I believe that it is possible to beat the market through a consistent and unemotional approach. This is primarily achieved through preparing instead of reacting. Click here to learn more about the indicators I use below and click here from my comprehensive trading strategy. Please be advised that I swing trade and will often hold onto a position for > 1 month. What you do with your $ is your business, what I do with my $ is my business.

My most recent Bitcoin Bubble Comparison led to the following predictions: 1 day - 28 days = < $5,750 | bottom prediction: $2,860 by 10/30

Previous analysis / position: “It still feels too early to breakdown $6,150 support. I feel like we need to range for another couple days or bounce up to the 12 EMA.” / Short ETH:USD. Took profit on 33% of position improving my average cost basis to $317.37 per ETH.

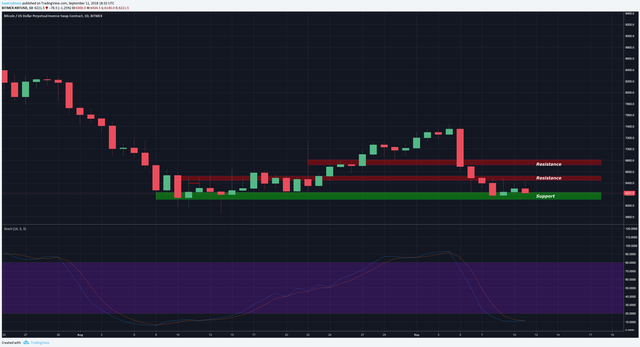

Patterns: Descending triangle

Horizontal support and resistance: S: $6,151 | R: Is $6,250 support becoming resistance?

BTCUSDSHORTS: Found support at 35,668 and is bouncing off a dragonfly

Funding Rates: Shorts pay longs 0.0203%

12 & 26 EMA’s (calculate % difference): 12 = -4.72% | 26 = -6.58%

50 & 128 MA’s: 50 = -9.87% | 128 = -12.19%

Volume: Still below MA but it is very early in the day, expect this candle to have high volume

FIB’s: 0.886 = $6,137 | 0.786 = $6,383

Candlestick analysis: Long wicks on daily candles indicate indecision and upcoming volatility. Current daily candle will be bearish engulfing if it closes < $6,237

Ichimoku Cloud: Tenkan = $6,765 | C clamp on 4h

TD Sequential: 12h & 4h recently had R2 < R1. Daily on R7

Visible Range: Currently testing point of control (POC) with 2m - 1y lookback.

BTC Price Spreadsheet: 12h = -1.9% | 24h = -1.11% | 1w = -15.56% | 2w = -11.47% | 1m = +1.54%

Bollinger Bands: Bouncing from bottom band. Retesting MA at $6,768 is to be expected.

Trendline: N/A

Daily Trend: Chop that seems to be favoring bears

Fractals: Up = $7,426 | Down = $5,866

On Balance Volume: Can see a small bull div when looking back to the middle of august. OBV has higher low and price has double bottom.

ADX: Bear trend

Chaikin Money Flow: Shows same div as OBV

RSI (30 setting): W = 48.44 | D = 43.48

Stoch: Buy signal right now. Notice how the last time we got a daily buy signal the price proceeded to make a fakeout lower low before finding support and rallying.

Summary: BTC looks like it has found support and should bounce to the $6,750 area before continuing the downtrend. However, alts are currently breaking down and there is a good chance that they drag BTC down with them.

I watch ETH’ as my leading indicator for alts and it has broken down $200, testing it for resistance and continued to break down from there. At the time of this writing it just broke down $180 and 0.029.

Over the next few days I believe the play is shorting EOS:ETH. For TA on EOS please see: The Most Overvalued Coin in Crypto: EOS

Thanks for reading!

Allow me to Reintroduce Myself...

Learn How to Trade! [part 1]

Learn How to Trade! [part 2]

Wyckoff Distribution

Bitcoin Bubble Comparison

The Most Overvalued Coin in Crypto: EOS

Bitcoin Daily Update (day 195)

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit