The day was August 6, 1991. The day that the World Wide Web went live. Back then you wouldn’t have known that and if you did, you were among the small minority who did know about it and actually cared.

It’s not uncommon for us nowadays to wake up, check our smartphones and browse news headlines, watch funny cat videos or send a funny selfie to family or friends. We’ve adapted, we’ve grown with the technology.

It wasn’t always like that. For most consumers during the late 1980’s and early 1990’s, a computer was not on the top of a consumer’s shopping list. They were expensive, ineffective at managing tasks and if you wanted to open a program, you couldn’t point and click. Computers back then were complex for users and you had to understand computing languages to operate and give the computer commands. Now completing a task and working with your computer or smartphone is as easy as “Hey Siri, open this…”

Even the internet when it first launched was a complete pain to use. If you are at least in your twenties, you remember the old days of dial-up internet connections where your parents were yelling at you to get off the internet so they could use the phone… oh, the horrors of dial-up.

Technology Can Take Years Before Being AdoptedThe beautiful thing about technology is the how impactful it can be towards society. Technology nowadays expands and improves at an alarming rate. It’s not always the case but even for technology that doesn’t pick up right away, it doesn’t mean there isn’t progress being made. Technology moves society forward. We believe cryptocurrency and blockchain technology is on the verge of a societal breakthrough that people are not expecting.

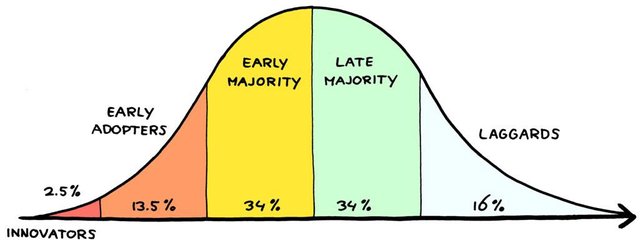

If you look at this graph, you could make an estimate of where we are with cryptocurrency. Some will say we are in the Laggards phase, others would disagree and say we are in the Innovators phase, for the purpose of this publication we will not provide our opinion on where we think cryptocurrency is positioned on this graph but instead explain some of the reasons we feel cryptocurrency has not yet arrived among society.

Why Cryptocurrency Hasn’t Been Adopted by Mainstream SocietyCryptocurrency used to be called “nerd money” because people who weren’t involved in the space at the time lacked a proper understanding of how cryptocurrency works. They didn’t understand how people could perceive digital money as a legal tender.

In some ways, this stereotype is still present today. Older generations don’t get it at all, while younger generations of people do and so there is a friction that is present between the colliding generations of people who see this new technology. Some find crypto as a revolutionary way to give people more freedom of control over their money whereas other people think this new technology is nothing more than a scam or tulip mania 2.0.

How will we ever achieve mass adoption if people feel this way towards this technology?

People won’t “get it” at first, but then the free market will force them to.

If you took the time to Google search the public’s opinions on Goliath’s such as Amazon.com or even the Internet itself you will find some hilariously wrong predictions at the dawn of their creations.

"Clifford Stoll from Newsweek posted this anti-internet article back in 1995, titled “Why the Web Won’t Be Nirvana” we recommend reading it for perspective."

Cryptocurrency and blockchain technology will have a prolific effect on society. Once we can conquer some of the fundamental issues that are currently holding this technology back, we will achieve mass-adoption.

These are currently some of the issues we face:

•Applications and Software

•Legalities, DarkNet and Public Reputation

•Security of assets

•Price Volatility

•Use-case scenarios

Bitcoin and Ethereum have paved the way for creating waves of enthusiastic developers ready to build their own DApps and form their own cryptocurrency project. This is great for all reasons related because behind all this positive energy, the world receives a new industry that helps boost the global economy, grows a new niche in the workforce, and creates an industrial revolution-like period of creativity and innovation.

Currently, one thing that gives fiat currency the upper advantage on crypto is the ease of use. If someone accepts cash, it’s as easy as pulling the money out of your pocket and handing it the to the recipient. There are no transfer fees for extending your arm and handing money to someone.

We also feel that it is completely fair to compare fiat and cryptocurrency in extreme comparisons such as the real scenario of Hurricane Maria, which left Puerto Rico’s citizens without food, water, and electricity. How are people supposed to access their money when an electric grid goes offline? You can still form a raw transaction offline but there has to be an established form of trust with the counterparty. Some improvements here could be crucial for whether or not cryptocurrency can be seen as legal tender and not just as an investment.

We believe that with the further development of applications presented on a blockchain-based network, we could vastly improve the use-cases of cryptocurrency to the point where people can actually use it as a currency and not for pure investment purposes.

Legalities, DarkNet and Public Reputation

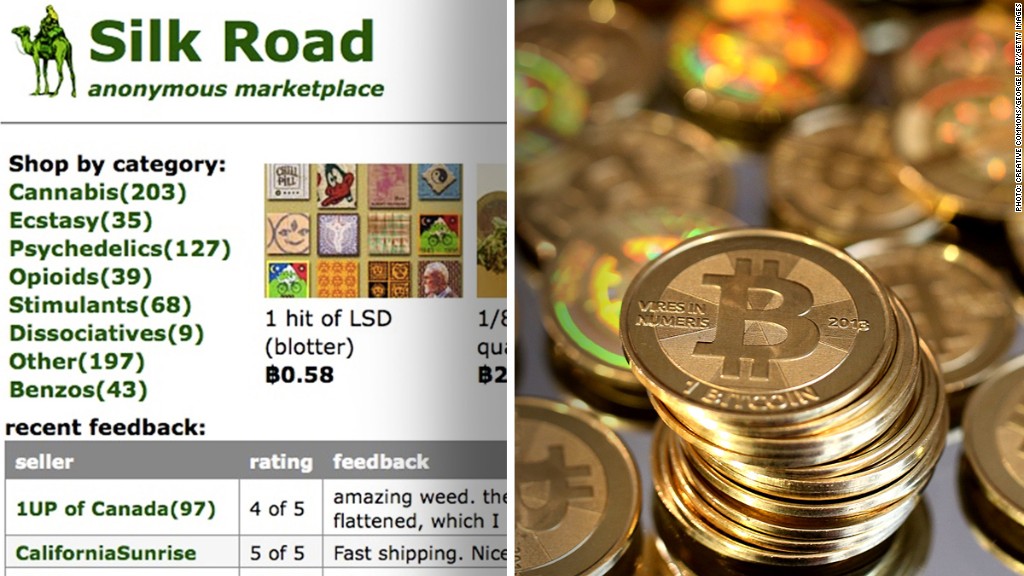

For the first few years, after it’s creation, Bitcoin had established a bad reputation for itself. Thanks to darknet websites such as Silk Road, Bitcoin was being used to process some pretty scary stuff. Anywhere from prostitution, drug trafficking, and other unmentionable illegal activities. This left plenty of bad press for cryptocurrency during its foundation. While people have spent fiat currency on similar illegal activities as well, it was more impressionable for the new emerging technology.

To top it all off, back before cryptocurrency became a multi-billion dollar industry that it is today, the U.S. government was against the technology by calling Bitcoin fraudulent and warned investors to not get involved. Which was harsh of the U.S. Government at the time after they had just bailed out the trillion-dollar fractional reserve banking system that took advantage of millions of citizens across the globe to help stabilize the shattered economy by offering the big banks a fancy bailout package. Go figure…

Now in 2018, cryptocurrency is being supported by some of the key players who set out to destroy it. Jamie Dimon, the CEO of JP Morgan Chase, has turned his opinion of the technology around and now halfheartedly supports the technology that one day may take over his business’s use-case. The U.S. and foreign legislators have formed meetings at events such as the G20 Summit and have discussed a future in which cryptocurrency and blockchain technology can co-exist in the world. Public opinions on crypto are changing towards a more positive outlook.

Security of Assets

If cryptocurrency is one day going to dethrone the fractional reserve banking system that we have today, it’s going to have to do a better job in regards to security. Events like Mt. Gox being hacked resulting in thousands of investors losing their money is not going to be acceptable in the future. We need vast improvements to how people can use cryptocurrency with regards to investing it, spending it for daily shopping and storing it away for events such as emergencies, vacations, and retirements.

Certain projects can improve on this issue and the team behind ETHOS is currently working on a universal wallet that will eventually support every single cryptocurrency. The wallet will allow you to trade and invest cryptocurrency as well as use it for offline storage similar to a hardware wallet.

The Ledger Nano S is one of our recommend hardware wallets that can be used for offline storage.

It’s a great option for security and investors should use one to secure their holdings. The device keeps your crypto offline for you so you don’t have to worry if a hacker gains access to your computer or if your exchange account you use to trade and store cryptocurrency gets compromised. The Ledger Nano S acts as a connected device to send and receive your coins but keeps your private wallet address offline and separated from malicious cyber attacks.

Cryptocurrency Price Volatility

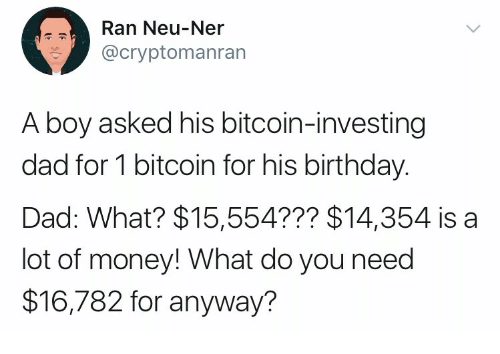

Bitcoin and other cryptocurrency prices are no laughing matter.

The wild-swings that get some investors on board with investing are the same that keep many people avoiding the technology completely. How can we fairly say that cryptocurrency is more effective than a banking system when one day you could be holding $1,000 worth of Bitcoin, the next day it could be worth $5,000 and the next $0?

Well, it turns out that the best way to remove the issue of price volatility is by increasing adoption. The wild fluctuations we see on the market every single day will be reduced if more people jump on board. Even fiat currencies experience deflation and inflation in value but because millions of people use it, the volatility is somewhat stable over an extended period of time.

Currency is typically based on a perceived value, the U.S. used to have a gold standard to back up their currency by storing large portions of gold bars in secure locations to justify the purchasing power of the U.S. Dollar. Now the U.S. is essentially backed by consumer confidence. Whereas Bitcoin caps out at 21M Bitcoins. This means Bitcoin will only have a finite amount in existence, which is comparable to the value of gold which only contains a set amount available on the Earth.

The Internet of Money author Andreas M. Antonopoulos, explains this perfectly in this video.

Use Case Scenarios for Cryptocurrency

Use cases for cryptocurrency will give the coin or token its value. Coins such as Dogecoin (DOGE) that became a $1B market cap coin, should not have happened back in December of 2017.

Crypto projects should stand for something and provide a value to society in order to be properly adopted. Projects such as Substratum (SUB), that combat the issue of internet censorship have an established use-case, it gives value. Ethereum, the world’s second cryptocurrency in valuation compared to Bitcoin, has an established use case by providing smart contracts to the blockchain network. In exchanges, people can form contractual agreements over a verifiable blockchain network.

Ethereum’s use-case of implementing smart contracts is revolutionary and is already bringing big changes to companies in need of this technology. It’s so innovative, that companies like Samsung and Walmart plan to utilize blockchain technology to transport goods and manage inventories.

SummarySo there are our reasons why we feel cryptocurrency hasn’t been adopted…yet. Do you agree with our list? Let us know by leaving us a comment!

If you aren’t already, consider joining the 7,000+ fans that follow us on social media!

✅ @sharecrypto, congratulations on making your first post! I gave you a $.05 vote!

Will you give me a follow? I'll follow you back in return!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @sharecrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit