More coins than stocks listed on the S&P 500

Where do we begin to navigate the new landscape

There is an old adage, "scared money don't make money," and for the most part its true. When you open a trade or start an investment, you do it with conviction. You can't hem and haw, buying and selling the position back and forth, and as you've learned by now, there are no refunds.

Your opinion is that the position appreciates, whether long (bull) or short (bear). Fear can be your single greatest enemy, but it can also save you from yourself. A lot of people tend to fall in love with an investment.

There is no room for apathy and a lot of the time, the position turns south and people resign to a HODL trade (Hold On For Dear Life). Is that really winning? What are we here to do? Grow our wealth, not lock in for a, 50/50, hold your breath for god knows how long, position.

What if you understood the fear, listened to your own apprehension? You might get out of a bad trade, you might preserve capital, you might have the capital to jump onto the right train. I learned early on to not just resign to the idea of being fearless because that question in my gut, the back of my mind, that's instinct. I embrace fear the same way I embrace risk.

Just like trading conventional equities, stocks, a lot of the same principles, methodology and rules apply.

- Never more than you can afford to lose.

- Capital preservation is key to risk management.

- Know what you bought. Especially investors, you really need to know what you bought.

- Stay liquid and study market conditions.

- Don't fall in love, especially with a ponzi coin.

- STUDY - learn to read a chart, learn to read a balance sheet, learn to read a white paper.

So I have been meeting new people and making friends through steemit and on steemit chat. If we aren't talking about sex, we are probably talking about crypto or food. There are quite a few people who are very knowledgeable about individual blockchains and their respective cryptographic assets or understand trading and investment.

By the same token (that was a pun) there are a lot of people who know nothing about trading, finance or blockchain technology who want in or are trying to offer advice. On top of this, there have been an awful lot of snake oil salesman, pumpers and bashers.

Aside from the above rules, the single greatest favour your can do, is consider the ladder noise, but engage in thoughtful discussion with the former - Don't be the victim of fomenting.

So what do you buy?

With 4403 different cryptocurrencies, the real question is how do you decide? Especially with no experience or investment and trading acumen.

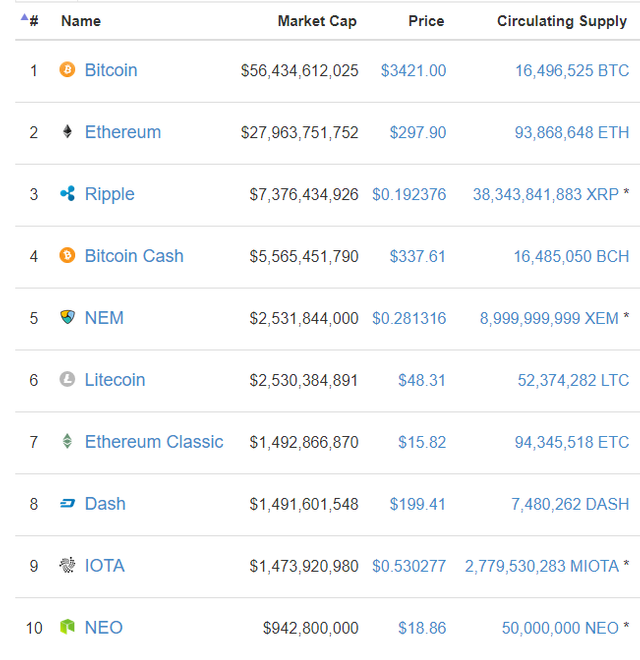

Just like with stocks, we buy market cap. Market capitalization, simply represents the total amount of a security in circulation multiplied by its current value, how much is a given security worth in total. The benefit of focusing your energy on cryptographic assets with a real market cap ($ billions) is you are playing where the money, where there is liquidity, where the risk is less.

My view is that the majority participating in the new crypto paradigm should be sticking to the stalwarts and avoiding risk as much as possible in this new, extremely high risk, industry. All it could take is just 1 of the 4403 crypto currencies to fail and entire swaths of them could be wiped out.

Check out coins by market cap as part of your due diligence when ever you think about trading and investing. It's not about buying the cheapest coins its about making sound investment and trading decisions based on rules and research, STUDY.

This article is the start of a short series where I will try to explore simple concepts of convential capital markets that apply to the new sphere of cryptographic assets.

I look forward to your comments and thoughts!

If you are the victim of a ponzi coin, why not get the t-shirt.

I hear you.... but with my 0 years of trading experience let me tell you why you are wrong.... lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

D E D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like how you broke down crypto into three categories, it is very true.

Also, with coin market cap people should be cautious and be sure to research the actual coin in my opinion because some of the "ponzi coins" we joke about so much are listed pretty highly on there. Always always always do your research before investing in to anything and the number one thing you mentioned in my opinion is NEVER INVEST WHAT YOU ARENT WILLING TO LOSE.

Up-Yunks for you...

Much knowledge has been spilt.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Keeping what might loose its value any moment is at "owner's risk" might be safer with bitcoin though .... Nice write up !!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great advice! One thing that has helped me improve my trading and investing is taking a few moments to write up my reasons for buying the stock or cryptocurrency based on my research. If my reason for having no longer exists I sell it.

My portfolio asset includes speculative investments. This is a very small portion of the portfolio. This allows me to take a chance on some of the newer companies and coins. This allows me to take some high risks that offer high reward. But it also adheres to your first rule, never more than I can afford to lose.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think thats my main issue why I can't get into crypto, stocks or even simple gamble at the local casino and ofc the whole concept is too abstract for me. I actually had to read this twice to get the gist of it. So i will be following these short series. I might never play on the field...but I am interested in the rules of the game.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hey some times that is all you need, there are alternatives for the risk averse - maybe i will dicuss in later posts

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think hodling is good only with Bitcoin. Everything else in my opinion is "shit coin" .Some are better than others but most are risky investments, even bitcoin is a risky investment :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

exactly, "avoiding risk as much as possible in this new, extremely high risk, industry" LOL its kind of funny a funny contradiction. Thanks for your comment!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yeap (:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I would say Ethereum is a close second to Bitcoin. Both as a store of value as well as practical application

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

bit coin at the end of the day is the shit coin.There are many quicker coins. Its just cause people use it , that is has value , speccially on deepwebs ect..At the end of the day let the free market decide what coins are ponzi or not, all the coins with real world uses, and tech value will flourish

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We will find out eventually which coin will remain at the top. Time always shows the truth :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thats true my brother, i think monero has a great future personally

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buy and hold and trade some of the ICOs as they all peak high then fade. Top 10 market cap...pay attention, and some of the top 100 market cap are future business contract platform and secure transaction blockchains and they are the future...!!! I know, I am a dinosaur from pre computers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

absolutely, keep an eye out for movers and shakers but the industry is so new, my advice to most is to play it safe. Nothing is expensive if you think in percentage gains! Thanks for your comment!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice advice. Thank you .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

quite welcome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hellooo, amazing post ,world class

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice analysis. Great blog

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit