Hello everyone, in this new post I want to introduce about INTRO project, and for more details let's just go to the following discussion:

In this article, we will be analysing & evaluating a Cryptocurrency team like how a Venture Capital or Start-up incubator program evaluates individual Start-ups.

About

“INTRO is a BI (Business Intelligence) system for the participants of off-plan development – builders, investors, homebuyers, banks and other agents. INTRO IT products provide access to advanced market analytics for industry professionals as well as for private homebuyers. The register of under construction objects and investors’ contracts are stored in the blockchain, which in turn receives data from official state sources. This allows for effective market analysis without violating the proprietors' rights to personal data protection. INTRO system users will be able to find the most attractive off-plan properties in dozens of countries and invest in the ongoing construction under smart contracts. The blockchain ensures reliability of the information about the building plan and transaction security, while avoiding costs of intermediation by real estate brokers, lawyers or profiteers. Smart contracts enable the users to save up to 30% on property investment.”

Problem

INTRO has succinctly described the problems that they’re aiming to solve with their products which is superb. Below are the issues that they have identified in their whitepaper :

- No unified register of under construction properties

- Data on off-plan property deals in state registers is not structured

- No register of apartments, parking lots and commercial properties under construction

- No control mechanisms for stages of off-plan construction

- Off-plan investors lack access to the investment records that influence their interests

- Developers often suffer cash flow gaps during the construction cycle

Problems 1, 2, 3 & 5 are significant issues for investors with less resources, as they will be unaware or unable to invest into properties that they either don’t have access too or are unwilling to take unnecessary risk due to a lack of information. This information asymmetry has generally resulted in many property investors only investing in properties that are near their local area, have transparent income documents, or properties that have highly reputable developers (3). The issue of information asymmetry is the one I’m most interested in, because if INTRO can remove this issue for their customers, they will have a significant market advantage as more international investors will be willing to purchase properties through their services.

Problem 4 in laymen refers to the issue where there is no easy way to manage the amount of investment that is given to a developer. This is a problem because if a developer runs out of funds provided by investors before finishing their construction either due to negligence or incompetence, the investor will either need to provide more funds which lowers their potential returns or abandon the project altogether. Investors are aware of this risk, and this is why some potentially lucrative property investment opportunities are just too high risk if the developer’s reputation is questionable.

Problem 6 is more straightforward. Due to the capital costs of construction projects, some developers simply can’t afford to finish their project without selling off properties or obtaining commitments from investors to buy those properties before they are complete (4). While it’s already possible for developers to sell off the plan buildings before they are complete, the amount of time it takes to find buyers could delay or put a construction project into jeopardy.

Solution

Thankfully, INTRO has placed their solutions to the problems right under the problems stated in their whitepaper. Below are the solutions to the problems that they have identified in their whitepaper :

- Our system includes a dynamic database of the off-plan properties.

- The automated linguistic analysis is employed for data tokenization. Then the property ownership records are matched with building plans with the use of AI technology. This way, the system detects and corrects errors caused by the human factor or changes in building designs.

- The system analyses floor plans of under construction buildings. Each off-plan property can be found on the plan and marked as “sold” when its developer cedes property rights to the investor. This allows for instant monitoring of sold and stock properties.

- A special module in INTRO checks the relation between investment volume and construction phase.

- INTRO users can access the anonymized state records on off-plan development agreements. It helps investors and homebuyers to find a reliable developer and profitable property.

- The module for private property auctions allows developers to quickly sale of properties and close cash flow gaps without damaging the general sales plan.

If these solutions are successfully implemented, they will mostly address the issues relating information asymmetry, bad construction developers & the developers need to quickly sell of properties.

The main concern I have is about whether & how INTRO would enforce compliance when it comes to developers who break the rules, or if an investor doesn’t pay what is owed to the developer. If a developer or government agency provided incorrect information inadvertently or willingly and the investor suffers or vice versa, what would be the repercussions? And if there were to be a legal dispute as a result, how would INTRO mediate this issue? If INTRO has an effective way of handling such disputes, then I think they’ll be able to easily acquire both construction developers and international investors who worry about this potential issue.

The Competition

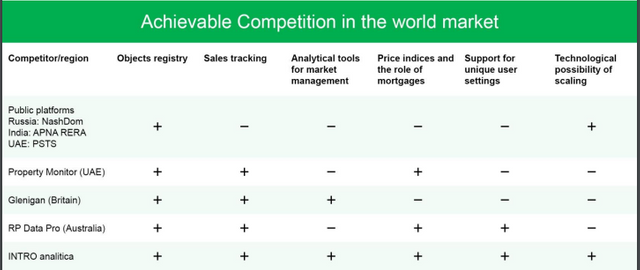

INTRO identifies their potential competitors in an easy to read table which shows what features each competitor does and does not have

If INTRO’s competitive analysis was thorough, then INTRO will have a major competitive advantage that will only increase as they scale their operations globally and obtain further funds to increase their technological lead compared to their competitors.

The Market

If INTRO’s Off-plan development market size figures are accurate, the ‘Domestic market’ is valued at $25.89 billion EUR and the ‘Achievable markets’ are valued at $142.89 billion EUR in 2016 (7). That is a significant market which should provide INTRO with plenty of opportunity to obtain the market share required to maintain and expand their operations. Given that 20 developers, 3 real estate agencies & over 1000 early subscribers among Russian home-buyers are waiting for the release of INTRO’s future products, it seems very likely that there will be demand for INTRO’s services when they begin expanding globally

The Team

INTRO’s team consists of many individuals who have a lot of experience in real estate, mortgage lending, local government & IT.

Some of the team members include:

Kirill Badikov, Founder and Management Board Chairman at Gosstroy, JSC. In 2015, Kirill was appointed for the position of the Director of the state Mortgage Housing Lending Agency's in Ufa. In 2012, Kirill was elected to the Ufa Municipal District Council, and in 2016, re-elected and appointed as the Deputy Chairman of the Municipality Council. In 2016, he founded INTROTECHNOLOGY RUS, JSC (9).

Denis Vechkanov, Executive with 13-year managerial experience in various fields: Business Valuation, Online Sales, Production and Retail. Since 2015, the Executive Director in the retail chain ‘Matrix’ (44 local shops in Russia and online shop). A graduate of the Hult International Business School (MBA, 2016). In 2017, he co-founded INTRORUS.

Oleg Oboloensky, Over 15-year IT experience In 2005/2012, he worked in Yandex, the leading Russian search engine, where he supervised several software development divisions. In 2012/2015, he was the Development Director at Rambler. In 2016, Oleg became a co-founder and the Chief Technical Officer at INTRO RUS, where he is now managing the development office software products.

Jason Hung (Advisor), he a serial entrepreneur and inventor in mobile technology, blockchain ecosystem, digital marketing, AI and ERP related business. He is the co-founder of Treascovery, Chidopi, TimeBox and CoinArt. And help on more than 25 ICOs as advisor (10).

Amarpreet Singh (Advisor), he is one of the leading advocates and contributing member of Global Blockchain community, senior Advisor of Global Blockchain Foundation and is an Advisory Board Member of many Blockchain projects around the world (11).

INTRO appears to have most of the expertise required to make INTRO a successful & sustainable start-up. A minor concern is the lack of blockchain experience in the team members bios apart from Amarpreet. However, given the level of IT experience in the team, it quite likely won’t be a major issue as they should be able to gain those competencies very quickly.

The Business Plan

INTRO has a great business plan which inspires confidence. They already have a working product in the form of INTRO Analytica & INTRO Sale which is already used by over 20 large Russian construction holdings (9). This suggests that they have already validated their products and that they’ve already consulted key stakeholders such as developers & investors as to whether their products are needed. COINvest is expected to be completed in July 2018 & INTRO Restate sometime in 2018 (12). If INTRO can stick to their relatively fast development plan, investors in their ICO should see rather quick gains on their tokens because of INTRO’s achievements.

Verdict

INTRO has created a Start-up which has the potential to significantly address many of the issues associated with buying Off-plan development properties internationally. Due to their very experienced team, existing service offerings and customer base, they have a decent chance to obtain a sizable market share globally.

Disclaimer

The information provided in this piece that relates to INTRO was accurate as of the 28th of April 2018. The information within this piece is not financial advice, and individuals should conduct their due diligence before making investment decisions. I am writing this article due to their bounty campaign.

Here are the reviews I present to you all in finding information and knowing the INTRO project currently being run by their team, if there is any lack of explaining this article, do not worry, I have set up a link for you to get accurate information. information and of course you will be able to speak directly with their founder or team, at the link.

For more information and join INTRO social media today please follow these resources:

Website: https://introa.io/en/

Telegram: https://t.me/introa_EN

Whitepaper: https://introa.io/files/%D0%98%D0%9D%D0%A2%D0%A0%D0%9E%20WP%20en.pdf

Username : 378budiman

https://bitcointalk.org/index.php?action=profile;u=1329865

Address 0x64947F03e8d6C2dC65e9F4e87cFc651d1fadd82D

Telegram Username : @lucifer69

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/cryptocurrency/@cryptogrant/intro-ico-start-up-review

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit