In view of the surge in Bitcoin(BTC) price, I decided to craft an article to analyse the current cryptocurrency situation. Is the price of BTC going to continue rising? Is it going to tumble in value? Is it driven more by speculation rather than true-valuation? There are many questions about BTC that we have, both as fellow consumers and as traders and investors. Yet the rising trend of possession of BTC by the general public worries me. Fear-of-missing-out(FOMO), a term which refers to people who frantically join the shepherd's herd in hopes of riding the next big financial wave. Majority of these sheep have no idea what they are actually investing into. They call a 10min Google search on BTC research. They are ever so confident that BTC prices will continuously go up, just like in past trends. Ladies and gents, the "HODL" meme cannot be taken as a joke anymore. People uneducated about the technology and market of BTC are rushing into the cryptocurrency space at an ever-increasing pace. There IS A NEED for us to slow down. WE ARE EVIDENTLY in a bubble waiting to be popped. In this article, I'll voice my opinions, in hopes of straightening our facts on BTC. Because I ultimately believe in the potential of this space too.

You may choose to skip the first 2 sections, but I highly discourage you skipping the remainder of the sections.

1.INTRODUCTION

2.ADVANTAGES

3.DISADVANTAGES

4.JUICY REALITY(IMPORTANT)

5.CONCLUSION

- INTRODUCTION

For the sake of the uninitiated, I'll provide a brief explanation of BTC. Between late 2008 to early 2009, the Bitcoin network was released to the public. The first ever cryptocurrency to be created. Intended to be "A secure peer-to-peer" electronic cash system, BTC's creator Satoshi Nakamoto created BTC's blockchain. This new system is very unique. It is an electronic ledger(Online record book) shared with everyone who supports the network(People who store their BTC on the network), creating a new secure information system that has everyone playing a part to support it. Hence the BTC blockchain is termed to be a decentralised(No controlling figure) network. In order to mine (Obtain) BTC, one will have to solve a part of the cryptographic hash SHA-256(A mathematical puzzle). Once solved, the user will then send to the network their solution to validate their Proof of Work(POW). Once confirmed, they will then be rewarded with BTC(A private key which gives them authority to spend "x" amount of BTC). Nowadays, Antminers are the most effective way of mining BTC.This is also one of the reasons why BTC is said to be secure. There is no government body or biased authoritative entity that has a say on BTC. Everything is done by the network. Even if one or two people decided to stop supporting the network, there are many other nodes(people) who still can maintain the network, stabilising the blockchain.

Wow that sure was a lot to take in. I have done my best to try to simplify the things as it is. Be warned that the remainder of this article will contain even more things that you will be unaware and unsure of. Now lets move on to the advantages of adopting BTC.

2.ADVANTAGES

Firstly, it is decentralised. To send money from A to B, the transaction will be sent to the network for verification via the POW consensus. This is superior to the current remittance system that we currently have. Let's say you have to remit money from China to your Aunt in America. You will have to go through your bank, issue an overseas remittance that could take days, and even have to pay a high fee. The bank in America will receive it, then it will take an even longer time before the money finally reaches your aunt. Fortunately, BTC transactions(As of this moment) take just several hours, and cost as low as 110 Satoshis/byte. A Satoshi is a smaller unit of BTC to make smaller transactions easier to manage (1 Satoshi = 0.00000001 BTC). There are so many ways that BTC can be adopted in our financial world. We wouldn't have to pay middle-men fees on Amazon. It is harder(Theoretically possible) to have our money hacked due to the nature of the blockchain. We would have a more secure form of financial storage! In fact, countries like Singapore are working on adopting the blockchain technology for Fintech applications.

Next, BTC transactions are anonymous(To a certain extent). Referring back to the aunt illustration, there must be a sending and receiving address in order for a transaction to replace. Now the flow would look like this:

"3J98t1WpEZ73CNmQviecrnyiWrnqRhWNLy" is what an address looks like. People who support the network are "responsible" for verifying the transaction. Once verification is complete, the BTC will eventually end up with your aunt as illustrated above. To conventionally identify/ hack an address, one has to track this specific transaction across the network's history. Sounds simple? No. You can either own 51% of the network and gain a majority voting call on whatever happens to the network(Control it, reverse it, whatever), or you can ATTEMPT to resolve all the POWs that have been solved ever since the transaction originated till this current point in time. To date, no such computing power can realistically do that. Hence, this is also what makes BTC pseudo-anonymous. There are ways and means to track people behind BTC addresses, and it has been done before. But for now we will leave it as BTC being PSEUDO-ANONYMOUS. This has also led to BTC being a widely adopted currency by the darknet markets(A part of the internet only accessible via the TOR browser). To further reinforce anonymity, a BTC tumbling service is used, jumbling up BTC addresses to make it even harder for authorities to track a specific address. Reasons for wanting anonymity are diverse and are completely up to the individual. Regardless of intentions, it does give us a certain sense of freedom from the prying-eyes of the government.

Finally, what I believe to be the most important yet overlooked point. BTC is a far better "Form of Valuation". Bitcoin is finite by nature, similar to gold. However we know that there can only be 21million BTC in existence, but we are still unsure of the amount of gold that is still to be mined. If one day there was a discovery of a huge gold node, the rise in gold supply would lead to falling gold prices simple because of the law of "Demand & Supply". According to coinmarketcap.com, we have roughly 16.7 million BTC in circulation as of now. The rate at which we mine BTC will increasingly decrease. This is because of the nature of the SHA-256 Hash where the "puzzles" will get harder and harder to solve. As BTC mining difficulty increases, the rate at which BTC is mined decreases over time. In a sense this stabilises the economy as we finally have a currency with a stable and accountable supply. Inflation would never be an issue since the supply will eventually come to a constant. Fiat money, the dollar note you have in your wallet, the well-accepted alternative to gold, a way to value objects. Fiat money has certainly served us well, seeing how it had replaced the archaic bartering system. Yet there are instances whereby fiat has failed us. The notorious Zimbabwean hyper-inflation, Japanese banana notes from World War II, they left people with notes worth even less than a piece of paper. Supply could be manipulated, causing these financial crises.

Furthermore, all transaction records are kept on the blockchain as an electronic ledger. Financial frauds, embezzlements and other pertinent money-based issues can be avoided if the blockchain were to be adopted by the global economy. Age-old economic issues like inflation, instability, unfavorable exchange rates can be reduced with the adoption of a "One-True-Currency". The only obvious disadvantage would be that BTC is virtual, whereas gold and fiat are physical objects. The issue now would be convincing the general public to be comfortable converting to such a system.

Looking at all these points. Everyone would of course think of BTC as the true solution to our economic woes. Of course there could be other advantages of adopting cryptocurrency which I have missed out, the list is not exhaustive. In fact, the points above can easily be derived with a simple Google search. However what I'm going to be providing you in the next section are things which people choose not to know off. On subreddits, online forums and blogs who brazenly promote the "perfect" system of BTC, sheep are misguided to believe that they are investing into the "Next Big Thing". Sheep think they are solely investing into "technology", that this is the next tech-revolution. The worst of the sheep hop on the bandwagon in hopes of becoming another BTC-millionaire. They brush aside all advice or warnings that cryptocurrency is in a bubble. Arguments like "It has always been rising in price" and "It is the next big thing" are simply a means to neglect the many glaring issues that the cryptocurrency world is now in. However, convincing people like this would never work. Instead I am going to spoon-feed you what there is to know and leave you to decide on your own.

3.DISADVANTAGES

Going back to the point about BTC being anonymous. Wellllll... it's not. Inventions are as full of flaws as the ones who made them. Quoted from an article on Sciencemag:

[The beauty of Bitcoin, from a detective’s point of view, is that the blockchain records all. “If you catch a dealer with drugs and cash on the street, you’ve caught them committing one crime,” Meiklejohn says. “But if you catch people using something like Silk Road, you’ve uncovered their whole criminal history,” she says. “It’s like discovering their books.”]

The reality is that even the darknet is not the "safe-haven" that we thought it was. Many illegal users of darknet bazaars have been caught through their BTC address. Sites like AlphaBay and Hansa have already been taken down, proving that this shield of anonymity is nothing more than a glass screen. The blockchain itself is why such a system will never be anonymous. It LITERALLY shows a full record of ALL transactions and is made available to everyone. Currently, authorities exploit this fact to hunt down darknet criminals.

Think of it this way. Every time you make a transaction, it leaves behind a digital breadcrumb. After multiple months you would have left behind a digital trail amongst the many other trails. Now all that is left to do is to link this trail to your Internet Protocol Address (IP Address), there goes your anonymity! For people who have intentions of purchasing something illegal through the darknet, my advice, don't.

Now, it also seems to me that people believe that BTC is 100% secure and that it would completely eradicate worries of having your finances stolen(Hacked in this case). The only way of purchasing BTC now is from online brokerages or exchanges. They are the "middle-men" we all have to get pass before we get into possession of our BTC. Now I'll introduce three types of investors.

a)People who store their BTC on exchanges

This is by far the worst of the 3 types. Either they are completely unaware of the risks involved or they chose to disregard it. When you leave your BTC on an exchange, you are not COMPLETELY in possession of your BTC. Yes you read that right. Although unlikely due to legislative regulations, owners of the brokerage and exchanges can still run off with YOUR BTC since they own the private key to it as well. What is more likely is for the brokerage to be hacked. The infamous Mt Gox incident, whereby 850,000 BTC were hacked around early 2014. Shockingly, this was the second time a huge exchange like Mt Gox was hacked, 2011 being its first incident. What became of Mt Gox? The company eventually fell into debt and was liquidated. Poor patronesses of Mt Gox were forced to sit by the sidelines, still waiting to be refunded of their BTC. It IS POSSIBLE for an exchange to be hacked. Hence, I strongly encourage for investors to invest in a cold storage. Which brings me to my next example

b)People who store their BTC on cold wallets

For people who don't know what a cold wallet is, it is a small device used to store all your private keys so that only you are able to retrieve them. I personally use a Nano Ledger S, but you can also try other brands like Trezor.

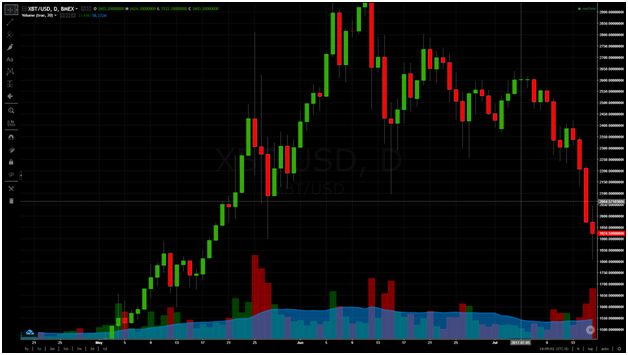

Of course there are risks like forgetting of passwords, but depending on the wallets you have they may have certain backup protocols. Now let us focus on the risks of cold storage. As you all are aware, BTC is notorious for its voltaility and its spectacular crashes. See for yourselves.

Depending on whether you're a short or long term investor, you might be in for the jitters as the worries of a 50% crash is always there. It takes time for you to transfer your cryproassets from your storage to the brokerage. By then the price might have already tumbled down to abysmal levels. After all, there is no economic tool affixed onto BTC to indicate a price floor...

Now let us move on to the last type.

c)People who day-trade cryptocurrencies

These are people who do not wish to hold crypto assets for the long-term. Instead, they exploit the volatility of the market in hopes of making profit. For potential day-traders I hope you understand that the competition you are facing in this market, is not human traders. There is no known source, but from the flash crashes you can clearly see there is a form of market manipulation.

On the popular GDAX exchange, the price of Ethereum(A type of crypto) crashed from $300 to $0.10 in a matter of seconds. Cause of crash? Algorithm-bots. A specially tailored program designed to react to market changes 24/7. A decent trader would be aware of the need of having stop-losses to prevent your account from being unintentionally wiped. Likely there was a glitch in a certain bot, causing it to bulk short(Sell) a large amount of Etheruem, causing a cascading ripple effect that triggered OUR stop losses. This signaled a shorting potential, causing OTHER bots to continue shorting it. Resulting in a 99.9% decrease in price within seconds. Potential traders, there is a chance of profiting through day-trading crypto, people have done it before. Just be aware of such a risk, never over-invest especially in crypto. Stop-hunting is prevalent in this market, perfect for the pros to feast on the noobies.

4.JUICY REALITY

At the end, I'll consolidate all my points and state my stance on cryptocurrencies. But before that, I'll directly confront the more popular statements made by supporters of both BTC as well as cryptocurrency.

a)I'm investing in the technology behind BTC

A very common argument that seems logical to the naked eye. Let me introduce a set of cryptocurrencies coined as the Altcoins. Ethereum is by far the most popular one. Unlike BTC, Ethereum was not meant to be just another cryptocurrency. It introduced a new technology termed as "Smart contracts" which could be used by coders and programmers on several coding platforms. In layman terms, it is a digital contract which automatically executes for 2 parties once certain terms and conditions has been met. Unlike BTC, Ethereum has much more application and utility, yet why does it have a lower market cap? Other coins like Ripple, Gas, Monero all provide their own specialised services/uses, yet they still can't compete on an even footing with BTC? Coins like Monero are made to be more-anonymous than BTC, coins like Ripple are made to be much-faster than BTC, yet why do we still see BTC as the header of cryptocurrencies? Is the first-mover advantage really such a game changer ?Is the technology behind BTC really so revolutionary? Are all Altcoins inferior to BTC? If you are really buying into technology, wouldn't the Altcoins be a far more logical and practical choice? Yet the price of Altcoins remains pegged to the price of BTC.

When BTC price rises, price of majority of Altcoins fall as money is being channeled to the now profitable BTC. When BTC price falls, price of majority of Altcoins continue to fall as "money" is funneled back to the less-volatile fiat. Can we really say that we are investing in BTC based on its technology?

b)I invest in cryptocurrencies which show potential, in the long run, HODLing will give me profits.

I truly believe that there will be the small number of cryptocurrencies that would prove to be profitable investments solely based on the fact that they can solve ACTUAL issues. However a good 95% of cryptocurrencies would fail. They are simply driven by too much speculation as well as pump and dump schemes.

Cough cough* Pyramid scheme cough*

No comments.

Facepalm*

All I can say is, have the strictest of grading criteria. Personally, I look at the team behind the crypto, their history, fundamentals of the coin(Whitepaper), support by the community(Reddit) and their business model. Is there an incentive for the developer to constantly improve on the network? I then grade them into classes of A,B,C,F. This allows me to safely weed out the bad-investments from the good. The stricter your criteria, the better. It's much better to completely avoid a train wreck than gain anything in this volatile market.

c)I'm not dumb enough to fall into pump and dumps as well as ponzi schemes.

Sorry to break it to you, but you most likely already have, multiple times... Assuming that you can already identify the extremely obvious pump and dump coins(I'm not going to name any), I'm going to introduce you this investment advisory group(Not going to name it). I have no doubts that they are a group of experienced investors. So far their track-record of calling good crypto investments have been spot-on. Examples include buying NEO @ $0.10(Now $34.11), and Monero @ $60(Now $270) are commendable. They send out monthly articles and suggest their best picks of the month. This is the trend which I have observed just before the release of their picks. Note: This is merely an observation, not an accusation.

Perhaps I might be over-thinking, being overly paranoid. I'll leave it up to you guys on what to decide based on this.

5.CONCLUSION

Ahhh finally we have reached the last segment. After all that, you might think that I'm just a biased writer. I'm just another guy that has lost on BTC before and wants to drag everyone down with him. No.

I support cryptocurrencies. I truly believe that they are the next tech-revolution, similar to how the Internet was at one point in time. However at the rate we are going, we are driving ourselves into a crypto bubble, NOT a tech-revolution. There are way too many people who view cryptocurrencies as a get-rich-quick scheme. This current influx in BTC possession is not helping us achieve the goal of BTC adoption. On the contrary, it's doing the exact opposite. Place yourself in the Government's shoes, how would you allow people to dabble in BTC seeing the volatility that precedes it. By all forms of economical and technical analysis, this is not a bull run, but a rocket ship that is running on speculation fuel. It destroys the image that BTC can ever be a stable secure financial currency, it puts down the many potential Altcoins which could have further introduced revolutionary technological concepts. Cryptocurrency is a new form of technology, not a get-rich-quick scheme. Why I chose to write such a long article? I simply have too many friends who are adopting the FOMO-mentality. Jumping straight into the bandwagon after reading a 10-min description of BTC on the internet thinking that they are fully aware of the mechanics of this market.

- Crypto is not a get-rich-quick scheme.

- Stop breeding new sheep. Getting your friends and family to hop in on the bandwagon is inevitably going to crash this market.

- Be aware of the many risks this market has. Read up and do actual research. Skim-reading does not count.

- Never over-capitalise. Due to its current state, there is no telling if this market is going to live to tell the tale. If it so happens to crash, having a healthy, well-spread investment portfolio is a simple way to safeguard yourself.

- Never under-estimate your market opponents. They are far more resourceful and knowledgeable than you. Never ever think you are smarter than the market.

- Do not make financial decisions by the influence of others. You are your own shot caller. You win what you gain and lose all you lost.

- Don't be fooled by overly-technical jargons smothered over whitepapers. Instead come up with strict grading criterions and decide whether that investment will solve a real-world problem.

In my eyes, if prices continue to spike, perhaps towards $50,000? There will be an inevitable crash down to the $1000-$5000 ranges. Back to its initial cost of production. I hope this article has given you a clearer idea of cryptocurrencies. Ultimately what I wish to see is for this market to expand and be adopted by society and the mega-companies. I have included links as well as further reading topics which you may be interested in. I appreciate donations and constructive feedback.

I also highly encourage you to share this with your family and friends if you feel that you have learnt something from it. Happy trading!

Disclaimer:

I merely provide my own personal opinion. I am not writing this on behalf of any brand/title/person. I am not a professional by any means. You are not inclined to follow any of my opinions. What I have written is my own interpretation of what is going on in the world of cryptocurrencies and is by no means a definite or accurate interpretation. This information is for you to digest, whatever decision made thereafter is solely your own choice.

Links:

http://www.sciencemag.org/news/2016/03/why-criminals-cant-hide-behind-bitcoin

https://coinmarketcap.com/

https://www.coinigy.com/

https://www.ledgerwallet.com/

Further reading:

Proof of stake(POS), Byzantine Fault Tolerance, GPU mining, Technical Analysis, Charting, Pump and Dump, Risk Management, Greed, Emotional Trading, Harmonic Trading Patterns, Trading plans, Forex, Stocks, Commodities, Precious Metals

Congratulations @shadyshade! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @shadyshade! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @shadyshade! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit