Some of you may have seen an earlier post by me that predicted the date when your stash of bitcoins could be worth $1 million. Obviously, the more bitcoins you own, the faster it could go. Today's price action just moved everybody that much closer, so it's time to update the table.

The previous blog predicted that people who own 150 bitcoins would become a bitcoin millionaire on 2nd November 2017 if the bitcoin price hit $6667.

The good news is that people with only one bitcoin now need to wait just over two years before it's worth a $1 million.

Today, the bitcoin price surged from around $6000 to over $7000 (in European time).

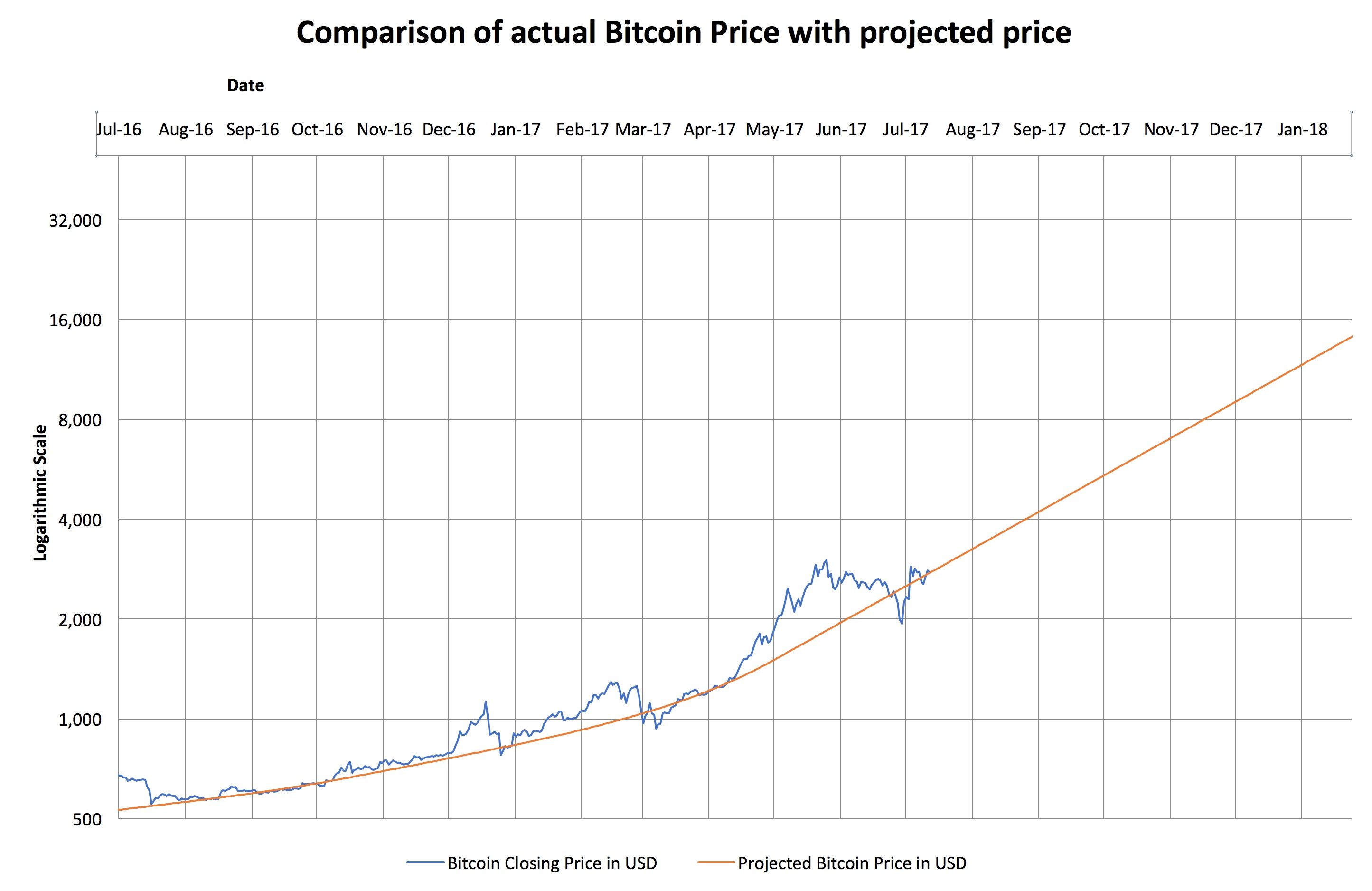

Previously in July this year, I produced the below chart forecasting future bitcoin prices. It uses similar maths of using a rolling average of past growth rates to predict future growth rates. So far it has been virtually spot on.

I had a couple of comments that most people own much less than 1 bitcoins, so I have re-done the table below starting at 0.1 bitcoins and using smaller increments.

The table makes one main assumption - which may turn out differently. The assumption is that the average rate of price growth seen in 2017 will be repeated in the future. Of course it may actually be higher or lower.

We started the year with a bitcoin price of $963.66, and currently it is around $7'000. That translates into a daily compound growth rate of 0.650%. (You can see how to calculate this in the formulas below the table). I have therefore assumed to today's bitcoin price will grow by the same daily percentage in the future.

Whether or not this turns out to be true is anyone's guess. Most people would say that 2017 was exceptional and won't be repeated.

Exceptional? The bitcoin price already performed better than that in 2011 and 2013. Anything is possible!

The results in this table are different from the one previously produced. Why?

Answer: Because more days have passed since the start of the year, and because the bitcoin price is higher. This produces a higher bitcoin growth rate for 2017.

Anyone who has read my blog this far, please include the word "hodl" in any comment you make, to be sure of a a good upvote and reward from me.

If you are interested in the mathematics behind the table, you will find it under the table below.

Instruction: Look up how many bitcoins you currently own in the first column. Your millionaire date is in the 4th column.

Formulas

In my formulas, I take today's date of 2nd October 2017 and today's bitcoin price of $7'000.

- What price do you need? Formula: $1 million/number of coins you own

- How long do you need to wait? Formula: N=log(FV/PV)/log(1+i) where FV= $1 million, PV= value of your bitcoins today and i is derivived from the following formula: i=(FV/PV)^(1/N)−1 where FV is today's bitcoin price of $7000, PV is the bitcoin price at the start of 2107, i.e. $963.66, and N=today()-date(2016,12,31).

- Expected Date: Today()+N, where N is the number of days derived in (2) above.

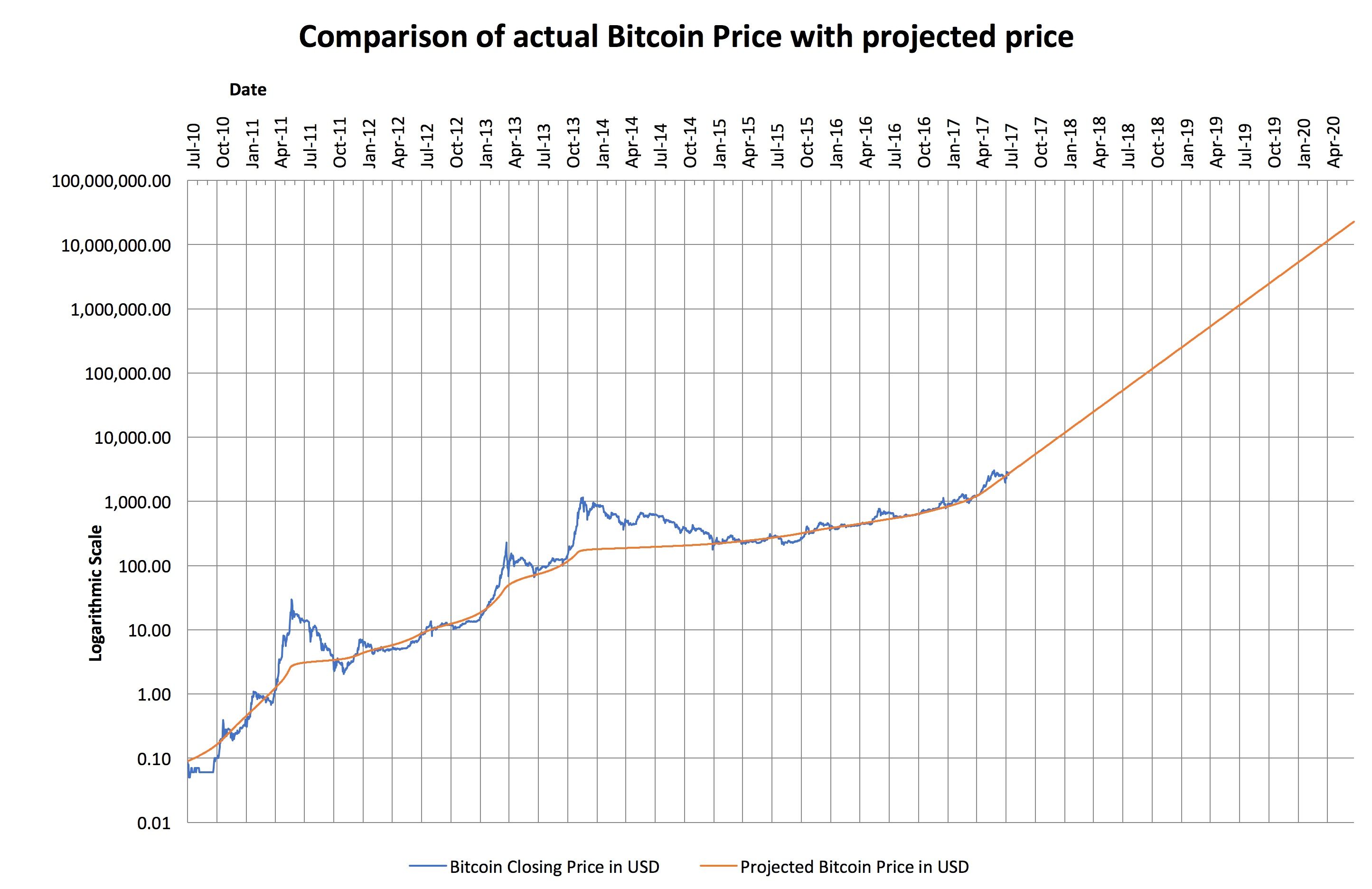

For those interested how a longer term price projection would look, here is the same chart extended until 2020, when the price reaches $10 million per bitcoin. (Believe it, or not, at your leisure). If that happened, then the 21 million bitcoins would be worth $210 trillion (market cap), which is equivalent to around $26'750 for every person alive on the planet, or 10 times the US national debt.

Longer term bitcoin price projection

Disclaimer

This is for fun only. It is not financial advice. The future growth rate may be different from that derived by looking at the past. In fact lots of things could even cause the price of bitcoin to fall to, or near to, zero, or there may be no market at all. It is after all, nothing but a series of digits in the ether that you can't eat or even use for firewood. Don't invest more money than you would be willing to completely lose. Imagine you are betting on a three-legged donkey, or a fat greyhound. How much would you risk?

Will your spouse divorce you and the kids hate you if the price plunges 50% tomorrow? If the answer is "Yes", then bitcoin is not for you.

A good friend who is dedicated to studying about the btc is something that few do, the best thing of all is that you know how to invest your money, and I think you do it very well. hodl. Saludos...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is by far the highest prediction that i've seen. It's achievable if the entire market can maintain it's exponential growth. However, what i'm not sure is, if this pace is healthy for the economy or for the cryptomarket writ large.

Here is what I think the problem is: Inflow of money into cryptocurrencies gets more difficult.

If the total market is 10T then to keep pace the time to reach 20T has to be the same rate as when it went from 5T to 10T. Right?

Regardless, I think everyone should HODL at least 1 BTC if they can in their portfolio at all times.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your idea is correct. If the previou rate of return - as achieved in 2017 so far - is made in perpetuity, it takes as long to go from $10t to $20t, as it does from $5t to $10t. The $10 million price in 2020 won’t be achied unless the $ is falling fast or becomes worhthless Zimbabwe style.

There is no shortage of people who think that is likely, but there are more who think it will just carry on.

With less than 1 in 800 adults owning any bitcoin, there is plenty of room to maintain the price growth. When 90% of the population own bitcoin it won’t be able to grow at the same pace. I think we are good for a year or so, then the pace of growth will slow. Along the way we will have our 30%, 50% or 70% crashes which will shake out doubters.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep, that's right @kryptonaut

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post! Looks like I'll be a millionaire in about 2 years according to your chart. Think I'll hodl!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I also have a really good friend teach me about bitcoins in 2013 and if I would've bought just 5 bitcoins back then I would be a millionaire today, But I only own a portion of a bitcoin today and I'm on hodl

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice! Just need to hodl a bit longer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This once again got my mind wandering and a pic taken of the chart to look back over time and see that we will have come a long way since this point now. One we get through this forking season, we'll see how strong the true trend is for the next few months. If 2X or BCH flop/go sideways, then the trend will resume as investors will be loyal to the one king.

I have BTC from fiat, but really like the cloud mining for my long term accumulation. Yes, it's a slower game, but I've more than paid off a "lifetime" contract that I started on August 15th ALREADY at the current BTC price. I like this approach because it's like daily cost averaging up a very very long and level ladder so I don't stress about much. It's passive to me and feels like a true investment. Hopefully the mining continues and I tweak hashpower/get a few friends and family on board so they can enjoy the ride at a reasonable risk exposure, while getting some referral bonuses to keep up with the difficulty increases.

Looking forward to your next daydream inducing post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I tried mining once (in July 2017),for a few weeks. The monthly after costs return was around 17% with bitcoin at $3000. I did some complex maths and concluded that if the bitcoin price stayed still, i would be making a loss before I had recouped 70% of my investment. That didn’t bother me because I was sure the bitcoin price would rise, and the equipment wouldnhave option value to others even if unprofitable to me.

The reason I pulled out of bitcoin mining was counter-party risk.

I figured that I could not know or find out who was behind the online miner in China. No names, no photos, no address, no audited accounts, only 2 or 3 years track record.

It wasn’t a huge investment, only 0.5 bitcoins, but I didn’t like the risk of the website just vanishing one day with no recourse. I pulled out a few weeks later and got back a profit. i think my 0.5 bitcoins turned into 0.62 bitcoins over 3 weeks. Not bad.

The website is still running today, so I missed a fair bit of profit.

At the time I went in the price of mining was around 6000 Satoshi per GHz. There was no fixed term contract - thankfully. I exited a few weeks later at roughly the same price, (in theory the price should fall towards zero unless the BTC price rises). Today the price is around 6700 satoshi. The missed profit was thus 17% per monthmining profit, plus the rise in the bitcoin price of 150% plus the rise in hash price of more than 10%.

Mining is certainly an interesting investment and profits will flow provided the bitcoin prices rises enough to compensate for the increasing difficulty (difficulty increases by about 13% per month). However, if the bitcoin price goes stable, your monthly profits will go to zero gradually over 6 to 10 months. At the same the value of your machine (or hash rate - if you are in a mining farm), will fall, so you won’t recoup the capital invested.

Simple conclusion: mining offers higher potential returns based on 2 assumptions - that your counterparty is safe, and that the bitcoin price rises at least 13% per month. If you get the first wrong, it 100% loss. If you miss the second, the profit may be less than expected, or even negative.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your thoughtful reply.

I've been using Genesis Mining and been 95% happy with it overall. A few hiccups, but it's the crypto space. As for their open-ended BTC contracts (one-time fee), they sold out of their grandfathered prices and should be releasing new ones soon. I have to say that the returns have been fairly excellent for me there. I can't say the same for my 2 year ETH contract, but I had a few solid months of that before I learned my lesson on what an ice age and difficulty bomb is.

I crunched the numbers on the BTC returns via the cloud mining and if they keep it up over the next year or two, it'll be a huge win for me. If they go longer, I'll be ecstatic, assuming that BTC is the winner between the forks. Even if it fizzles out in a year, I'll still be super profitable and have spent less for my BTC than if I bought on the open market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting approach @swissclive!

And I definitely like the last 2 sentences of your post. Funny and clear way to put it ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hodl

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Those are absolutely brilliant calculations my dear!

How did you come up with that formula?

That was awesome!!

@swissclive

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How did I come up with the formula? I presume you are referring to the most difficult of the formulas, which is Formula: N=log(FV/PV)/log(1+i) ?

I learned the power of compound interest in school when in a sponsored walk I was offered a penny for the first mile, tuppence for the next mile, fourpence for the next, and so on. Even though we used to have 240 pennies in the pound back then, it still didnt take too many miles before I was owed more than £1!

For more complex versions of compound interest formulas, you can refer to websites like this one:

http://www.tvmcalcs.com/tvm/lumpsums_other

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post! I love the enthusiasm and motivation for Bitcoin. This is the "peoples money". No central authority needed between us to exchage money anymore. The great redistribution of wealth is upon us! spread the word. lives are changing with Bitcoin!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow. This is going to the moon @manonthemoon

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was a fun read @swissclive :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Let's also not forget Ethereum as another way to hedge from a different angle, while also having some exponential growth/adoption ahead.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit