Hi Everyone,

This is StoneCrypto bringing back to you some more rock solid crypto content.

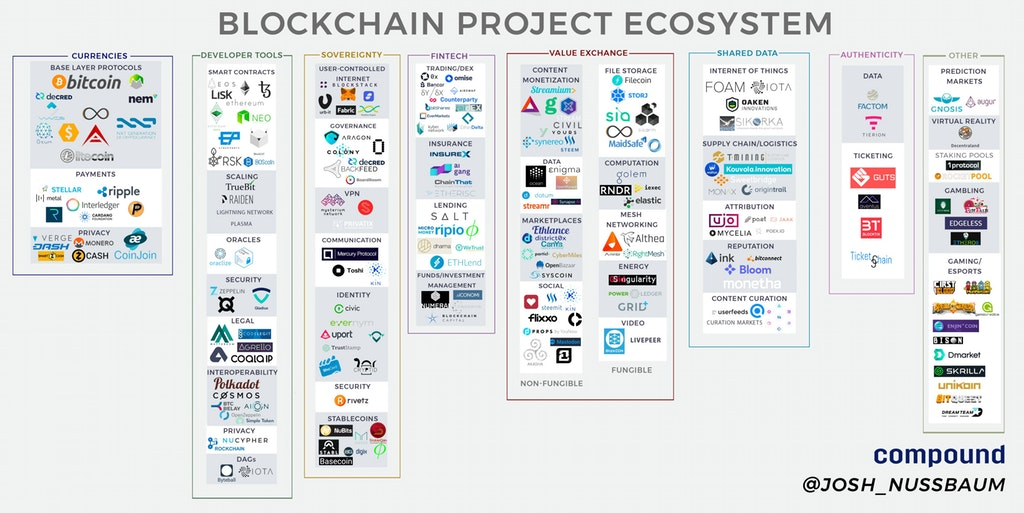

Today's topic, I'll be going over how to easily differentiate between different types of cryptocurrencies. Who knows how many of them are actually out there outside of Bitcoin. Probably Tens of thousands. Here is an easier way for you to break them down, define which coins you like based on their use cases, and ultimately help you navigate through the crypto space to invest, use, and trade the coins you like.

How To Differentiate Different Types Cryptocurrencies - Topics

Today's topics are - What is CoinMarketCap.com and how to navigate it.

The different category of coins and their use cases such as store of value, payment coins, utility coins, privacy coins, charity focused coins, and decentralized application or platform coins.

Lastly, I'll review CoinMarketCap.com with you all briefly just to show you how I use it.

--

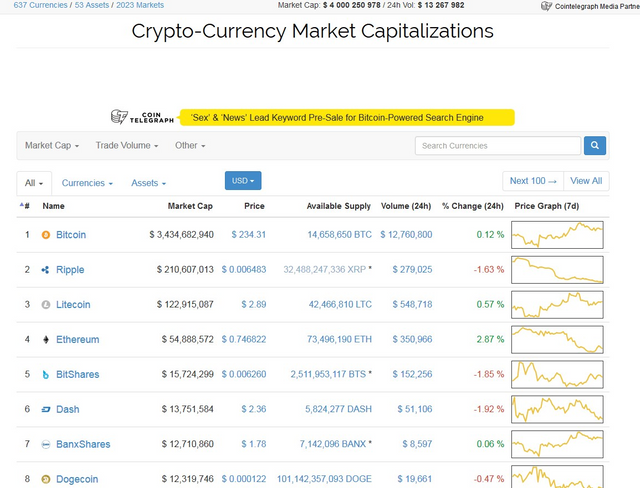

What Is CoinMarketCap.Com?

The image on the bottom is a snapshot of what CoinMarketCap.com currently looks like. It's the #1 go to site for real time market capitalization of coins. What that means is, coinmarketcap will display the current amount of that particular crypto currency that is in circulation and also display the real time market price of that crypto. If you take the coins in circulation and multiply that by the current market price, you get the market capitalization. Essentially it lets you know the value of lets say, all the Bitcoins in the world at this given moment. Market caps change depending on the current price of the coin and also coins in circulation.

Coinmarketcap.com is similar to yahoo finance if you're a finance guy and like to watch the stock markets.

Coinmarketcap also lists over 1,000 of the highest traded crypto currencies. I'll navigate and review the coinmarketcap website later on in this episode.

Store Of Value coins

Let's get started with our most popular coin, Bitcoin. Bitcoin is classified as a store of value coin. The top 3 reasons why Bitcoin is currently the largest coin by market cap is because of the finite supply, deflationary model, and it's secure network infrastructure.

Bitcoin will only ever have 21 million coins minted into existence. No more, no less. The finite supply creates a strong demand as there are over 7 billion people on the planet alone, and there will not be enough bitcoins for everyone to hold even half a bitcoin.

Bitcoin is also deflationary. The more people that learn and adopt Bitcoin, the stronger the network gets, the less Bitcoin that will be in supply for people to own and hold which drives the price up. This is done by design with only 21 million of finite supply.

Lastly, the security of Bitcoin. As I've discussed in previous videos, Bitcoin network infrastructure of hundreds of thousands of miners across the world that are mining for new Bitcoins, processing transactions, are also simultaneously securing the network. In order to even consider attacking the Bitcoin network, you'd need greater than 50% control of the network infrastructure or control of thousands of the miners all across the world. Good luck with that.

Privacy Coins

Next up, we have privacy coins. Monero is one of the more popular privacy coins and is in the top 10 of the crypto coins by market cap. Unlike bitcoin which provides publicly viewable addresses, Monero addresses and privacy addresses are stealth and unlinkable.

When you send a transaction through the Bitcoin network, not only is the address viewable, but the transaction is viewable. This is not the case with Monero as all the transaction amounts are confidential.

When you add all this up, privacy coins are meant to be untraceable back to the sender and recipient.

Payment Coins

Now we move onto payment coins. These coins are designed to handle high volume so that people can use them in everyday use cases. A common example is buy a cup of coffee. It's a bit hard to do that with Bitcoin right now because the network is very congested due to the high demand and transaction volume but coins like Litecoin and Dash are designed better for payment use cases.

They have faster transaction processing as well lower fees. The lower fees will be a positive for businesses to adapt as their are paying 1-3% of their revenue to Visa/Master Card alone while using crypto payment coins it would be a tiny fraction of that amount.

Currently, the Litecoin Network can handle 8x the transaction volume of the Bitcoin network.

Decentralized Applications (Dapps) or Platform Coins

Dapps or platform coins such as Ethereum, Neo, Quantum, Stratis and many more are platforms that provide businesses that don't want to spend the countless hours or millions of dollars to develop a secure public blockchain. These platforms provide a DIY model of build your own blockchain.

Their platform's are decentralized and allow these businesses to tie in smart contracts onto their blockchain that help lower costs and increase efficiency drastically. Smart contracts are basically contracts written in code that have a "If then happens, then that will happen" type of model all done automatically to reduce friction and human error.

Lastly, many of these platforms such as Ethereum have separate programming languages and or developer tools and kits so that companies can hire developers and build ontop of the Ethereum platform by follower easy step by step tutorials.

Utility Coins or Dapps (built on dapp platforms)

Finally, the last type of coin i'll be discussing are utility coins. There are many specialty coins out there as well such as pink coin for charity, golem network token for CPU lending and selling, SiaCoin for cheap computer storage buying and selling but for simplicity's sake, Utility Coins will be the last one I discuss as I think you kind of get the picture from here.

Utility Coins are coins from companies that have built their companies on Platforms such as Ethereum or Neo. They see a significant advantage in utilizing blockchain technology and smart contracts as it not only increases transparency in industries that were lacking transparency but also increases cost efficiencies through smart contracts by automating redundant tasks and more.

Some utility coins or dapps are Populous, an invoice factoring company built on ethereum. AdEx a digital advertising exchange that allows you to buy and sell excess digital ad inventory built on Ethereum and Neo. Veritaseum a peer to peer universal exchange built on ethereum, 0X, and Salt Lending.

If you liked this content, please feel free to upvote and follow @StoneCryptoNews

See you all next time!

Informative! Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This wonderful post has received a bellyrub 0.74 % upvote from @bellyrub thanks to this cool cat: @aaagent. My pops @zeartul is one of your top steemit witness, if you like my bellyrubs please go vote for him, if you love what he is doing vote for this comment as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @stonecryptonews! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @stonecryptonews! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Warning Segwit2x is a bankster takeover

https://steemit.com/bitcoin/@spiftheninja/alert-segwit2x-is-controlled-by-the-banksters-the-plot-thickens-look-at-this-evidence

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit