin lately is probably aware how slow it is. But that's not the only weakness of Bitcoin. It's also very expensive.

Transaction fees have been rising because people want to get their transactions included in within a reasonable period of time. But don't be fooled to think that transaction fee is the only cost.

Usually people tend to forget that transactions are subsidized with the block reward. Currently block producers get 12.5 btc in addition to transaction fees. That's quite a big sum if you compare that to how many transactions are actually processed. What makes Bitcoin so inefficient is the fact that blocks are already full. No room for more transactions.

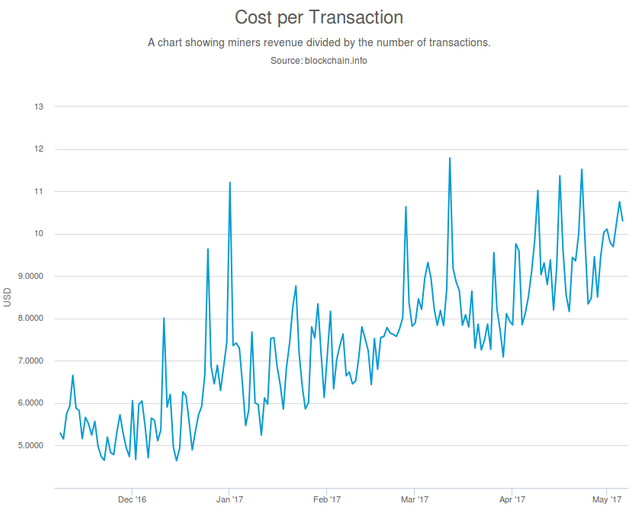

How inefficient it is? You can see the full cost per transaction from Blockchain.info's chart.

Lately it's been around 8-11 dollars per transaction. Just think about it a little while. If the inflation is accounted, people are paying approximately ten dollars for one transaction – and it's going up.

Disagree - look at FIAT.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

While fiat-currencies are in many ways bad, at least people can actually use them for daily transactions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

lol - I use Bitcoin also daily for transactions.... it is called freedom of choice :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do the math: Bitcoin can be used for daily transactions only for a small minority of people in the world. There is no freedom to choose when blocks are full.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

LiteCoin adding Segregated Witness (SegWit) makes it more appealing for daily use than Bitcoin. That would make Bitcoin a safe haven asset, rather than a day-to-day use for transactions by comparison.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Litecoin has the same problems as Bitcoin because they are essentially the same technology. I'm not sure how great solution segwit is because it just adds another centralized layer on top of a blockchain. Satoshi's original intention was to create a peer-to-peer currency and segwit is clearly not P2P.

Safe haven assumption is also quite weak. Why would people put their money in a system that is very expensive and hard to use? A blockchain that can handle daily transactions for normal people will become the safe haven because it has so much more demand.

EOS is the first blockchain that could be a real alternative that can actually serve the whole world as a currency.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I tend to no longer think of Bitcoin as a currency, but more as a "backup" to other crypto-currencies and a very risky long term investing vehicle.

It's similar to the gold-dollar relationship, but less secure. Almost like an independent "index" (although it isn't) to gauge the blockchain market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't see any reason to think Bitcoin as a some kind of backup. It needs huge sums of money just to exist. Most of the block reward is going to buying mining hardware and paying electric bills, the value is not even staying in the ecosystem.

A true backup would be like gold – you just buy it and it exists on its own. It's very durable and resilient.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Actually, Bitcoin requires energy to exist, not money. Energy is something much more fundamental than money. Energy can be bought with money at different costs depending on how and where it was sourced. But in contrast to money, energy can never be fabricated.

The point that I´m trying to make is that bitcoin is based on the everlasting and unhackable rules of thermodynamics.

At the same time, I fully agree that other digital tokens are better suited for everyday transactions. Yet I would argue that those wouldn´t even exist without the bitcoin bedrock.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well look at it this way, bitcoin is a rival to fiat currency, it's never meant to replace gold. This transaction fees issue is just temporary :).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

But it doesn't work as a currency because the blocks are full.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Think of the bitcoin space itself as a "tech and money reserve", for the other currencies. It will empty in time without developement, but first mover advantage is huge.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin is here to stay!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We shall see, but so far it seems it will =)

I would have prefered for Bitcoin to slowly die off so other currencies can take in expertise that's been locked into or distracted by Bitcoin. But if it doesn't, then developement could make it a viable currency again. Either way it's interesting to follow.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

BTC is not a currency , BTC = Gold , there are lots of other coins that are a better currency such as DASH

You could use your gold to buy a car if you really wanted to by first selling for cash, but if you did it would cost you money and time, not very efficient.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Solid article. Interesting to see I'm not the only one that is thinking about this. The biggest group of uneducated investors in mankind get's a shot to determine the price of a crypto. It's an interesting world we live in. Besides coinmarketcap.com there is: https://www.coincheckup.com They give great insights in the team, the product, advisors, community, the business and the business model and other techincal insights. Check: https://www.coincheckup.com/coins/Bitcoin#analysis For a complete Bitcoin Indepth analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit