The Ordinals protocol numbers mined satoshis, recording the order in which they're placed. This makes it possible to attach random content to coins, be it graphics or other media files. In other words, the Bitcoin network now has the ability to coin and resell digital objects (similar to NFTs), which has caused anger among some and excitement among others.

Image source: ordinals.com

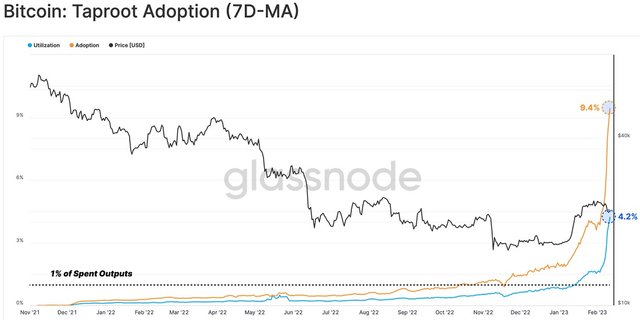

The Ordinals protocol was launched in late January by Casey Rodarmor. Check out his blog for more details on the new protocol. In order for it to operate fully, a Taproot-enabled node must be deployed. Because of the high interest in Ordinals, Taproot adoption jumped by 9.4%, and usage rose by 4.2%.

Image source: glassnode.com

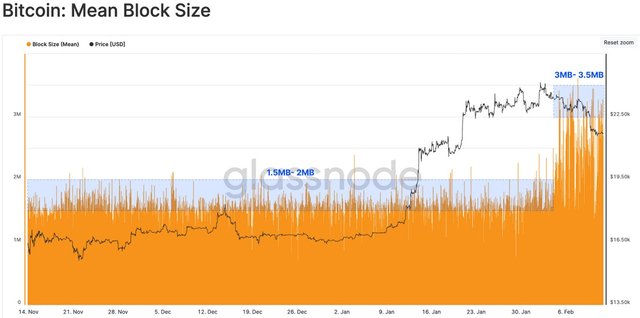

The average transaction fee has doubled in the past 30 days to $1.80, while the average block size has increased from a steady 1.5-2.0 Mbytes to 3.0-3.5 Mbytes.

Image source: glassnode.com

In less than a month, 80,000 ordinals were minted, and the number of Bitcoin addresses with a non-zero balance reached an all-time high of 44 million.

Image source: glassnode.com

The new feature has received mixed reviews from the community. Most critics cite Satoshi Nakamoto's will, which saw Bitcoin being created solely for financial transactions. Rene Pickhardt, the lead developer of the Lightning Network, has called the situation "spamming", while radical members of the market are even calling for censorship.

On the other hand, supporters of Ordinals insist the network has progressed to a new quality that Nakamoto couldn't have foreseen. The rise in demand for block space will increase fees, resulting in higher miners' profits and increased decentralisation. This will become especially relevant after the last Bitcoin is mined.

Image source: StormGain.com

So far, the invention of Ordinals hasn't affected Bitcoin's price that much. But the latest trends indicate a steady demand for a new way of storing and transferring digital objects.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)