The Journey of ScalpexIndex: Past, Present & Future of Crypto Analysis

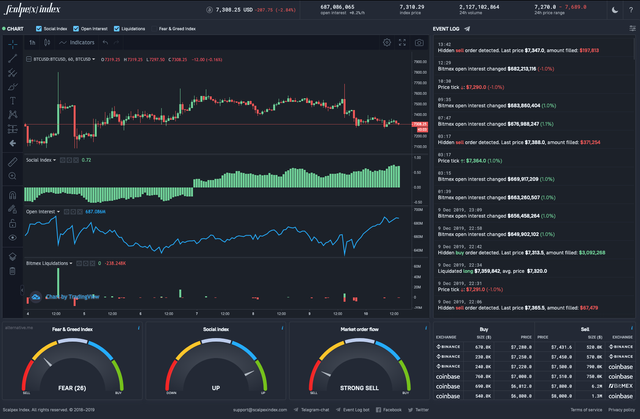

We at ScalpexIndex have received many questions about our journey as the first Fundamental Analysis toolbox for crypto-traders, as well as the way we came to develop our main instrument — the Social Index, which now helps thousands of traders every day. So here’s a look at our story and the “magic” behind the mechanism

How It All Began

We started as an Algo-trading firm (prop shop). Throughout years of trading on BitMEX and executing a vast amount of research, we collected a massive amount of data, which gave us the idea of developing trading strategies based on fundamental analysis.We wrote an ingenious model that analyzed text streams from exchange platform chats and social media, which is how we discovered the correlation between what people talk about online and the BTC price in the midterm. This way, our in-house venture started to look very interesting indeed. We thought: why not use our unique knowledge to go into retail. That is how ScalpexIndex was born.

Technicalities Behind The Fundamentals

Our primary indicator — the Social Index, displays our market mood analysis in a barometer-like format for ease-of-use. But how did we make it work?What we did was relatively simple. We signed up for all primary public crypto resources: exchange chats, Facebook groups, Twitter pages, and more. We then took real-time text information from there, passed it through our model, and received a score from -1 to 1, which told us whether the information was more long or short, more buy or sell. In 2 months, we have analyzed over 10,000 messages.In order to build the model, we further involved 20 people, and tested each text message on them, asking what they thought of it on a numerical scale. This way, each message was evaluated by at least 7 independent individuals. In some cases, all evaluations matched, some had few inconsistencies, some displayed complicated cases of 3 for long, 4 for short, etc. Regardless, based on the detailed analysis — we trained our model. It’s a Random Forest Model, as a matter of fact, but we will talk about that in further articles.As a result, we developed a mechanism that not only prioritizes the freshest data, but analyzes the last 4 days. At the very start, in July 2019, the accuracy of our creation was at 64%. Today we have already reached 74% and improving, as the model “learns” on more data. With our Social Index tool at the core, we then proceeded to build a full trading system. Since July, our strategy, taking into account the Social Index, the Open Interest and Current Trend Identification earned 16% with a maximum of 5% drawdown.As we launched, we were not surprised at the amount of positive feedback from the audience. This confirmed that the service has much more potential than just an in-house build to be used by a couple of people — we may surely have something to bring to the market table.

The Proof of the Pudding is in the Eating

Evaluating with our new analytics, we were inspired by how the index works on key Bitcoin zones. For instance, the prediction of the famous fall of November 2018 from 6,400–6,500. With Bitcoin staying relatively stable around this number, the markets got positive. All one heard was buy-buy-buy. We all know what happened after — a sudden crash to 3,000.

Another interesting example is the negative market mood of mid-March 2019. As the BTC price was stuck at around 4,000, everyone wanted to sell. Yet, in two weeks we saw the usual rally, followed by more negativity.

The 25th of October 2019 rise also came with a share of prior negative market mood.

Our analytics were able to trace the market moods before they became apparent and influenced the BTC fall.

What the Future Holds

We have a variety of new services in development, as we strive for an all-in-one indicator go-to space.For instance, we will launch an instrument, displaying key price levels in active buy and sell zones, as well as a Market Regime Detector. We also continue to actively work on the improving of all existing indicators, aiming at the highest accuracy. In fact, those of you with us must have already picked up on the accuracy improvements with the Social Index optimization and the addition of extra services.

Free Service, No Registration…What’s the catch? Why do we do this?

People often ask what is the point of our service. Indeed, it’s based on unique and costly data, which we share for free with no pay and without registration.Firstly: the reason why we don’t mind providing our service for free openly is that the capacity of our fundamentals’ — based strategy is endless. It won’t run out as technical strategies do, hence we are not afraid of it being abused, and don’t look to monetize the instrument any time soon, leaving the possibility of donations to our Bitcoin wallet up to you.Our aim is to create a community of professional crypto traders and gain authority in the market. As ambitious as it may sound, we look to become a benchmark for crypto-trading services — the new addition To the top trader tools — TradingView and CoinMarketCap.We are happy to receive feedback from all of you, as well as to answer any follow-up questions. We are also open to the reviewal of integration/partnership offers.Don’t hesitate to reach out to us!

Happy Trading!