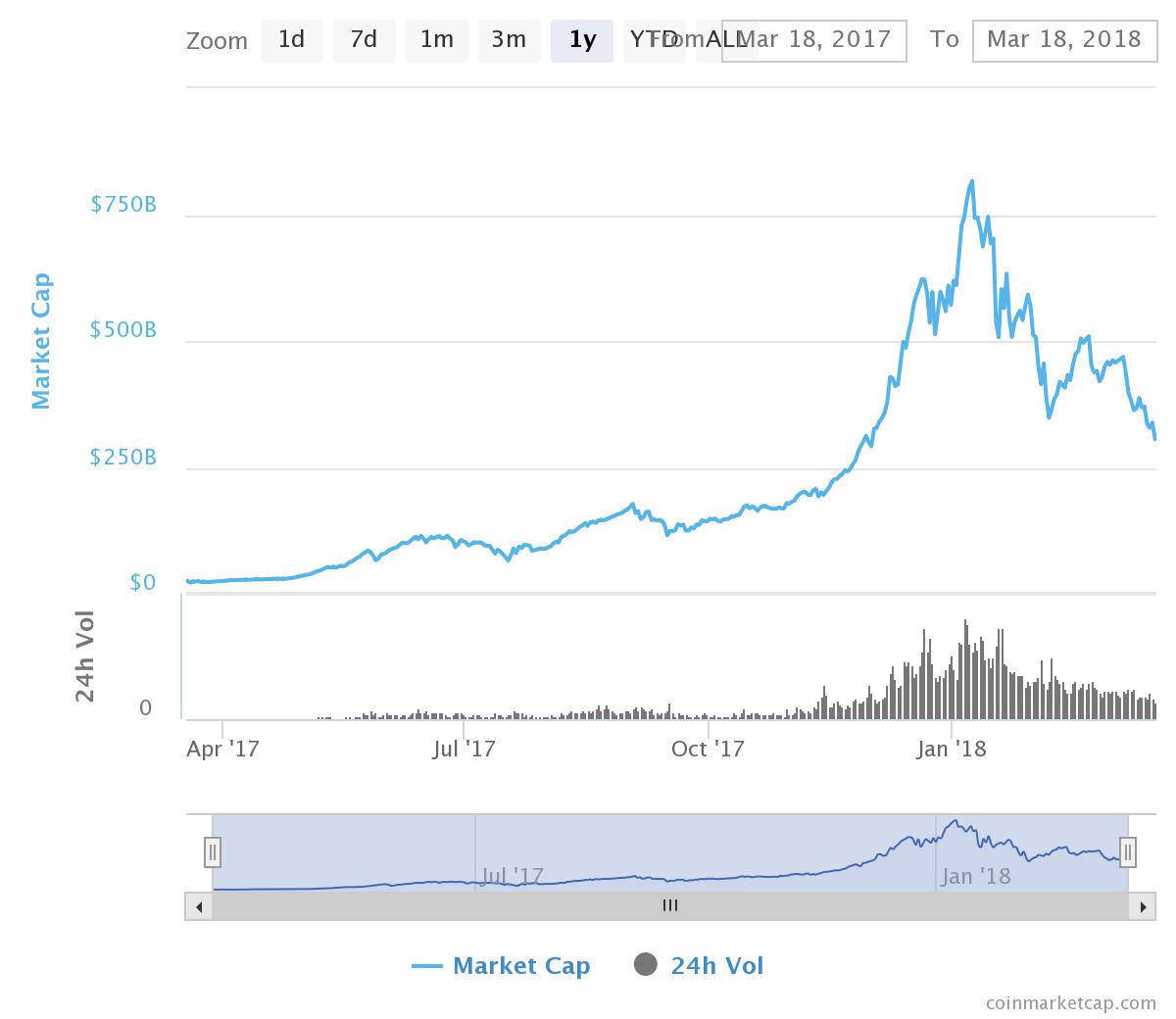

Pictured Above: Do you see a crash? Or do you see a rise in value over this time last year?

Yesterdays post on Google banning crypto ads drew a couple of comments. One comment came from @CryptoIsSweet asking my prediction for Bitcoin in the next few days.

I won't answer with what I think will happen in the next few days. I will give my prediction for the next two months.

While others use technical analysis to predict price movement, I don't get into all that. I use another, much easier system taken from my career. I use basic psychology and emotional patterns.

Technical analysis probably does work but I find it lacks one important metric. A way of accurately measuring an idea. For example, the idea of a mobile phone or the idea of the internet are easy to see the value of because there are whole industries built around it. But the blockchain is an idea that is largely intangible compared to those older ideas. So the value of it is anyones guess. Hence the price instability.

As a result, I find technical analysis lacking, rather than productive in my portfolio management. It appears to me that it is measuring other peoples reactions, not the technology itself. So I use is a basic graph to show me the up or down trend and an understanding of psychological patterns.

When you look at coin graphs from a psychological perspective, they make a whole lot more sense. Which is pretty much what the TA crowd is trying to work out - i.e. What people will do to shift the price up or down. Using an understanding of psychology, you can better predict forward movement and trends. Because emotional states always suggest the next mood you will experience.

How do you apply psychology to a Bitcoin graph?

- The graph is really a thought pattern. Don't think of it as a price. Think of it as a brain wave pulsing. You are looking at what people think about the price of cryptocurrency.

- When graphs are going up, people are thinking positively. When the graph is going down, people are thinking negatively.

- Thoughts are hooked into the emotional / survival centres of the brain. So when people perceive a rise in value, they buy, buy, buy. When they perceive a loss of value, they run and hide.

Anyway, there are other factors involved but the main one is that people are really speculating on their own interests. I.e. how rich they will get / how much money they could lose. They are not really speculating on the actual market and industry value of the coin.

That's one thing.

The next thing - and this is something the technical analysis charts don't tell you - is that emotional patterns run in cycles. In chapters. There are usually 5 stages that you will go through before you reach another emotional state. In other words, when you are sad, you will go through several different related emotional states before you return to a normal state of mind. Same thing when you are happy.

Human emotions, which is a key driver of price in the cryptocurrency markets, go through closely-linked stages. Gradual changes. We don't go from sad to happy ( or the reverse ) directly. At break neck speed.

So the markets won't either.

If you apply this to the Bitcoin price and markets right now, the markets are not going to suddenly rebound and moonshot in the next few weeks. Right now, the markets are "sour" and people are feeling "burnt off" by the January collapse of cryptocurrency. So the idea of "happy days" in March, or even April, is pretty much out of the question.

I think late April, May, the markets will return to green pastures.

The markets are "sour" because a large percentage of people who got into Bitcoin in December - January were betting on Bitcoin to pay off their debts. How many investors are in financial debt? I would imagine a lot of people are banking on Bitcoin to pay off loans and their over leveraged lifestyles, let alone buy themselves a yellow lambo.

Which is why I think the markets are "sour" as many people bite the bitter pill that Bitcoin is not a steady rise to riches. At the click of a mouse button. With no risk.

Anyway, I always relate the coin markets to an emotional state and that's how I produce my 'technical analysis' forecasts. Right now, the markets are like school holidays and its raining outside. The kids are restless, agitated they aren't getting their moonshots and... sulky.

The cryptocurrency markets are sulky right now because the collective mentality of investors is sulking. March to mid-April will play out that sad sac attitude because so many people think "Bitcoin owes them a fortune".

I think the markets will slide again for the next couple of weeks, January-style. Emotion and basic psychology tell me this is more than likely. These methods work well for me because my whole career is built around peoples emotional behaviour and how that influences their thinking.

While a bear period until late April, early May may seem to be bad news, it is not. Now is the time to dig in, do your homework and keep the fires under your portfolio burning. Don't get emotional. Get tactical.

- The thing to note is that the market is at a "compressed value". Meaning that we are way below ( on some coins ) market and industrial value. So when the markets do go green again, which they will, expect to see some coins go to Mars, not just to the moon.

- Some coins will overshoot their values in the first few weeks of a return to a bull market. So there will be chances to sell off and take profits. So be ready for that.

- "Overeager" is the emotion for May - The prolonged bear market, rainy days and restlessness of investors will create waves in the market before prices normalize. Certain coins will become hyped and will be overbought early on, so watch for the chance to sell off before everyone dumps.

In short, we will go from one extreme to the other - a massive lull to a massive hype - before things settle again. All based on emotional cycles and stages of behaviour.

One other thing, technical analysis is probably awesome, it's just not my tool of choice. I have my own predictive methods and you will have yours. But for me, pure psychology is the most accurate tool as we are dealing with human behaviour and emotional buying. So I will stick with that as it has served me well so far.

P.s. Peeps, there isn't really a crash. The cryptocurrency market cap was $25B USD this time last year. Considering it's still at $400B, that's a heck of a lot of increase in value.

Thanks for watching,

Brendan Rohan - Indie developer of 'next gen' natural medicine from Melbourne, Australia

Www.Skyflowers.co ( see "botany" tab for the plant research )

Www.ClinicalFlowerTherapy.com

Social @iSkyflowers

YouTube Skyflowers.Tv

If you support natural medicine and an independent research project that began in 1997, then steem me. The creds I get will help me provide a solid body of information that future generations can build upon.

DISCLAIMER: This article is written by an amateur investor and is offered purely for information purposes. This is not financial advice and you should always seek the advice of a finance professional.

Great post - but you do realise that if you just did a really bad picture of a teapot you could make $1200 without typing anything?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@skyflowers Thanks for your post..found it so refreshing, with your perspective on Bitcoin and the emotions of people.:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Emotion and basic psychology are the main metrics I use when looking at the markets. You have to factor for the way the human brain is wired before you apply any other measures. So many Telegram groups / communities are toxic and sour on cryptocurrency... When companies like IBM are announcing plans to become "the kings of blockchain development". Big money is about to enter the space and everyone is moaning about dirt cheap prices of top quality investments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So good to always look at what lies beneath and behind, the thinking and emotions, of people:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit