I will try to make it as simple as possible. Don’t worry – you don’t need to know much about cryptocurrencies. If you are new to all this, by the end of the article you should have a pretty good understanding of what this thing is about.

TL;DR

I’m buying cryptocurrencies every week for a set amount of money and depositing it to my private Crypto Retirement Fund (also called a “hardware wallet”).

Amount: 50NZD (~$35)

Frequency: weekly

Time period: 5years+

Price Averaging

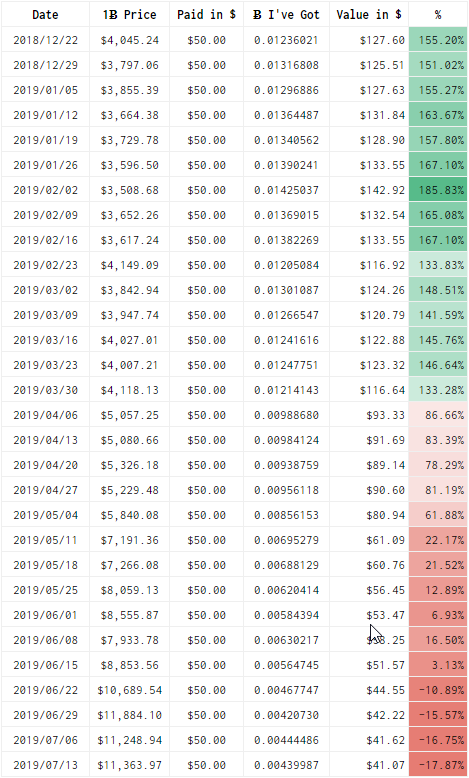

Here’s a 30 weeks simulation (based on real BTCUSD data) I have made to illustrate how the price averaging works and why I have decided to use it for this experiment.

Date

Each deposit is made on a set date. Every 7 days a small amount of Bitcoin is purchased and deposited to a secured wallet.

1Ƀ Price

The average price of Bitcoin on a specific date.

Paid in $

The amount of money that was used to buy Bitcoin. In order to make it easy for everyone to follow I’m using USD, but my actual deposits are in NZD.

Ƀ I’ve Got

What’s the amount of BTC that got purchased. I used the exact price for the day as a reference for the simplicity of the example. In a real scenario, the price will change during the day, you will need to pay transfer fees and you will lose some due to rate difference (exchanges always cheat with rates so you never get actual market price).

Value in $

How much our Bitcoin is actually worth today.

%

What’s the difference in value compared to the amount paid and the current price.

If you look at the %, you can see a clear trend. It reflects the change in Bitcoin’s price over time. You have probably already noticed that the best day was 2019/02/02 with a nice 185% profit. If instead of breaking it all up we would invest everything on that day, we would make 2x more.

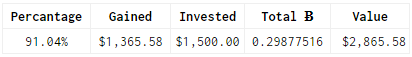

Here’s what we’ve got instead:

It may look like a missed opportunity, but at the time we didn’t know if the price will go up or down in the future. It could drop massively and we would lose the majority of our investment. On top of that, we would need to pay a whole $1,500 in one go.

We went for our own, private Bitcoin pay-as-you-go system instead 😉

When people first learn about cryptocurrencies and hear how much Bitcoin costs, it’s overwhelming, feels super expensive and risky (and it is!). What they don’t realise is that you don’t need to buy a whole Bitcoin.

Instead of focusing on the price of BTC, think about it in terms of X amount of USD worth of Bitcoin. In fact – the majority of people who play with cryptocurrencies never owned a full Bitcoin. It can be divided into 0.00000001 chunks, called Satoshi.

1 Satoshi = $0.0000986 (at the time of writing this).

Here’s A Couple Of Assumptions I Have Made

The overall trend of the crypto market will continue to go up. That means total market cap, daily volume and monetary value of Bitcoin and some of the other cryptocurrencies will be higher in the future than they are now.

I am prepared to lose 100% of my investment. I can’t stress this enough… Never invest more than you are prepared to lose. Do not mortgage your house, borrow from family or sell your kidney to invest in crypto. It’s a highly volatile and unregulated market. Many people have lost their life savings this way.

Banks supported by governments will try to take over. It’s a matter of time when financial institutions and big tech (like Facebook’s Libra) will launch their own coins and do everything in their power to kill the open crypto market. They will push for regulations, centralizations, licencing, overseeing institutions and try to turn it back into a centralized and debt-based currency.

We will have massive pullbacks and times of doubt. Those times will be hard and I will be tempted to cash out and quit this project. Some people will say I’ve wasted my time this or missed opportunities, etc.

I’m already prepared for that and I will stick to the schedule. It’s a long term plan and a year or two of a massive price drop means I can buy a lot more Bitcoin at a lower price.

Here’s What I Know

Current price doesn’t matter. It may sound a little controversial but it’s nothing else than price averaging stretched over a long period of time.

Cryptocurrency can’t be stopped. There is no way to switch it off, remove from the Internet or in any other way stop people from using it (other than switching off the Internet). Governments can make it illegal, banks can stop relationships with exchange platforms but that will not stop people from using it. As long as there is an Internet connection and someone who is willing to accept BTC as a payment – we are good.

No matter what happens, I’m going to stick to the schedule. I will do my best to keep emotions out of it and do the deposits on a set date, without checking any charts and analysing if maybe I should wait a couple of hours to catch the best possible moment. It’s a retirement fund, not a trading account.

I don’t have an altcoin schedule. Only Bitcoin deposits are on schedule. Altcoin deposits will be random until I decide which coins and what percentage of the budget should be used to buy them. I will update this section once I work it out.

My Crypto Pensioner project.

Congratulations @satoshit! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit