Few realize that it’s actually Bitcoin’s enemies who have the greatest incentive to acquire and hold the cryptocurrency indefinitely. Here’s why:

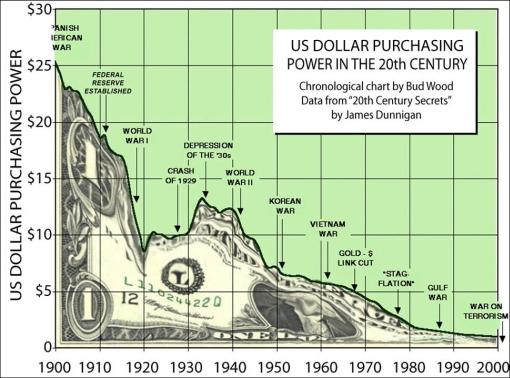

The Cypherpunks who labored for years to create Bitcoin did so for a particular reason—to undermine politically controlled fiat currencies issued by nation states and replace them with sound money that originates in voluntary human consensus and interaction. By limiting government’s control over money, and particularly over money supply—and providing the public with a voluntary, alternative currency ready for the digital age—the Cypherpunks hoped to end the the funding of wars and crony-capitalistic bailouts by governments via hidden inflation. Bitcoin’s explicit goal is to make fiat currencies mostly worthless, or at least worth far less than they are today.

Does Bitcoin stand any chance of succeeding in this regard? Well, whereas just a year ago it was reasonable for the establishment to largely ignore Bitcoin, that’s no longer true. Bitcoin is currently a Top 20 world currency by money supply, making it more significant than the currency of all but a very few the world’s nation-states. It’s rate of user adoption has trended on a consistent path for nearly a decade now, with the number of bitcoin users doubling about every 8 to 12 months during that time. While bitcoin usage is currently “only” at 1 percent of its potential market, that’s “just” 7 more doublings (only 4 to 7 years at historical trend) away from 100%! (1, 2, 4, 8, 16, 32, 64, 100).

If bitcoin continues on anything approaching its almost decade-long historical growth trend (which is really no different than the trend experienced by a number of other recent digital innovations), then Bitcoin will over the next decade do to money, banking, finance and nation-states (not to mention law and accounting) what digital film did to Eastman Kodak, digital music did to music stores, digital books did to book stores and the Internet did to newspapers.

While the odds of Bitcoin’s extreme success may yet seem remote, no rational person can still consider them to be zero. Said another way, the establishment now faces a non-zero (perhaps even non-trivial) chance of a “hyperbitcoinization” event—a period of a few years when the public adopts cryptocurrencies and abandons fiat currencies en masse (just as they previously embraced digital photos, music, books, news, etc. en masse), leading to incredible purchasing power gains in the former and painful purchasing power losses in the latter.

While hyperbitcoinization would be a boon to anyone holding bitcoins, and especially anyone acquiring them early (and anything short of ten percent adoption is still “early”), it would severely disrupt and perhaps even bankrupt those whose savings and reserves are held entirely in fiat currencies (like most individuals, banks, Central Banks, and even nation states today). Those fiat denominated reserves would experience a rapid decline in purchasing power at the same time that bitcoin’s purchasing power continued to soar.

The Establishment’s Dilemma

With Bitcoin’s odds of succeeding no longer zero, its establishment opponents find themselves in a very precarious position: They can either ignore the threat of this new technological innovation and just hope for the best (how did that work out for record stores, books stores, newspapers, Eastman Kodak, etc?), or they can hedge their risk of disruption by acquiring some bitcoins early “just in case”. By acquiring a little bitcoin sooner rather than later, they can ensure that at least some of their losses are offset by bitcoin’s gains in the event of hyperbitcoinization or something like it.

To illustrate, suppose you’re a corporation with $100 billion in dollar denominated assets. You currently estimate the odds of a hyperbitcoinization event in the next decade at “only” one half of one percent. But, if that unlikely event happens, your assets will decline in value precipitously (while the value of bitcoin skyrockets) and you’re likely to bankrupt as a result.

However, you can hedge this risk almost completely by holding just .5% of your corporate assets (a mere $500,000,000 of your 100 billion) in bitcoin today. You can hedge half the risk by allocating just .25 percent of your assets to bitcoin. You can hedge hedge a quarter of your risk by allocating only .125% of assets to bitcoin.

So...What do you do?

If you acquire bitcoin as a hedge and it crashes to zero, you’ve lost a tiny fraction of your assets. By contrast if you don’t acquire bitcoin and it skyrockets, you’ve lost everything. When the risk of loss is great and the cost of hedging is low, there’s only one rational option: You hedge.

Over the next 12 months, I’ll be very surprised if we don’t start to see large corporations, banks, pension funds and perhaps even central banks and nation states begin to hedge in this manner.

Hedging Leads to Higher Prices Which Leads to More Hedging

However, more hedgers means a higher bitcoin price. The new supply of bitcoin is strictly fixed. Bitcoins can’t be created any faster in order to satisfy growing public demand, both organic demand from proponents and hedging demand from detractors. With demand growing and new supply strictly fixed, prices must rise.

Hedgers Are the Most Committed HODLERS

Note that when bitcoin is acquired by its detractors as a hedge, they have very, very little motivation to ever sell. Unlike a trader or speculator who may be tempted to cash out and take profits the next time bitcoin doubles in price, the hedger’s concern over disruption grows with each price increase. The more valuable bitcoin becomes, the greater its odds of disruptive success and the greater the hedger’s need to hold on for dear life (HODL) or even to acquire more. Rising prices accelerate hedging/hoarding which drives prices yet higher.

In the end, the Cypherpunk’s greatest innovation may not be the technology of Bitcoin itself but rather the brilliant game theory incentives that ensure even its haters, especially its haters, acquire and hoard it or risk economic catastrophe.

Excellent analysis as always, Sean!

I also think corporations, banks, and nation states will attempt to hedge by creating their own private "blockchains" (I just call these distributed databases as they miss the whole point of a blockchain). We've seen this pattern before with the various walled gardens of the Internet.

Some of those attempts, unfortunately for the cypherpunks, will succeed in gaining market share and value because many are not ready for the shift in consciousness required to fully take personal responsibility for their own stores of value. Also, these organizations have emended Network effects and marketing experience where much of the cryptocurrency scene is dominated by nerds who can't explain their wizardry to the muggles.

Either way, it's an exciting time to be alive!

Resteeming.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, Luke. I agree that there’s likely to be a stage where “walled garden” distributed databases will gain some usage and market share, perhaps even a lot. But I don’t see that being the end result Nash Equilibrium. In the end I think walled gardens will be to bitcoin/blockchain what AOL was to the Internet. Regardless, it will be fun to watch this play out!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is the most informative and easy to digest description of Bitcoin (and cryptocurrency at large, if I'm talking understanding it) that I've read. Thank you for this post, and also this super apt and clear analogy:

If bitcoin continues on anything approaching its almost decade-long historical growth trend (which is really no different than the trend experienced by a number of other recent digital innovations), then Bitcoin will over the next decade do to money, banking, finance and nation-states (not to mention law and accounting) what digital film did to Eastman Kodak, digital music did to music stores, digital books did to book stores and the Internet did to newspapers.

xo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome post! I've resteemed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

100% upvote, well written and so true. I also see lot's of capital coming in and I hope the hedgers hold BTC and it will stay stable and grow.

In terms of cryptocurrencies, I just hope we will keep both variants of money: cryptos AND papercash. Imho this is important, because even we have privacy coins and the transparency of cryptos is good in so many ways, I don't wanna see a system, in which everybody is totally transparent. I would go so far, that I can say: papercash is a fundamental human right, because it also gives some freedom. If we just have digital money, the people can be more controllable.

What do you think?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very nicely written and well done Mr. King. I've recently sat back and pondered the future of BTC with Wall streets involvement as of late. Will it go higher? Can it go higher? I've always believed so even though these crooks are going to manipulate it in ways not imagined yet. Your words freshen and strengthen the hope I have in it. Yes, there are only so many BTC and yes at some point, very soon I think, the big boys are gonna start snatchin' em up to hedge their bets driving the existing price much higher. Thanks for the enlightenment. I needed it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amazing theory and very convincing article. I am sure it is what started to happen recently. And i love it. Also now i better understand what hedging is and how it works, so thank you for this knowledge explained in a very simple and understandable manner.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Sean. I always feel smarter after reading your posts. Please keep sharing your thoughts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Sean. I always feel smarter after reading your posts. Please keep sharing your thoughts. interesting post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin already have HUGE problems with a transaction fees and times. No way it can be practically used in a worldwide scale. Lightning is sucks as a scaleability measure. So... I'll HODL something else, like Steem )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

These days I think Bitcoin is a NWO plot but up to a week ago I rode along on it for the profits- now I've traded most of it for alt coins.

At this point my picks are Steem, Litecoin, Dash, Bitcoin Cash, Etherium, and Monero. And holy crap they have gone well.

I expect Bitcoin to drop within a week, but have kept a small amount as an insurance policy in case Wall Street keeps pumping it for another few weeks.

All the people who worship Bitcoin past it's pump date are going to get screwed over I think! I'm riding the alt coins for a while now. Jeepers this is a buzz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting viewpoint. Personally I don't buy and hold BTC. I prefer to buy and hold Bitshares. Its a much better Bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! Interesting article. The tricky item right now is the ALT coins. What if you hedge against the wrong coin? I feel like an organization has to now hedge 10% across 20 top coins. This is a tricky time for investors dealing with large sums of money. Hopefully they chose wisely. I anticipate that this industry will constantly iterate to new projects. Investors may need to become computer programmers. Probably a better bang for their buck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Btw: I nominated you for the 7 days black and white challenge yesterday 😊

here:

https://steemit.com/sevendaybnwchallenge/@art-universe/day-black-and-white-challenge-day-1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

what a great post that show the details of the reality ...this the most clear explanation I have ever seen thanks for sharing dear @sean-king

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article and a very true point. The idea that you only need to ascribe a 0.5% probability in order to have a good reason to hedge is amazing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great Post Companies wish to benefit from your knowledge and experience

@sean-king

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@sean-king Beautifully written, totally agreed!

The whole crypto thing hasn't even started yet. Crypto market cap is 0,62 trillion USD, while all bank currency in circulation all over the world equals approximately 2 quadrillion USD. In other words, it's too early yet!

Cryptos can't be considered mainstream yet. Not even BTC. Within the next few years the masses will jump in and altcoins are going to skyrocket! Of course the same applies for BTC, but altcoins will be the huge opportunity for margin. BTC is already too slow. Therefore, I totally agree!

Highest Regards

@lordneroo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I believe that this has already begun. In Canada, for the last 3 years, most of the banks (and government) have been posting/hiring employees with blockchain "expertise", but now those postings have dried up. My guess is that they've now built up their solid understanding of the technology as well as the currencies.

I'm expecting the fiscal reports from most of the Canadian institutions will have at least a paragraph on their approach to managing/investing in blockchain and cryptocurrencies.

The future will definitely be interesting. My question is ... which cryptocurrency will reign supreme? I don't think it will be Bitcoin. The dev team doesn't seem to be listening to the needs of the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

HODL the big mom named BITCOIN!!!!

Enjoyed reading your post dear @sean-king! cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Aaaahahaa yes brilliant analysis! I’ve been thinking similarly... such as how the US government now wants to sell thousands of bitcoin they’ve confiscated, without disrupting the price. We may find More and More governments being serious hodlers to hedge against the uncertainty of their fiat bond and deficit spending positions!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Fed is and has been devaluing the dollar for a century.

BitCoin has nothing to do with it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

bitcoin very need for future

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was/is a great post and a great analysis. I'm sure many large corporations, banks, nations will start to hedge for safety purposes. It really doesn't make sense not to, when the investment versus current worth is such a small portion of wealth.

Either way, I'm looking forward to what the future brings!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting analysis, im a lover and im gonna get as much as i can... great post once again

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You analysis very well. so i can understand more about BTC

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin is future .nice post Sean

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks . I always feel smarter after reading your posts. Please keep sharing your thoughts. interesting post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/steemit/@mahikaler/go-where-ever-you-want-to-go

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is very interesting analysis about how so called 'hyperbitcoinization' may affect the major banks and financial institutions and furthermore the the entire economy of nations. I learned a lot from your post and thank you very much for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit