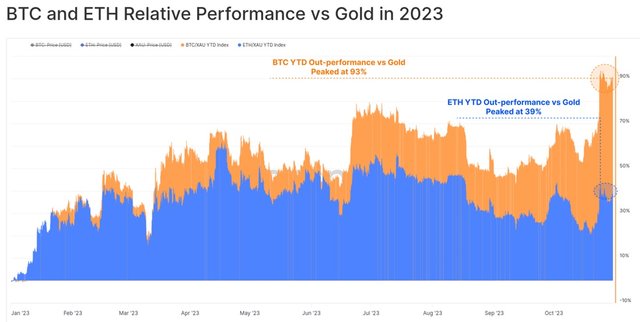

Renewed interest in cryptocurrencies has led to a record inflow of institutional capital into exchange-traded funds and really put a gap between Bitcoin and traditional investment instruments such as stocks and gold. Ethereum's price rose by 39% against the precious metal, while Bitcoin's saw an impressive 93% leap.

Image source: glassnode.com

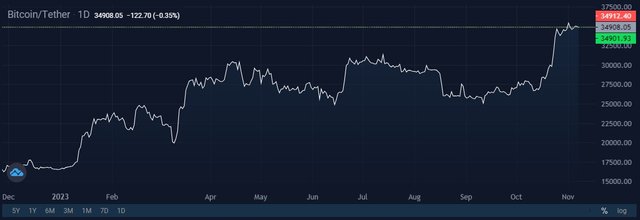

Support from hodlers, who have been accumulating again since January 2023, has played an equally important role. By October, they had reached accumulation levels of 50,000 BTC per month, and now, their aggregate reserves are approaching 15 million BTC.

Image source: glassnode.com

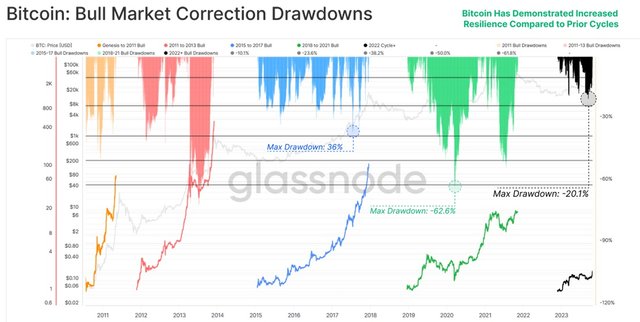

Because crypto enthusiasts believe in Bitcoin's future growth, the crypto saw only a 20% drawdown in 2023 compared to a 36% drop during the 2017 rally.

Image source: glassnode.com

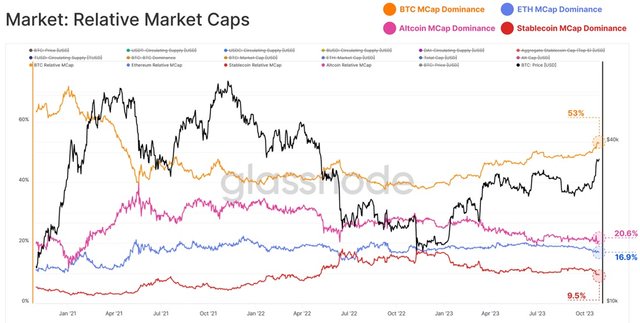

Thanks to macroeconomic support that could come from the potential resolution regarding spot Bitcoin ETFs in the United States, BTC's share of the cryptocurrency market has grown to 53%. On the other hand, that indicator has decreased for Ethereum, other altcoins and stablecoins.

Image source: glassnode.com

Yesterday, Fidelity's Director of Global Macro, Jurrien Timmer, called Bitcoin a "commodity currency" and "exponential gold". In his opinion, gold is "too clunky", so investors are increasingly considering Bitcoin as its replacement.

For reference: According to Fidelity's website, as of 30 September 2023, the firm has assets worth $11.5 trillion under its management. The company has previously submitted an application to the SEC to launch a spot Bitcoin ETF.

Image source: StormGain.com

Fidelity is far from the first investment company to recognise the shift in large investors' interest from gold to Bitcoin. Analysts at Bank of America and JPMorgan had previously come to similar conclusions.

The cryptocurrency's active expansion is constrained by the lack of clear regulation and high volatility. However, over time, the former issue will be resolved by legislation, and the second will be levelled as BTC's capitalisation grows.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)