The recent boom in the blockchain industry has brought about huge amounts of well-deserved attention to cryptocurrencies. Today, the governments of some countries are thinking about release of the own coins. For example, Dubai is the first state that officially announced the release of national tokens with the aim of enhancing its economy and protecting members of the financial system. As a result, now, there’s a lot of hype around Bitcoin as well as other popular altcoins like Ethereum, Ripple and Litecoin. They became so popular due to the value brought by businesses behind them to the world. It’s a reason why during 2017, a high number of TGEs have been founded.

But why all of them claim they will change the world and industries in which they operate?

Is this true?

The most interesting thing is that the majority of such startups don’t have a product or even any valuable assets. Coin Telegraph reports that today, it’s absolutely normal to raise several million of dollars having only an idea and good custom-tailored website. Nevertheless, it endangers crypto-investors and other people who support the blockchain industry due to the high possibility of putting their money in a bubble and losing it.

Taking into account this tendency, the Hacken team decided to create a simple guide on how common blockchain enthusiasts or crypto-investors should evaluate an ICO startup to determine whether it’s a bubble or not. We believe that by following four simple steps, anyone can assess a TGE project properly to understand whether it’s worth their attention. We hope that by our effort, we will prevent the loss of money and trust in TGEs.

Step 1: Ensure that a Startup Seeks to Solve a Significant Business Problem

Obviously, to be paid back, money must be invested in a business that makes a difference. Therefore, in the case of TGEs, with their multimillion crowdsales, the executive team must address a prominent problem. As without this foundation, there isn’t any credibility. Is it?

The reason is that to provide investors with “dividends” — returns caused by an increasing price of a token — a company is to be profitable, and only addressing a vexed problem enables the management return millions of dollars. So, we recommend crypto-investors spend some time examining a whitepaper, blog, social networks, interviews with founders and team members to determine whether an idea represented by a startup is relevant, feasible and needed.

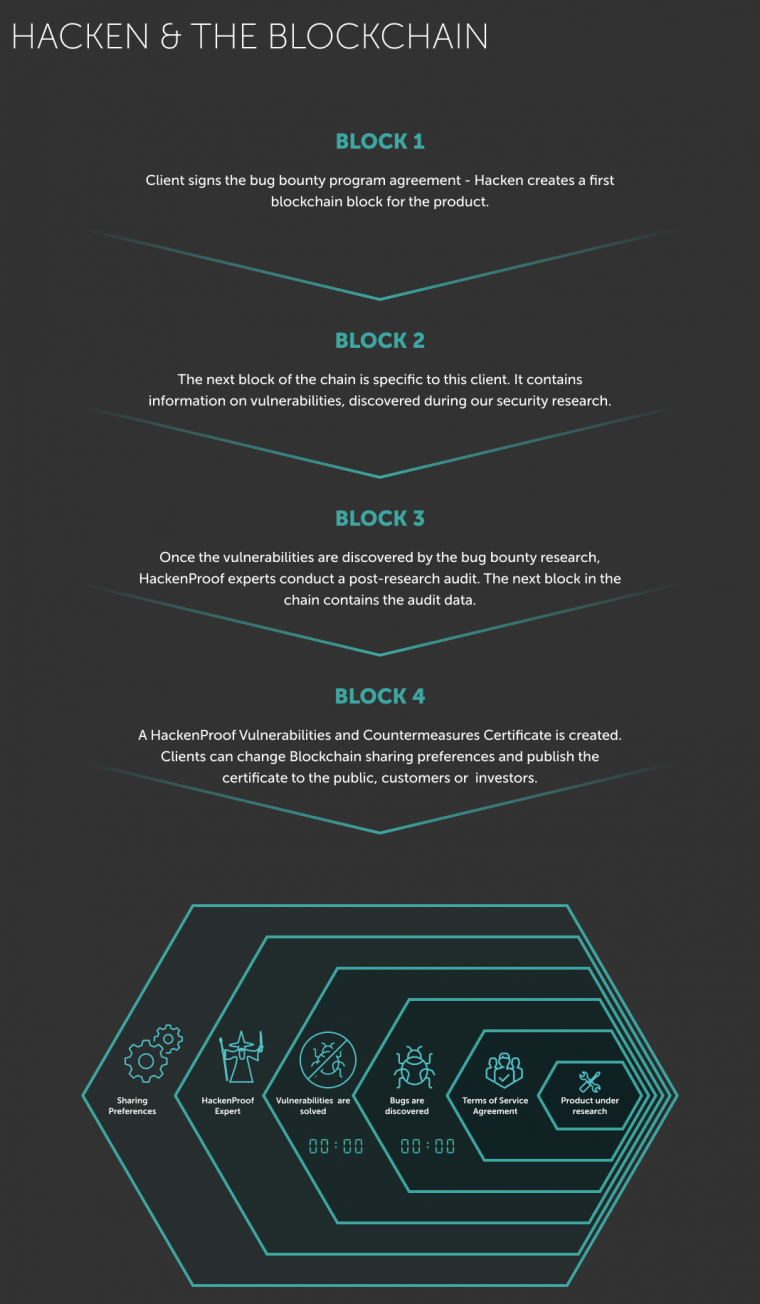

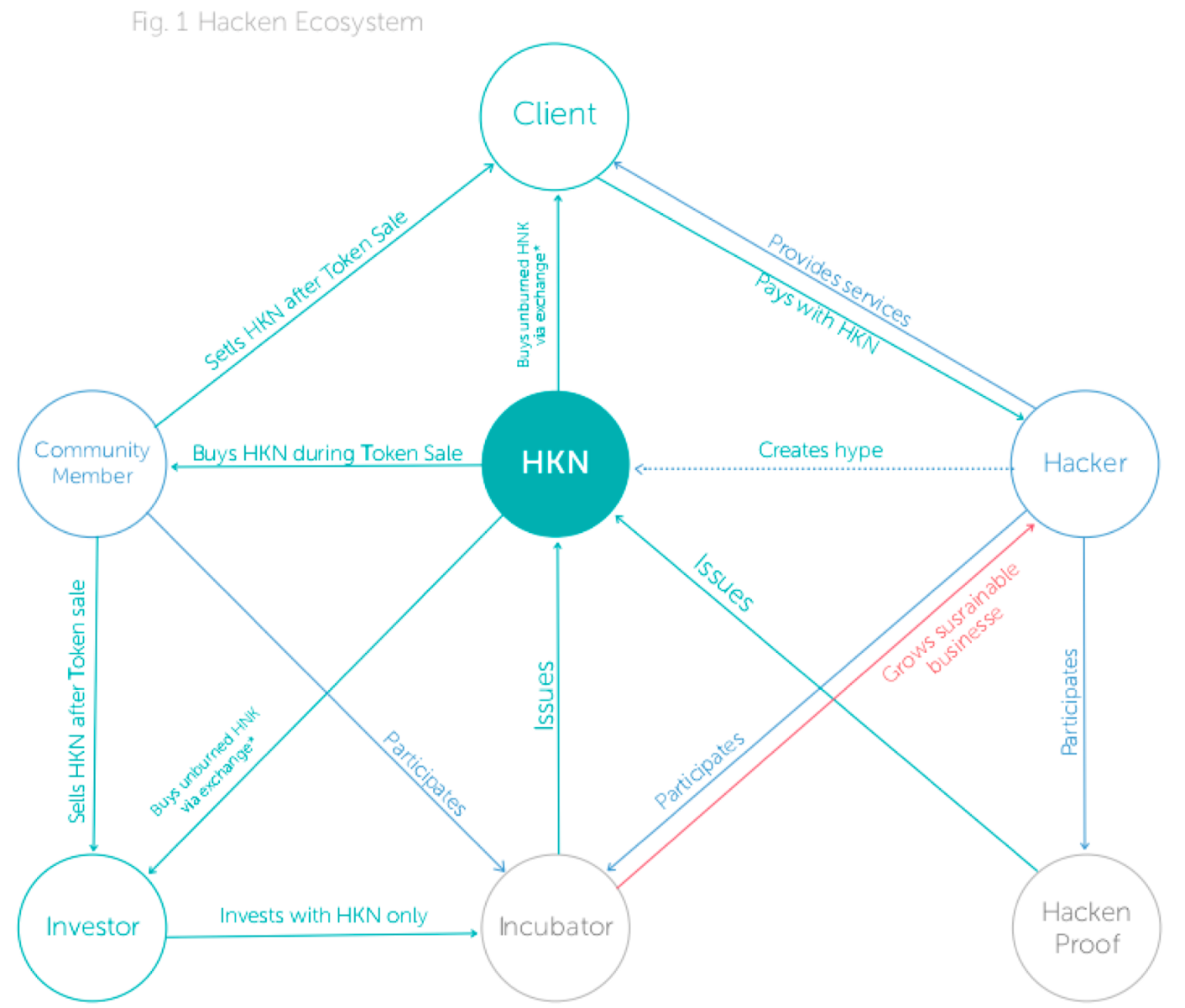

As you can see in our WP, Hacken is going to resolve one of the main problems of the digital era — a lack of cybersecurity. We intend to resolve it by implementing the blockchain to exclude human factor from the relationships between white hat hackers and their clients. To convey our idea, we’re always analyzing the industry and updating our social media in order to inform our community on how we will be making a difference.

So, you should spend enough time on analyzing the documents of a startup and its media presence. It’ll help you differentiate a really good project with strong idea from a straight up scam.

Step 2: Is it clear how a startup’s proposition works and why would customers buy into it?

In general, during the development of their fundamental business strategy, the majority of ICO sturtups focus on attracting investments. Originally, they may not even care about the future elaboration or even operational processes of their products. They simply endeavor to encourage crypto-investors to buy their tokens actively within a certain period. Without a doubt, it’s the wrong approach. The reason being that all of this is extremely important for the future operations of a sturup as a mature business unit. These things will determine whether the price of a token issued by a company goes up or down at the crypto-exchanges. Obviously, all ICO supporters are waiting for 10x capital gain, but the majority of us do not care about the deadlines for a project release.

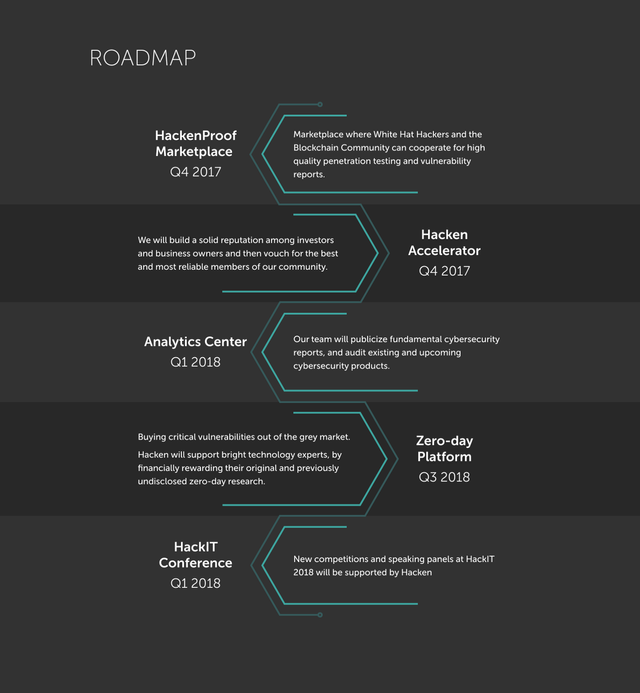

For example, before starting our ICO campaign, we’ve spent a huge amount of time on brainstorming to devise our product and its competitive advantages. The project development team of Hacken created a comprehensible frame depicting how our proposition will work to meet the demand of both customers and employees. To clarify, we demonstrated how the blockchain and smart contracts will work in HackenProof. We even tested the alpha version of HackenProof during HackIT bug bounty marathon, which took place at the end of September. As a result, we managed to examine our product in action as well as collected valuable feedback to fix bugs and implement necessary improvements.

Therefore, Hacken’s supporters, partners and existing and future clients clearly understand how our proposition will work and provide benefits to the Hacken Community.

Step 3: Consider the management team, are they qualified and what experience have they had starting and running a business?

To build a successful and sustainable business, founders and top executives have to be skilled and highly-qualified. Top management of a TGE startup must have an expertise in business development and field in which they are going to operate. It will help you ensure that a team will spend the funds raised in an appropriate manner to get a higher efficiency with minimal spending.

For example, the executive board of Hacken contains top managers, cybersecurity professionals and technical specialists with profound experience in the corporate sector (Dmitry Budorin, Yegor Aushev and Andrii Matiukhin). Having worked for sustainable and successful TNCs and mid-sized companies, they managed to hone their skills in decision making, financial planning and business development. All of them are aware of how to provide the value to both token holders, cybersecurity researchers and customers of the Hacken Ecosystem.

So, for this purpose, you should check the Linkedin profiles of each team member and look at which companies they’ve worked for, as well as the representatives of which industry are in their contact list. In addition, it would be good to take a look at advisors of the project as good blockchain experts won’t participate in scam activities. Eventually, you should check the management profiles on other social media platforms (Facebook and Twitter) to assess their progress in the blockchain world. It will help you make sure that the top executives are really experienced people who will be able to develop a product and ensure the profitability of the business.

Step 4: Is there enough information on which to base an investment decision?

It’s obligatory to piece all the facts together to make an informed decision regarding your investments. Thus, you should determine if a company conducted market research to identify a particular problem based on qualitative and quantitative arguments. Its white paper must contain facts supporting the arguments that prove a company’s ability to provide a solution to a problem while getting an income.

So, before investing in an ICO, you should find the following sections in the White Paper of a startup:

Profound research identifying a problem and why an industry must resolve it;

Problem evaluation determining the main aspects of a problem;

Providing a Unique Solution (product) based on the first sections;

Description of Benefits of the solution for all parties (token holders, employees and clients);

Finally, it’s necessary to explain how funds raised will be spent on building a product from the ground up.

Nowadays, there are too many TGE projects. Obviously, it is extremely dangerous for the financial well-being of crypto-investors and blockchain enthusiasts. But we hope that by analyzing a startup based on these 4 points, you will manage to avoid different kinds of scams. So, stay cold-blooded and be more attentive while you make an investing decision.

Source:

https://blog.hacken.io/4-steps-to-determine-if-an-ico-startup-is-credible-or-not-4a8bf3d10e4c

Copying/Pasting full texts without adding anything original is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.hacken.io/4-steps-to-determine-if-an-ico-startup-is-credible-or-not-4a8bf3d10e4c

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @techfish! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit