SEC Commissioner, Hester M. Peirce, made a crypto-friendly speech at the Medici Conference, on 2nd May, in which she set-out her vision of the SEC's regulatory role, likening it to a lifeguard on a beach;

watching "over what is happening, but she is not sitting with sandcastle builders monitoring their every design decision. From her perch on the lifeguard stand, she can spot dangerous activity and intervene with a blow of the whistle or, if necessary, a direct intervention. She always stands ready to answer questions about the rules of the beach. She puts up the red flag to warn of dangerous riptides or sharks."

This regulatory framework would be in contrast to the 'regulatory sandboxes' of the UK, U.A.E and Singapore, an approach also being considered by Malta, Lithuania, and Bermuda, amongst others and one that Hester M. Pierce appears to dislike;

Indeed, she asked the listening audience to;

"help us learn more about the technology so that we are able to think about the regulatory obstacles that may stand in the way of crypto-technology’s ability to improve our lives. How can I, in a sense, be a better lifeguard?"

Regarding ICOs, Hester M. Peirce warned against a blanket ban and the classification of all ICOs as securities, as in her view this would stifle innovation and the social benefits that blockchain technology could bring.

Read the full speech here; https://www.sec.gov/news/speech/speech-peirce-050218

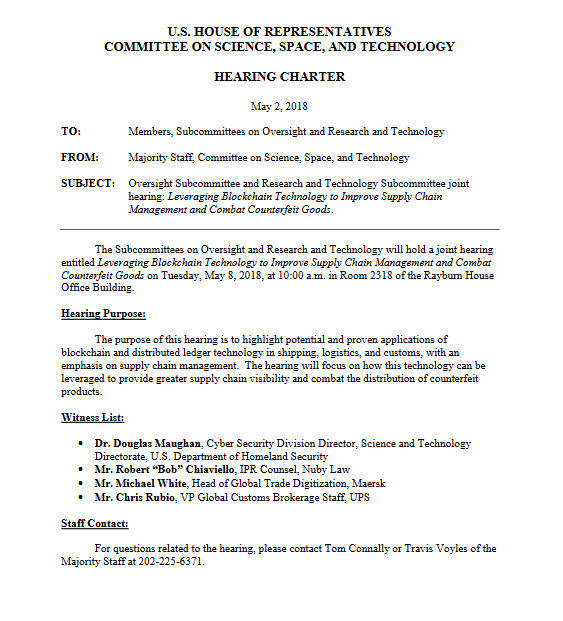

We saw a lot of FUD over the last few days concerning a supposed SEC meeting to determine whether or not Ethereum and XRP should be classified as securities. It now transpires that no such discussion took place at this meeting, as can be seen from the Hearing Charter below, which is only concerned with "the potential of blockchain and distributed ledger technology" etc;

I think that is a wise approach in terms of regulation in regards to the lifeguard analogy. Makes the regulators lives easier too.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit