As always, please feel to comment on the following topics. I will get back to you guys quickly. The topics I will discuss below includes the following: weak hands, strong hands, performing a rudimentary ICO liquidity test, and lastly recognizing good and bad ICOs post sale.

Weak Hands

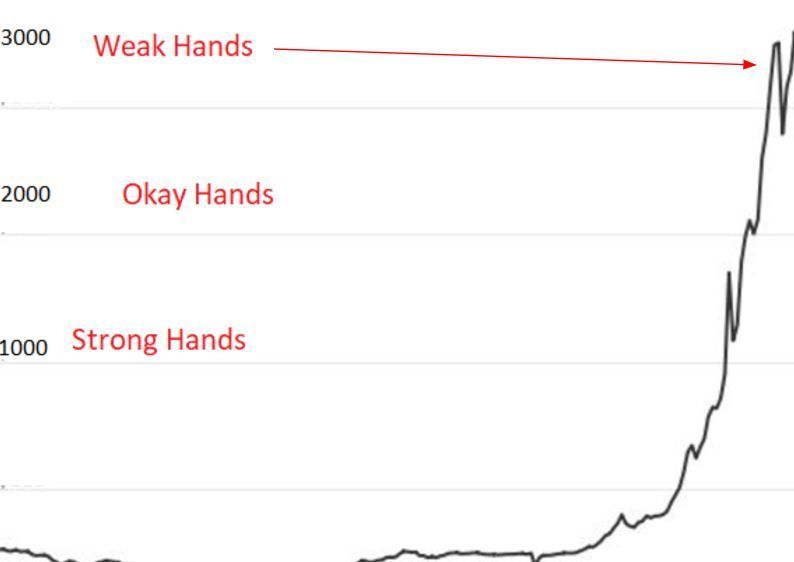

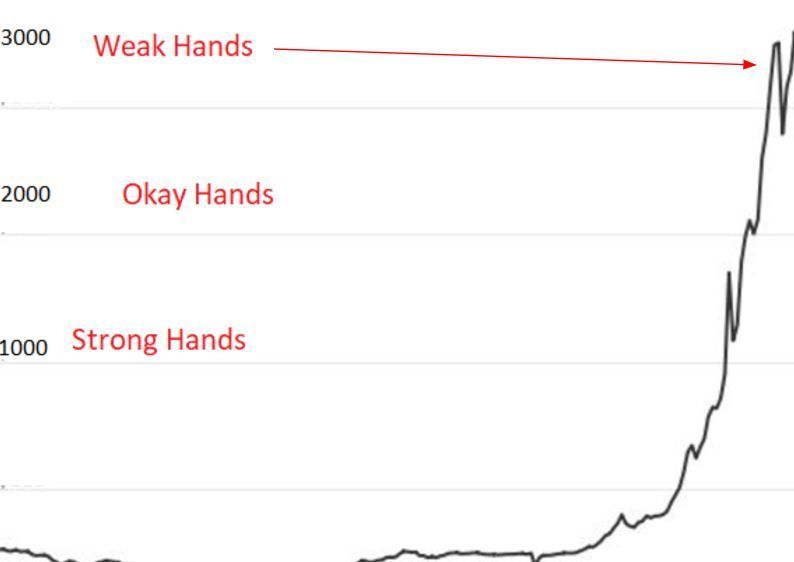

Below is a chart of Bitcoin. It's not drawn to scale though. First thing to go over is what is a weak hand. This typically consists of people with lack of fundamental knowledge about a market. Short-term traders, novice investors, and speculators typically fall into this category. They typically tend to buy when the price is high and even panic sell when any fearful news comes out from anywhere. I believe that ⅓ of the crypto market currently consist of these type of investors. For novice investors, they will panic if anyone around them panics or if they feel threatened by anything. There are pros to having a weak hand however. You might be lucky enough to dodge a bullet if the market tanks. But long term buying in and out of a market for short-term traders accumulates transaction cost over-time. So for advanced traders they may tend to have a decent spread or padding between a buy and sell price. If you have a weak hand the best way to strengthen your understanding about a market is simply by getting more educated about that market. This is typically a lifelong process. Search for articles and various youtubers within the crypto space for educational material.

Okay Hands

“Okay” hands are people in the market that jump in when they see potential to enter in a market with hopes of staying long term. They will enter when the water is warm enough. They will sell whenever they sense price is moving at a ridiculous level up or down. This group of people consists of weak and strong hand people so it’s hard to differentiate between this group. They want to play it safe, invest long-term, and at the same time hedge. The obvious recommendation for this group of people is to read up more about a market and also diversify. I personally find myself to be in this group but gaining knowledge each day about this market and to stay diversified. As time goes on, some people in this group will eventually develop stronger understanding of the market, thus developing stronger hands and putting more skin to the game.

Strong Hands

Strong hands are people characterized as holders. They have the notion of staying into a space long term. This group of people actually offer a good level of support for the crypto market. Some people in the group are what is referred to as a Bitcoin maximalist or crypto maximalist for that matter. They will have more favoritism towards a particular coin or token (i.e. Bitcoin, Litecoin, or whatever altcoins). Within this space you also have institutions, foundations, miners, and exchanges that are built on the principle of staying in this market long-term. These institutions both public, private, decentralized, and centralized offer a strong source of liquidity for the overall market. It would take severe threats like pointing a loaded gun to these guys heads for them to leave or threats of forcibly closing their business like we have seen with a miner in Venezuela and an exchange in Latin America already. So don’t expect these guys to ever give up any of their alt-coins that easily. There are risks to having a strong hand. Some of these guys may have their eggs in one basket thus giving them more exposure if anything bad happens. The suggestion for this group of people is to stay diversified.

ICO Liquidity Test

Do not be surprised to see some of these ICOs closing shop soon or staying dormant for a long while. Some of these ICOs captured under coinmarketcap have lost more than 70% of their value since their high. Since these are not publicly traded companies with financial reports, it’s hard to measure how much liquidity these companies have left. Some of these ICOs supposedly did keep their coins or tokens during the pre-sale for liquidity reasons, but there is no guarantee of that even happening or any law saying you have to abide by what you promised on your white papers. Either these ICOs could have been greedy and already cashed out their coins or tokens. Or they are still in this game and they have lost more than 50 to 70 percent of their market share.

I’ve been questioned by a few close folks (friends and family) on if they should jump into these ICOs. I have recommended them to do their own liquidity test. Since these ICOs do not have any financials at all, the following things you should look at is the following:

How many people are on their website. Assign a cost of $100,000 per year on each of their salaries. This includes programmers, board, advisors… Basically the more people on their website the more administrative fixed and variable cost to assume.

Next what was their token or coin trading at it’s high this year pre or post ICO. What is the value of their coin now with respect to today’s market cap.

If the additive cost of 1 is much greater than the value of 2, then that startup has a liquidity issue.

This is just a basic metric I came up with. You guys can come up with your own metrics. You can take into account if their board members/management offer any intrinsic value of goodwill for the company. You may also want to look at if they are being backed by a special alliance group made up of big banks and tech companies. That is just a hint.

Bad ICO Example (Post Sale)

[Actual names have been hidden]

So this company you are looking at had their ICO sale this year. And well to protect their names, I’ve come up with a fake representation of another company that’s been grayed out here. I won’t say they are bad but they have lost half their market share since their peak and there is altogether 12 people listed on their website. Their market share right now is at $7 million and to sustain a salary on average of $100,000 per person comes out at $1.2 million dollars per year. So you can do the math to find out roughly where this company would be at in a few years at this level. Now disclaimer this is not a perfect metric at all but just to give you an idea. You can assign x amount of dollars per year to each of these people. And again this is by no means a perfect formula. Currently there is no way to buy puts to hedge against bad ICOs as this crypto market is only 10 years old.

Good ICO Example (Post Sale)

[Actual names have been hidden]

This is an example of another company that had its ICO sale this year. Again I am using an example to represent a good company. This company only has three employees that also includes the CEO and that was basically it. I interpret that for a company as being more agile and not too heavy on overhead. Now disclaimer: this is not a perfect metric at all but to give you a sense that having more people involved in a tech company can slow down innovation. This current company's market cap currently sits at more that $300 million dollars. This company with only three people definitely has plenty of liquidity still left.

Again all of this is my own opinion and please talk to a licensed financial advisor before investing in cryptocurrencies and/or seeking advice. If you like this video/blog, please click on the like/upvote button or feel free to subscribe/follow me on YouTube or Steemit.

Nick is a content creator for Sobuka with a background in programming, information technology, finance and digital forensics. He shares interest in cryptocurrencies by reporting on International Affairs. You can find Nick, Brilliant B, and Awesome Sarah here from time to time.

You can reach the team here

Facebook

Twitter

YouTube

Steemit: @Sobuka

[Actual names have been hidden]

[Actual names have been hidden] [Actual names have been hidden]

[Actual names have been hidden]

Good..👍👍.Follow.!!😃😃

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

re-post. i needed to update and format the alignment for posting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit