The market struggled to recover from a downturn in value that actually began at the end of last week. News that the Korean exchange Coinrail was hacked began to spread on Sunday around the same time that prices began to plummet. The market valuation stood slightly above $290B early on Monday and this rose to $300B as almost $20B worth of trading took place on Monday. The market went on to fluctuate until Tuesday evening when prices began to deteriorate significantly as around 4% was lost as the total valuation fell from $294B to approximately $282B. The market then fell to a low of $265B on Wednesday evening as things failed to improve. It took until Thursday for things to begin to recover and the valuation jumped from $271B to $289B, an increase of 6.6%, and despite declining slightly, the market generally went on to fluctuate close to $280B for the remainder of the week. The majority of trading took place on Monday as the 24-hour trading volume exceeded $20B, and the trading volumes steadily declined over the week and fell below $10B at the weekend to currently stand at around $6.7B while the total market valuation currently sits at approximately $281B.

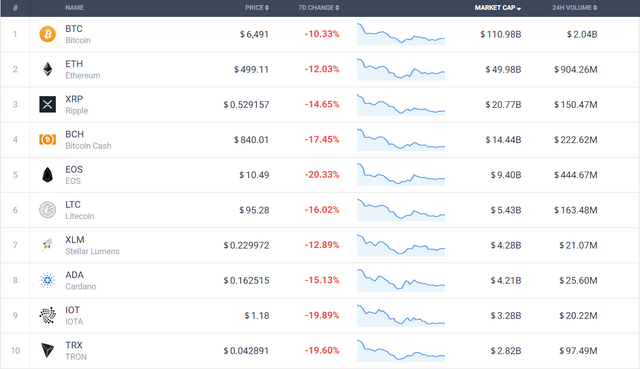

The entire market was negatively affected by the early dip in valuation and the top coins on the market all recorded significant losses. The entire top ten all declined by at least 10% and EOS, Tron, and IOTA were the most significant losers as they recorded a drop of around 20%.

Pundi X benefited from taking the top spot in the Binance Community vote for listing new coins to increase in price by around 40%. Binance’s BNB jumped by over 10%, while Emercoin (+4%), and Decentraland (+2%) were among a small list of gainers.

Bitcoin fell by around 10% in value and opened up the week trading at a price of around $6,700 and hit $6,850 early on Tuesday. However, the price went on to fall significantly on Wednesday and dipped to around $6,295 on Wednesday evening/Thursday morning as Bitcoin lost around 8% in value from its weekly opening price, when news about the Tether's involvement in the November-December rally began to spread. Things improved on Thursday as Bitcoin exceeded $6,500 before going on to hit $6,665 in the evening and the price remained stable for the rest of the week even though trading volumes began to diminish. The majority of BTC trading took place on Monday as the 24-hour volume exceeded $4B, and apart from Thursday, which almost hit $4B, trading generally fluctuated between $2.5B and $3B. Bitcoin’s 24-hour trading volume currently stands at $2B and BTC is trading at a price close to $6,500. BTC retains a market cap of $111B and enjoys a market dominance of 39.4%

Ethereum fell in value by around 12% and fluctuated wildly in price during the midweek. After starting out at a price of around $515, ETH grew to around $530 on Monday and stayed there until Tuesday evening, when the price dropped significantly. ETH fell from around $525 on Tuesday to $465 on Wednesday, a drop of 11%. However, Thursday saw the price jump by 11% and move from $467 to $520, and Ethereum went on to trade at around $500 for the rest of the week. The majority of ETH trading took place on Monday and Friday as the daily trading volumes came close to $2B. The 24-hour volume currently stands at just under $1B. Ethereum is trading at a price of just under $500 and retains a market cap of $50B.