Bitcoin exchanging can be to a great degree beneficial for experts or tenderfoots. The market is new, very divided with colossal spreads. Arbitrage and edge exchanging are broadly accessible. In this manner, numerous individuals can profit exchanging bitcoins.

Bitcoin's history of air pockets and unpredictability has maybe accomplished more to acquire new clients and financial specialists than some other part of the crpytocurrency.

Each bitcoin bubble makes buildup that puts Bitcoin's name in the news. The media consideration makes more end up intrigued, and the value ascends until the point when the buildup blurs.

Each time Bitcoin's value rises, new financial specialists and examiners need their offer of benefits. Since Bitcoin is worldwide and simple to send anyplace, exchanging bitcoin is basic.

Contrasted with other money related instruments, Bitcoin exchanging has almost no obstruction to passage. On the off chance that you officially claim bitcoins, you can begin exchanging in a split second. As a rule, check isn't required keeping in mind the end goal to exchange.

On the off chance that you are keen on exchanging Bitcoin at that point there are numerous web based exchanging organizations offering this item as a rule as an agreement for distinction or CFD.

Avatrade offers 20 to 1 use and great exchanging conditions on its Bitcoin CFD exchanging program.

Why Trade Bitcoin?

Before we demonstrate to you generally accepted methods to exchange Bitcoin, it's critical to comprehend why Bitcoin exchanging is both energizing and one of a kind.

Bitcoin Is Global

Bitcoin isn't fiat money, which means its cost isn't straightforwardly identified with the economy or strategies of any single nation. All through its history, Bitcoin's cost has responded to an extensive variety of occasions, from China's degrading of the Yuan to Greek capital controls.

General monetary vulnerability and frenzy has driven a portion of Bitcoin's past cost increments. Some claim, for instance, that Cyprus' capital controls pointed out Bitcoin and made the value ascend amid the 2013 air pocket.

Bitcoin Trades every minute of every day

Not at all like securities exchanges, there are no official Bitcoin trades. Rather, there are many trades the world over that work all day, every day. Since there is no official Bitcoin trade, there is additionally no authority Bitcoin cost. This can make arbitrage openings, however more often than not trades remain inside a similar general value go.

Bitcoin is Volatile

Bitcoin is known at its fast and regular cost developments. Taking a gander at this day by day graph from the CoinDesk BPI, it's anything but difficult to recognize various days with swings of at least 5%:

Bitcoin's unpredictability makes energizing open doors for dealers who can receive speedy rewards at whenever.

Discover an Exchange

As said before, there is no official Bitcoin trade. Clients have numerous options and ought to think about the accompanying variables when choosing a trade:

Direction and Trust – Is the trade reliable? Could the trade flee with client reserves?

Area – If you should store fiat money, and trade that acknowledges installments from your nation is required.

Expenses - What percent of each exchange is charged?

Liquidity – Large dealers will require a Bitcoin trade with high liquidity and great market profundity.

In light of the components over, the accompanying trades command the Bitcoin trade advertise:

Bitfinex - Bitfinex is the world's #1 Bitcoin trade as far as USD exchanging volume, with around 25,000 BTC exchanged every day. Clients can exchange with no confirmation if cryptographic money is utilized as the store technique.

Bitstamp - Bitstamp was established in 2011 making it one of Bitcoin's most seasoned trades. It's right now the world's second biggest trade in light of USD volume, with a little under 10,000 BTC exchanged every day.

OKCoin - Bitcoin trade situated in China however exchanges USD.

Coinbase -

Coinbase - Coinbase Exchange was the main controlled Bitcoin trade in the United States. With around 8,000 BTC exchanged every day, it's the world's fourth biggest trade in light of USD volume.

Kraken - Kraken is the #1 trade regarding EUR exchanging volume at ~6,000 BTC every day. It's at present a main 15 trade as far as USD volume.

Bitcoin Trading in China

Worldwide Bitcoin exchanging information demonstrates that a huge percent of the worldwide value exchanging volume originates from China. It's imperative to comprehend that the Chinese trades lead the market, while the trades above essentially take after China's lead.

The fundamental reason China commands Bitcoin exchanging is on account of monetary directions in China are less strict than in different nations. Therefor, Chinese trades can offer use, loaning, and prospects choices that trades in different nations can't. Also, Chinese trades charge no expenses so bots are allowed to exchange forward and backward to make volume.

On the off chance that you'd jump at the chance to take in more about Bitcoin exchanging China, this video from Bitmain's Jihan Wu gives extra knowledge.

Step by step instructions to Trade Bitcoin

Kraken will be utilized for instance for this guide. The procedure and essential standards continue as before over all trades.

In the first place, make a record on Kraken by tapping the dark join confine the correct corner:

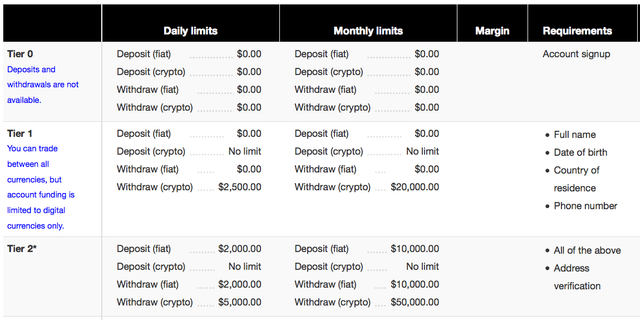

Kraken offers numerous store techniques, which are recorded here:

EUR SEPA Deposit (Free) - EEA nations as it were

EUR Bank Wire Deposit (€5) - EEA nations as it were

USD Bank Wire Deposit (Free until 3/1/2016, at that point $5 USD) - US as it were

USD SEPA and SWIFT Deposit (0.19%, $20 least)

GBP SEPA and SWIFT Deposit (0.19%, £10 least)

JPY Bank store (Free, ¥5,000 store least) - Japan as it were

Computer aided design Interac Deposit (Free until 3/1/2016, at that point 1%, $10 CAD expense least, $5,000 CAD store most extreme)

Computer aided design EFT Deposit (Free until 3/1/2016, at that point 1%, $10 CAD expense least, $50 CAD charge most extreme, $10,000 CAD store greatest)

Stores influenced utilizing the conventional managing an account framework to will take somewhere in the range of one to three days. Bitcoin stores require six affirmations, which is around 60 minutes.

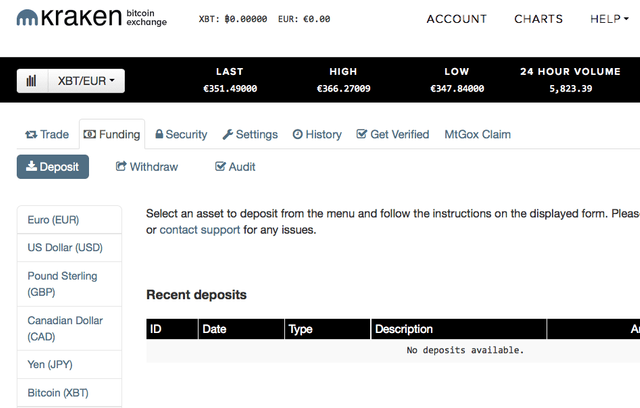

Presently, explore to the "Exchange" tab. Utilizing the dark bar at the highest point of the page, you can switch exchanging sets. In this illustration we'll utilize XBT/USD. We need to purchase bitcoins, so how about we put in a request. Explore to the "New Order" tab.

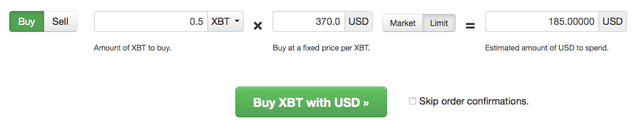

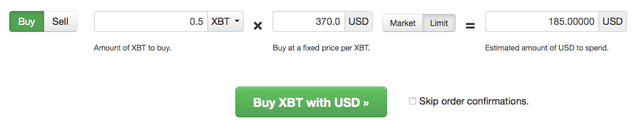

Suppose I've saved $300 into my record with a USD bank wire. In the case underneath, I've presented a request to purchase 0.5 bitcoins (XBT) at a cost of $370 per bitcoin.

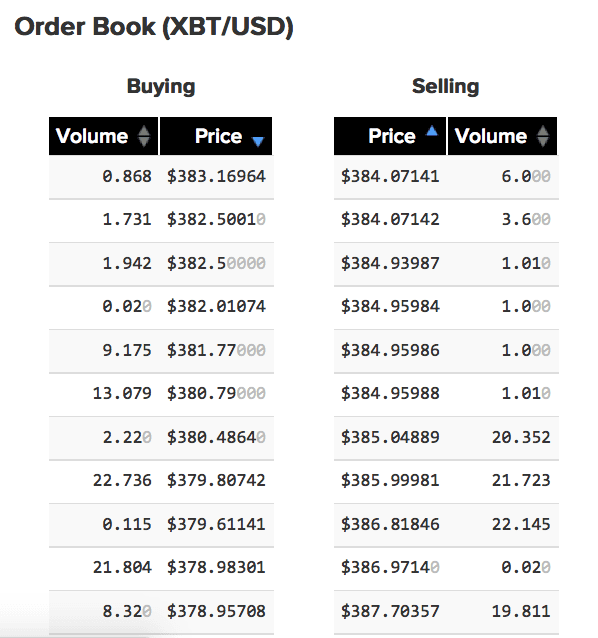

Why present a request to purchase at $370 per bitcoin (XBT) and not $383.17? One may present a request lower than the present cost on the off chance that one expects the cost of Bitcoin to fall. For this situation, since my request is lower than different offers in the orderbook, I won't get my request for 0.5 bitcoin quickly. Submitting a request at a predetermined cost is known as a limit order. Before putting in a request, make sure to check the orderbook for your exchanging pair.

In the illustration orderbook underneath, you can see that the most noteworthy purchase offer is for $382.5 per bitcoin, while the least offer request is at $384.07 per bitcoin.

A market arrange for this situation would present a purchase arrange for XBT at the cost of the least accessible offer request. Utilizing the orderbook over, a market arrange for 0.5 XBT would buy 0.5 XBT at $384.07 per XBT. In the case of offering bitcoins, a market request would offer bitcoins at the most noteworthy accessible cost in light of the present purchase orderbook—for this situation $382.5.

Exchanging Risks

Bitcoin exchanging is energizing a result of Bitcoin's value developments, worldwide nature, and day in and day out exchanging. It's essential, nonetheless, to comprehend the numerous dangers that accompany exchanging Bitcoin.

Leaving Money on an Exchange

Maybe a standout amongst the most well known occasions in Bitcoin's history is the fall of Mt. Gox. In Bitcoin's initial days, Gox was the biggest Bitcoin trade and the least demanding approach to purchase bitcoins. Clients from everywhere throughout the world were cheerful to wire cash to Mt. Gox's Japanese ledger just to get their hands on some bitcoins.

Numerous clients overlooked a standout amongst the most essential highlights of Bitcoin—controlling your own particular cash—and left in excess of 800,000 bitcoins in Gox accounts. In February 2014, Gox stopped withdrawals and clients were not able withdrawal their assets. The organization's CEO asserted that the lion's share of bitcoins were lost because of a bug in the Bitcoin programming. Clients still have not gotten any of their assets from Gox accounts.

Gox's disastrous fall features the hazard that any merchant takes by leaving cash on a trade. Utilizing a controlled Bitcoin trade like Kraken can diminish your hazard.

Your Capital is at Risk

Keep in mind that as with an exchanging, your capital is in danger. New dealers should begin exchanging with little sums or exchange on paper to rehearse. Novices ought to likewise learn Bitcoin exchanging methodologies and comprehend showcase signals.

Bitcoin Trading Tools and Resources

Cryptowatch and Bitcoin Wisdom – Live value graphs of all major Bitcoin trades.

Bitcoin Charts – More value outlines to enable you to comprehend Bitcoin's value history.

bitcoinmarkets – A Bitcoin exchanging sub-reddit. New clients can make inquiries and get direction on exchanging strategies and system.

TradingView – Trading people group and an awesome asset for exchanging diagrams and thoughts.

When everything seems to be going against you, remember that the airplane takes off against the wind, not with it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit