Disclaimer: This is not meant as financial advice and is for entertainment purposes only.

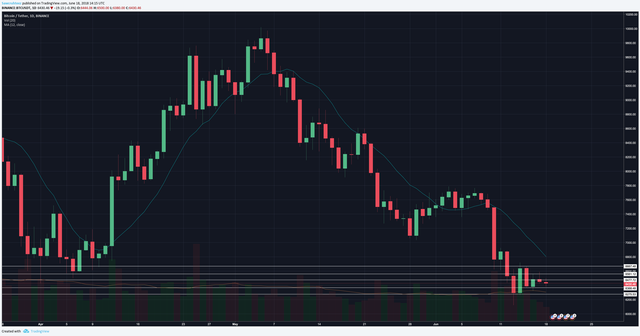

On June 11 in the 106th daily update I said that the price of Bitcoin was oversold and said that it is very important not to chase after a move of 10% in less than 24 hours. That was primarily based on how far we had fallen below the 12 period EMA (teal) on the 4 hour and 1 day chart.

I said we would either get a bounce to $7,000 - $7,200 or see days of consolidation. The latter option was the most bearish option that I saw. It tells me that the market does not have enough demand to create a short term rally. Bears are lining up at each point of resistance and they are winning.

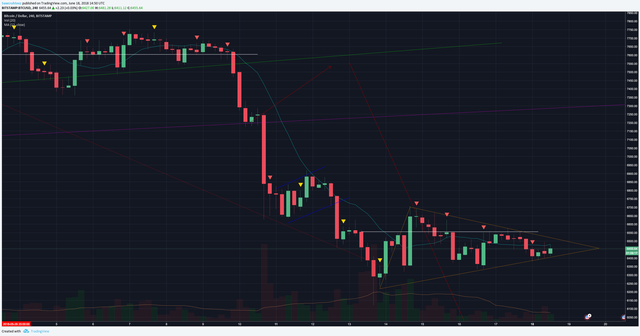

Let’s take a look at the 15 minute chart.

As you can tell the bears seem to be in full control. Steadily breaking down areas of support and strongly holding the areas of resistance. Currently the major area of resistance is $6,500 (white line) and the major area of support is $6,375.

Over the past 5 days the price has consolidated into a triangle (orange) and is currently resisting the 12 period MA on the 4 hour chart. I would still like to see a retest of the 12 day MA .

As you can see there is still quite a bit of room between the price and the shortest term MA that I follow. This could allow for whales to create a bear trap. I expect a lot of traders have their stop loss set above $6,555 (white line) and/or right above the triangle.

A pump to $6,700 would trigger those stops and also retest the 12 day MA, which I expect to act as strong resistance.

If not in a position then there are some good options still on the table. Keep in mind that these prices are taken from Bitstamp and would need to be adjusted for your exchange.

(1) Wait for retest of 12 day MA. Sell spot and/or open short at 12 day EMA . Save some (at least 50%) to sell the 26 day EMA in case price continues to rally. If price doesn't continue to rally then refer to #2 to enter the other 50%.

(2) Set an order to short BTC and/or sell spot at $6,374. That creates a new swing low and breaks down the triangle. Start with 33% of you total desired position and add ⅓ after new swing lows are made below $6,324 and $6,115

(3) Sell ETH:BTC. Currently at trend and horizontal resistance cluster

(4) Sell LTC:BTC after new swing low below 0.01432

One thing I have been closely keeping my eye on is LTC being a leading indicator. It looks to be in the weakest technical position and has been breaking down support before BTC and ETH.

That can be a great way to get a low risk entry. Plot major areas of support and resistance. If LTC breaks down and BTC or ETH have not then don’t hesitate to open a large position. Keep in mind that the leading indicators usually do not last long due so be careful!

Thank you for your time! Have a question? Leave a comment! Click follow to make sure that you don’t miss out on future updates and remember that likes are good karma!

After content like that, who wouldn't want more?

Yesterday's Post - BTC:USD 4 hour chart DAILY UPDATE (day 112)

Personal Challenge - 0.1 > 1 BTC Trading Challenge - Day 99

Gold Bubble Weekly Update - Week 14

School - Intermediate Trading Strategy | Gold Weekly Update (week 13) | White Paper Cliff Notes: AION | Intro to Indicators: Stochastic | Bitcoin Market Cycle

Need a break? Read some Poetry! - I believe | Aliens | The Universe is a Hologram | Sunset

Come on! BTC trade above 6300$

if it slips more below 5977$ than 5000$ is not far

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

BTC got the pump, but will it be enough to rally through the 12 day EMA?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Better is the price now I am confident for a +5% move in next 30 hours

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit