Under Bitcoin Improvement Proposal (BIP) 148, Bitcoin will be undergoing a user activated soft fork on August 1, 2017.

There are three possible outcomes of the soft fork, although the exact outcome is unknown as the outcome will depend on the actions of the nodes on the network.

In a worst case scenario, BIP 148 could cause Bitcoin to chain split into two separate blockchains, one with SegWit activated and one without.

Before we get started, let me try and define some very important terms, which I hope will make it easier for me to fully convey what exactly is going to happen on August 1st.

Hard Fork - A hard fork is a permanent divergence in the blockchain, that occurs when non-upgraded nodes can't validate blocks created by upgraded nodes that follow newer block validation rules. This can be caused by a change in a blockchain's protocol that makes previously invalid blocks/transactions valid, and as such requires all nodes or users to upgrade to the latest version of the protocol software. This essentially creates a fork in the blockchain, one path which follows the new, upgraded blockchain, and one path which continues along the old path. Generally, after a short period of time, those on the old chain will realize that their version of the blockchain is outdated or irrelevant and quickly upgrade to the latest version.

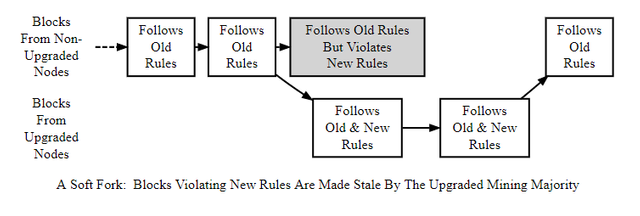

Soft Fork - A soft fork is a change to the bitcoin protocol where some previously valid blocks/transactions are made invalid, and the rest of the previously valid blocks/transactions are kept valid. Old nodes will still recognize the new blocks as valid. Soft forks don't require any nodes to upgrade since all blocks with the new soft-forked rules also follow the old rules, therefore old clients accept them. This kind of fork requires only a majority of the miners to upgrade in order to enforce the new rules.

User Activated Soft Fork (UASF) - A UASF is a soft fork activated on a specified date, enforced by node enforcement instead of miner signaling. The idea is to have the economic majority, businesses and users (not miners) choose whether or not to activate this soft fork within their Bitcoin software client. On the proposed time, clients that have activated the soft fork will only accept blocks mined from miners that have also updated to start signaling for the soft fork, and will reject blocks that were created from miners that had not updated. Clients that have not updated to activate the soft fork will accept blocks mined from both miners that have updated and miners that have not updated.

By the specified date, miners are then given an opportunity to make a choice of their own, based on how much of the economic majority has activated the soft fork. If the economic majority upgrades, then miners have an economic incentive to update, as not following along would make it more difficult to sell coins mined after the chosen date, as the blocks would not be accepted by the economic majority. Essentially, miners on the old platform would be producing an altcoin not recognized by the majority of users and exchanges, making them less useful and in lower demand. Because of how the Bitcoin network only follows the longest blockchain, if a majority of hash power follows the soft fork, all nodes will follow the soft fork chain regardless of if they have updated or not, and the UASF is successful.

However, if the vast majority of the economic majority does not upgrade, then the UASF will have given miners no additional incentive to upgrade and thus miners will not update or they risk following fork rules that are or will surely be obsolete. And in fact, any of the economic majority that had upgraded now must roll back their clients to the old version, else they would be unable to spend their Bitcoin. Their updated clients would reject any blockchain that includes any non-upgraded blocks created past the specified date, so any transactions they attempt to make will be added to the soft forked blockchain which would be maintained by the soft forked nodes and miners (if there are any soft forked miners at all). This soft forked blockchain will undoubtedly remain shorter than the original blockchain containing the non-updated blocks. Thus, the soft forked blockchain will never be accepted by the non-updated clients, and the transactions of the updated clients will never be included in the original blockchain; the transactions from the updated clients will never go through.

In the unlikely case that neither side is the clear winner, this is where it gets messy. A chain split will occur, where two versions of the blockchain will emerge. All coins that existed prior to the chain split will exist on both chains. If the original "legacy" blockchain remains longer, any coins mined under the soft forked blockchain will be nonexistent according to the legacy chain, and will only exist on the soft forked chain. However, if the soft forked chain ever becomes one block longer than the original, "legacy" chain, all transactions on the legacy chain that occurred between the time of the split and the soft forked chain getting longer will be erased forever and replaced with those of the soft forked chain, at which point the soft forked blockchain will likely remain victorious.

I hope there remains no confusion over my definitions, especially so in my defining of a UASF. I will attempt to answer any questions in the comments in order to further clarify.

August 1st, and the Future of Bitcoin

August 1st, and the Future of Bitcoin

Bitcoin Improvement Proposal 148 (or BIP148 for short) is a UASF that encourage users to push miners to upgrade to SegWit. SegWit, along with fixing third party transaction malleability allowing for sidechains to be developed, will also improve Bitcoin's scalability over both the short term and the long term, as the malleability fix will allow for the implementation of Lightning Network, a more permanent solution to Bitcoin's transaction speed bottleneck. As Bitcoin is a decentralized system, here's how SegWit is supposed to activate: In any consecutive chain of blocks that are 2016-blocks long, ending November 15th, 2017, 95% or more of mined blocks must signal that the miners are ready for SegWit. If that doesn't happen, SegWit activation dies. Once SegWit signaling meets the criteria, there's a 2016-block long "pause" where SegWit activation is pending, but voting no longer matters. After that point, the network will accept SegWit transactions and miners are expected to accept them into blocks.

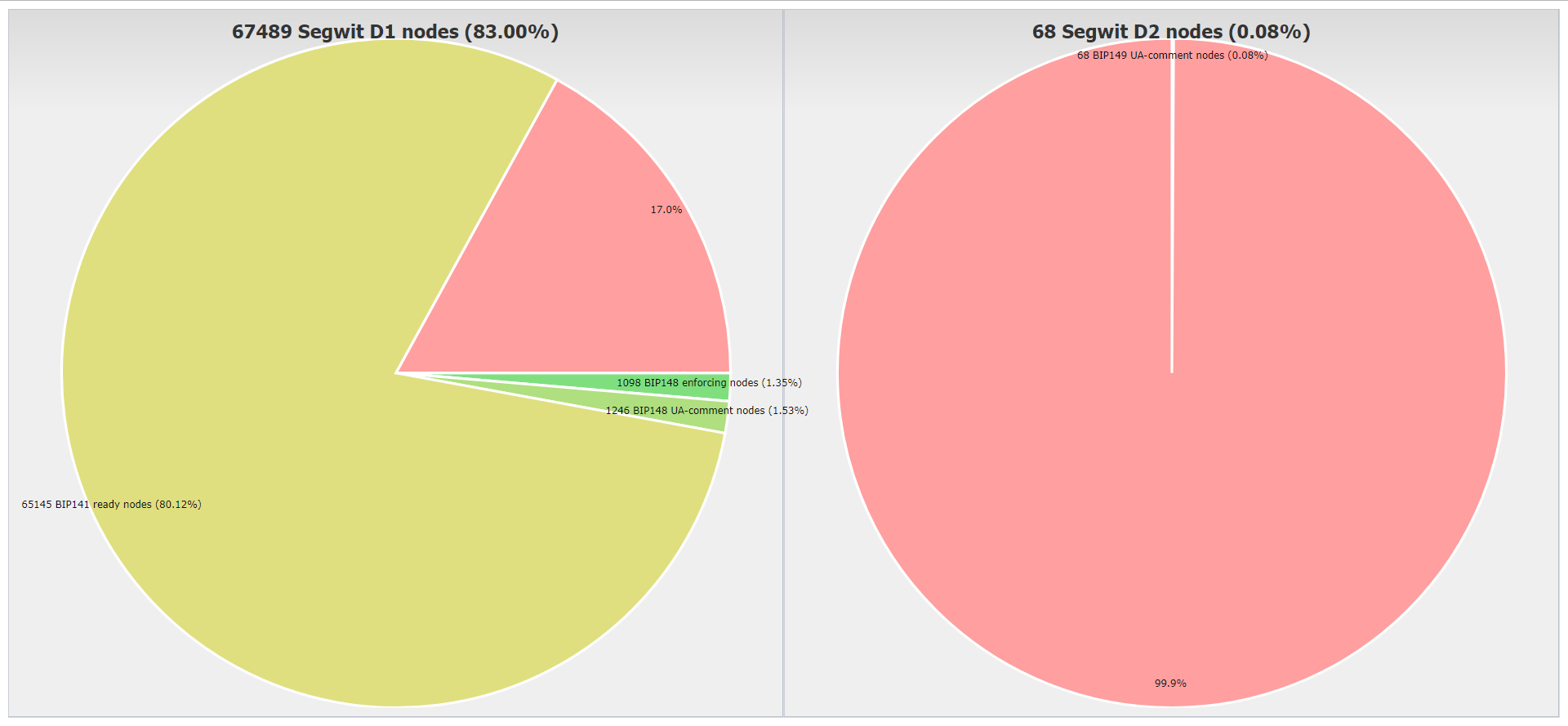

BIP148 will activate on August 1st, 2017. All BIP148 does, is refuse to accept blocks that do not signal SegWit-ready after August 1st, 2017, either until SegWit activates or until the deadline of November 15th, 2017 hits. In so doing, it forces the existing activation mechanism to deploy SegWit. From that date on, miners that want their blocks to be accepted by nodes that have updated to BIP148 will be required to signal readiness for SegWit by switching to the creation of blocks with a new version, called 'bit 1'. After enough miners are mining 'bit 1' version blocks, enough so that 95% or more of mined blocks in any 2016-block chain are of the version 'bit 1', the above requirements for SegWit activation will be fulfilled. Then all SegWit ready nodes, which currently make up over 80% of the network, will activate and begin SegWit enforcement, and thus SegWit will have been successfully implemented into the Bitcoin Network.

As a soft fork, BIP148 avoids having to force most users to upgrade their software. Also, the way BIP148 and SegWit are designed, once SegWit is activated, users who are not running BIP148 will still get the benefits of the activation of SegWit.

Possible Scenarios

Possible Scenarios

A confrontation will happen on August 1st, but right now the exact outcome is unknown because the outcome will depend on the amount of support that miners give to the two sides. There are three possible outcomes:

BIP148 succeeds. If the economic majority is signaling as of August 1st, miners have many incentives to follow along. Not following along would make it difficult to sell coins mined after August 1st as the blocks would not be accepted by the economic majority. If a majority of hash power follows BIP148, all nodes will follow the chain regardless of if they are running BIP148. The protocol upgrade will activate smoothly. Non-compliant blocks will be orphaned. Bitcoin goes on exactly as it did on July 31st but with all blocks signaling for SegWit and all SegWit-ready nodes will eventually activate SegWit. Nobody has to change any of their software.

BIP148 fails with very little economic majority support. BIP148 requires support from the economic majority, particularly exchanges and wallets. If this does not occur, users will not run BIP148 node software after August 1st so as to prevent a chain split. There are strong economic incentives in the Bitcoin system for nodes to cooperate and remain in consensus to prevent chain splits. If no nodes are running BIP148, then BIP148 has failed. Bitcoin goes on exactly as it did on July 31st. People who installed BIP148 nodes need to roll back their nodes to be able to spend their bitcoins. Everyone else is unaffected.

Neither side is the clear winner and the blockchain splits, where two versions of the blockchain emerge. This is the disaster scenario. All coins that existed prior to the chain split will exist on both chains. If there is a greater demand for the blocks produced by the BIP148 miners, then profit-driven miners would eventually flock to BIP148 chain and if the BIP148 chain ever becomes one block longer than the legacy chain, as in it accumulates the most proof of work, all transactions on the legacy chain that occurred between the time of the split and the BIP148 chain getting longer will be erased forever and replaced with those of the BIP148 chain. This is because both BIP148 nodes as well as legacy nodes would switch to the BIP148 blockchain, discarding the legacy chain. If 50% of the mining power goes to the BIP148, it will almost certainly become the only chain. Nobody will want to mine or transact on a chain where the mining reward and transactions can disappear at any moment forever. But unless and until this happens, there is always at least a theoretical risk that the legacy blockchain can be overtaken and be discarded like this. That chance should decrease as time goes on, but will realistically exist for hours, days, or maybe even longer. If the demand is less for the soft-fork chain, then both chains may co-exist indefinitely. BIP148 nodes will never acknowledge the legacy chain, so these nodes will not switch to the legacy blockchain regardless of which chain has more hash power. However, it is very risky to buy, accept or hold any of the BIP148 Bitcoin, too. Most importantly, there is no guarantee that BIP148 Bitcoin will continue to be used and thus the coin's long-term value is in contention.

Most likely, one of the first two scenarios will unfold, where BIP148 either succeeds triumphantly or fails definitively, and Bitcoin will go on as it were, for better or for worse.

Yet despite the odds, however improbable, an investor must always consider the worst case scenario in his or her risk-reward evaluation and examine if taking on the according risk-reward is appropriate for the goals of his or her portfolio

Good Info, but Segwit2x has 80% + of hash power. So 80% of the bitcoin mining community are already decided and Segwit2x has been activated. It's not much of a debate anymore. =/ All the big bitcoin mining pools are mining Segwit2x.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the share. August will be pretty exciting for sure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://seekingalpha.com/article/4081991-august-1st-end-bitcoin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit