Bitcoin futures buying and selling quantity in its first week changed into best a fraction of coins Bitcoin transactions. Futures extent has been abysmal at $60 mln according to day, in comparison to the cash transactions of $8.5 bln every day.

but, come Sunday, the CME will start Bitcoin futures buying and selling. furthermore, huge brokerage houses are likely to conform with in shape and permit their clients to trade in Bitcoin futures. If this occurs, we're probable to look the futures amount pick out up.

Will the participation of more traditional investors enhance the marketplace capitalization of Bitcoin and the cryptocurrency universe? Max Keiser who hosts the Keiser report on RT in truth thinks so. He believes that futures buying and selling will help the cryptocurrency marketplace capitalization attain $1 tln and better.

but, these are predictions for the lengthy-term. permit’s examine the charts to find out the possibly movement of cryptocurrencies within the short-term.

BTC/USD

Bitcoin broke out to new lifetime highs the previous day after a 3-day consolidation. that could be a bullish development.

BTC

The breakout opens up a sample goal of $24,291.fifty eight for Bitcoin. but, this target is not going to be performed in a hurry. The cryptocurrency is in all likelihood to face some resistance at $20,000.

Our bullish view may be invalidated if the bears overpower the bulls and sink the virtual foreign money below $15, hundred stages.

With the start of futures buying and selling on CME, we will count on an growth in volatility. therefore, customers ought to lessen their position duration for the following couple of days till volatility subsides.

Intraday investors, however, gets good enough opportunity to place bets on both aspects of the alternate.

ETH/USD

Ethereum fell to a low of $610.03 the day before today, near our expectation of a fall to the 50 percentage Fibonacci retracement diploma.

ETH

The prolonged tail the day prior to this indicates that bulls are keen to buy the dips. but, failure to interrupt out to new lifetime highs suggests that they're booking income at better stages. As a quit end result, Ethereum is probably to stay variety-certain until the fee breaches $610.03 on the downside or $780 on the upside.

but, if the bulls’ breakout to new highs and preserve it, the subsequent purpose on the cryptocurrency is $995.99.

the ones goals are fine assumptions based totally mostly on technical evaluation. usually these targets aren't met and we exchange our view consequently. consequently, traders ought to continuously path their stops higher to shield their profits and now not be fixated handiest at the aim.

BCH/USD

we are within the money on our trade in Bitcoin coins. So, does the chart pattern recommend in addition upside or has the rally run its path?

BCH

The cryptocurrency broke out and closed above the variety on Dec. 14. This ought to have preferably propelled Bitcoin coins in the path of its goal intention of $2,387. but, it could not skip $2,one hundred levels.

subsequently, bears attempted to push the cryptocurrency decrease again into the range. but, the bulls have managed to shut above $1,758 ranges for the beyond 3 days, this is a pleasing signal.

the subsequent up waft will begin as quickly as the fee breaks out of $1,950 tiers. sooner or later, please hold the positions with the prevent-loss at breakeven. The bullish view is probably negated as soon as the rate sinks beneath $1,520 degrees.

XRP/USD

In our previous evaluation we had encouraged shoppers to ebook partial profits due to the fact we predicted a robust resistance at $zero.86 tiers. On Dec. 14, Ripple crowned out at $0.88268 ranges.

XRP

On Dec. 15 the cryptocurrency pulled back to the 38.2 percent Fibonacci retracement of the rally. nonetheless, the lower degrees maintain to attract looking for from the bulls. We count on the bulls to try to break out of the lifetime highs once more. If a success, Ripple will make a sprint toward $1 stages and higher.

but, if bulls fail to breakout and hold above the lifetime highs, we're probably to witness some days of range-positive buying and selling among $0.sixty one on the lower quit and $zero.88268 on the top surrender.

IOTA/USD

We predicted a fall closer to the 20-day EMA and that is what occurred. On Dec. 14 and 15 IOTA fell close to the 50 percent Fibonacci retracement tiers of the rally.

IOTA

The bulls purchased the autumn to the crucial manual levels. but, the cryptocurrency keeps to stand resistance on each rise.

The chart pattern will become bullish in the quick-term only on a breakout and near above the downtrend line, above which a rally to the lifetime highs is in all likelihood.

however, if rate fails to breakout of the downtrend line, it's going to result in the formation of a descending triangle pattern, that is a bearish improvement.

The cryptocurrency becomes poor on a breakdown and close under the vital help stage of $3.032.

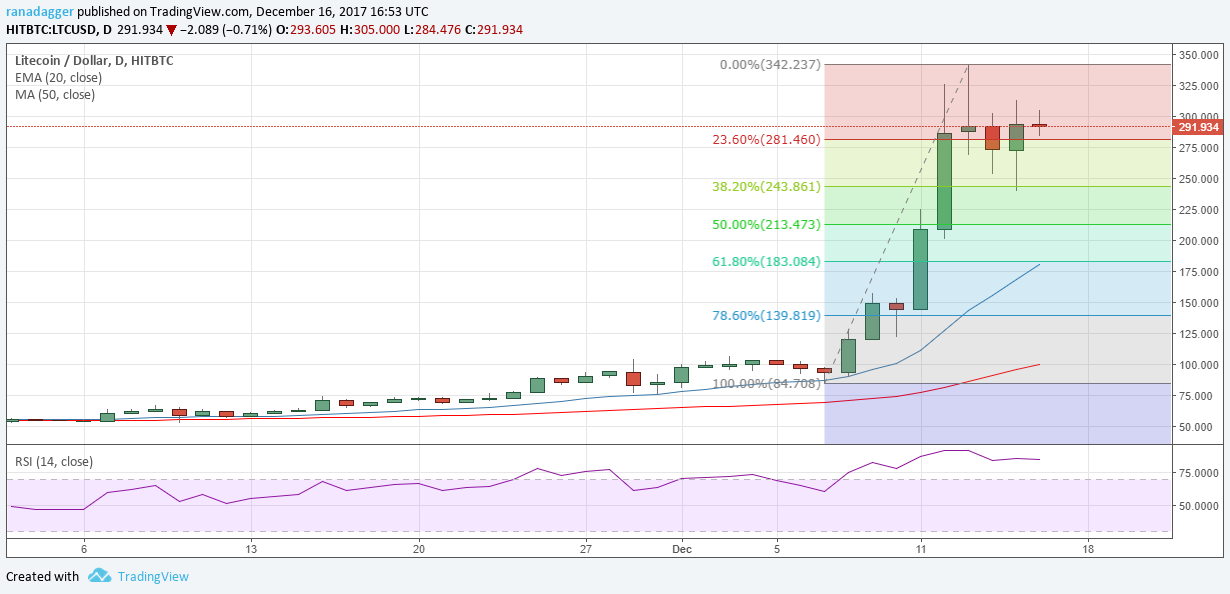

LTC/USD

We had forecast a length of correction/consolidation in our preceding evaluation and that is what we were given.

LTC

As expected, the bulls bought the dips to $243.86 stages, that is the 38.2 percent Fibonacci retracement of the rally. however, we take into account that the ranges among $three hundred and $342.237 will keep to behave as a stiff resistance. We be given as authentic with that after the sharp rally, Litecoin can be variety-sure for the subsequent couple of days.

notwithstanding, if the bulls’ breakout to new lifetime highs, then the following intention aim on the upside is a rally to $497.53.

dash/USD

even though sprint has now not run away to its aim of $1,199.01, it’s maintaining above $815 levels, that is a exceptional indication. Bears tried to push the cryptocurrency again under $815 degrees on Dec. 15, however, they had been unsuccessful.

sprint

This will increase the possibility of an upside breakout of $979 and a rally in the direction of the aim objective. The bullish view could be invalidated if the virtual foreign money falls and sustains below $815.

buyers who had bought lengthy positions on our in advance analysis have to improve their stops to $780 at the remaining 50 percentage positions.

This post has received gratitude of 1.00 % from @jout

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I actually hope for IOTA to make it through tough

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 0.20% upvote from @postpromoter courtesy of @jout!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

but bitcoin is a very high level trade in the market

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit