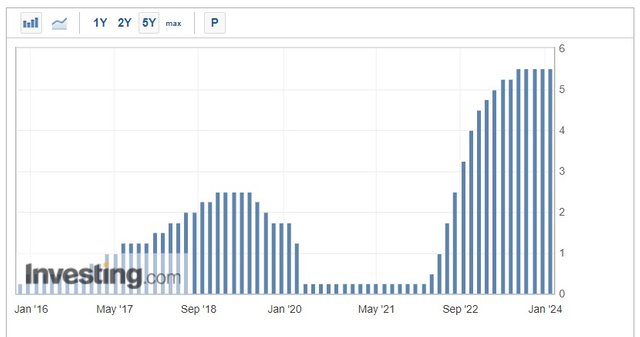

In March 2023, the US banking sector faced a series of bankruptcies, primarily caused by the Federal Reserve's increase of the key interest rate. Rate hikes led to a reduction in income and the depreciation of banks' investment portfolios. This primarily affected Treasury bonds. During the "easy money" period of 2020-2021, a number of banks stocked up on treasuries. The rate hikes resulted in their value dropping.

Image source: investing.com The US Fed's key rate changes

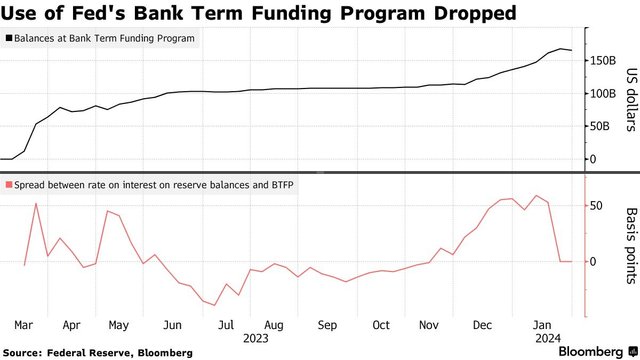

The government and the Fed had to intervene to resolve the situation. Banks were given the opportunity to sell bonds at old prices. In addition, the Fed launched a one-year emergency lending line. Within the scope of the latter, banks have took $165 billion in loans. On 11 March, the lending line will be closed.

Image source: bloomberg.com

This has spared the economy from the open flame, but the coals are still hot. Throughout 2023, a number of economists and businessmen urged the regulator to cut the ineterest rate to prevent a crisis that would start with regional banks. But the Fed still believes the situation is under control and that all measures should be aimed at achieving the target inflation goal of 2.0% to 2.5%.

The new red flag appeared yesterday when NYSB, the bank that bought the assets of the bankrupt Signature Bank, reported an unexpected loss of $252 million in Q4 2023. Investors and customers rushed for the exits, withdrawing their funds in the process. It's worth noting that deposit outflows are one of the most serious stress tests for the banking industry.

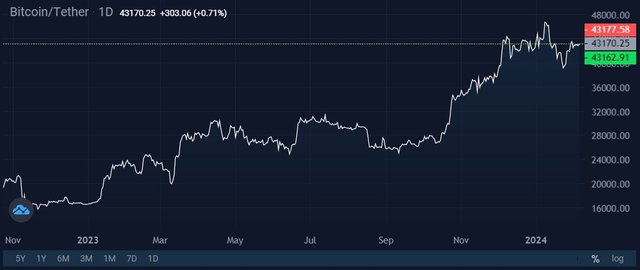

Image source: investing.com

Goldman Sachs wrote in a note to investors that market sentiment has turned significantly negative for the first time since late October, and the weakness of regional banks should be offset by a "dose of hedging" in the investment portfolio.

Image source: StormGain.com

Last March, Bitcoin became one of these "hedging assets" and experienced a significant influx of investments. Unlike bank deposits, cryptocurrency has no insured amount beyond which funds can be irretrievably lost. For example, SVB, which went bankrupt a year ago, had 85% of its $175 billion in deposits that weren't insured by the FDIC. And if it weren't for the direct intervention of the Fed and the Treasury Department, the list of bankrupt companies (which would've been dragged down by collapsed banks) would've been impressive.

Since the underlying problem hasn't been resolved, the banking sector's profitability remains at an uncomfortable level. With the end of the emergency programme and a high key rate, new shocks await banks.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)