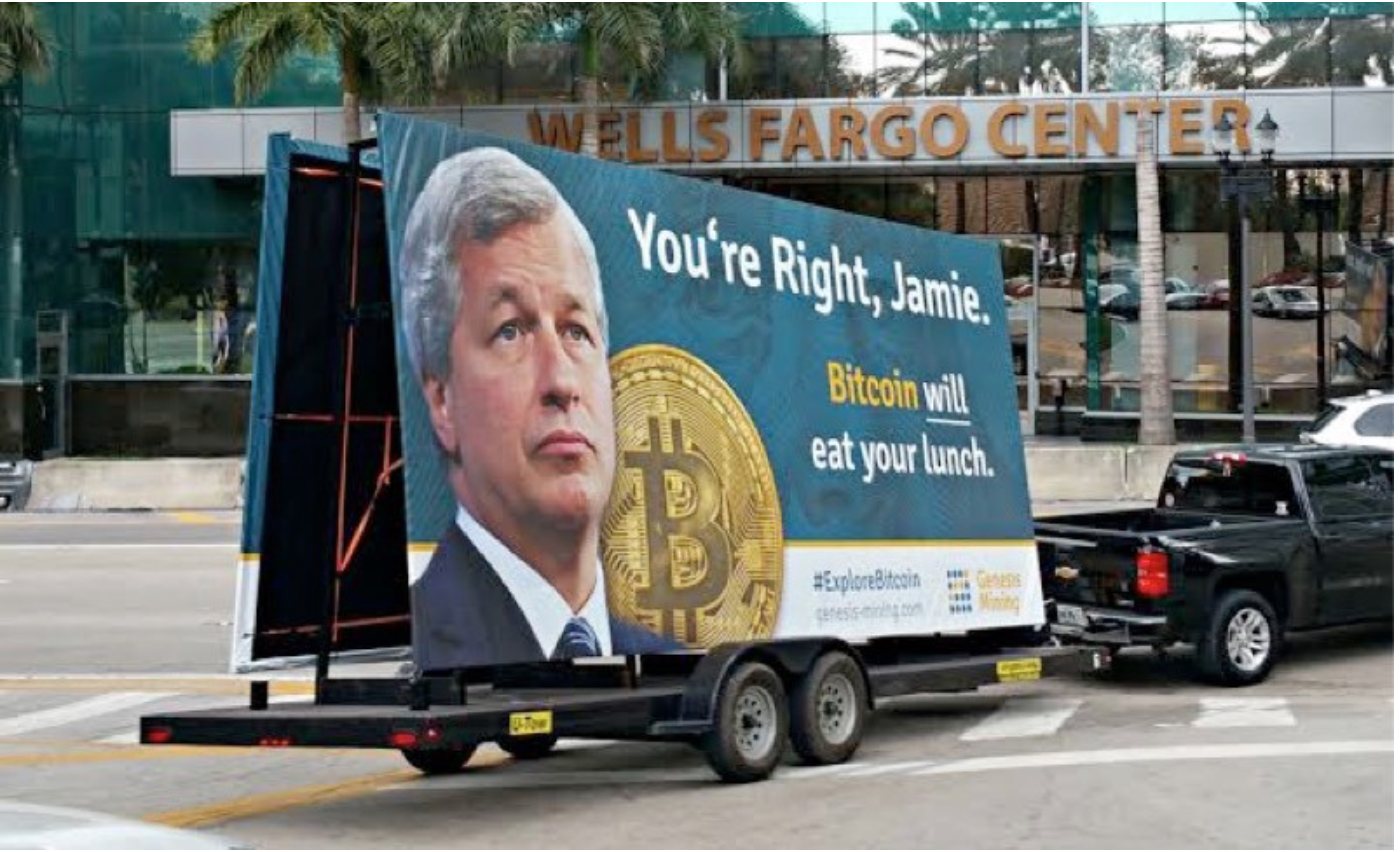

Recently, Chief Executive Officer of JP Morgan Chase, Jamie Dimon, was quoted saying that Bitcoin is a “fraud”, and if he caught any JP Morgan trader speculating in the cryptocurrency market, he’d “…fire them in a second. For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.”

The cryptocurency “wont end well,” he told investors in a conference in New York City last Tuesday. He spoke of his speculations, predicting that the market is in a bubble that could continue to grow, but will eventually pop.

And although he may not fully understand the technology behind Bitcoin and the use-cases it offers, his statements still stand with good reasoning:

Since early-mid 2017, Bitcoin prices have soared close to 400%, causing massive-scale attention and money to flood into the market. Alongside Bitcoin, many cryptocurrencies such as Litecoin, Ripple, and NEO, experienced 20x, 30x, and even 50x gains, returns rarely ever seen in traditional equity markets.

(2017 Cryptocurrency Market Capitalization Chart below) Source: CoinMarketCap.com

Due to these massive increases in valuation, crypto speculators from all corners of the globe have been shouting the word “bubble!” in everyones ear, causing fear, uncertainty, and doubt (FUD) to be the central emotions that drive action among crypto traders and investors.

Therefore, due to the current sensitivity of the market, Jamie Dimon’s bashful comments toward Bitcoin and cryptocurrency as a whole lead prices down a small correction of 0.65%, almost $30 USD on Septemeber 12th, according to Bloomberg Technology.

Although Jamie Dimon’s negative comments did have some effect on Bitcoin’s price, this is not the main factor to consider when trying to find the primary cause of the large sell-offs and price corrections it has experienced this month.

As you all may know by now, Chinese regulators have reportedly announced that all major Chinese Bitcoin exchanges are to shut down operations for domestic traders no later than September 30th. In consequence, Chinese traders have been forced to liquidate all of their digital assets held in these exchanges. This alone has played a major role in forming the recent, month-long price downtrend that Bitcoin and many other cryptocurrencies have been experiencing.

So, with the negative comments coming from financial and technological leaders and executives, along with the forced liquidations being experienced in China, and ofcourse, FUD, the Cryptocurreny Market has been delt an $80 Billion blow so far this month. (September 2017)

The largest price drop of the month happened on September 15th at 12:00 UTC: the market shedded $15 Billion in merely a few hours, with Bitcoin tumbling over $800, hitting strong resistance at $3000, and recovering nearly the same amount shortly afterwards.

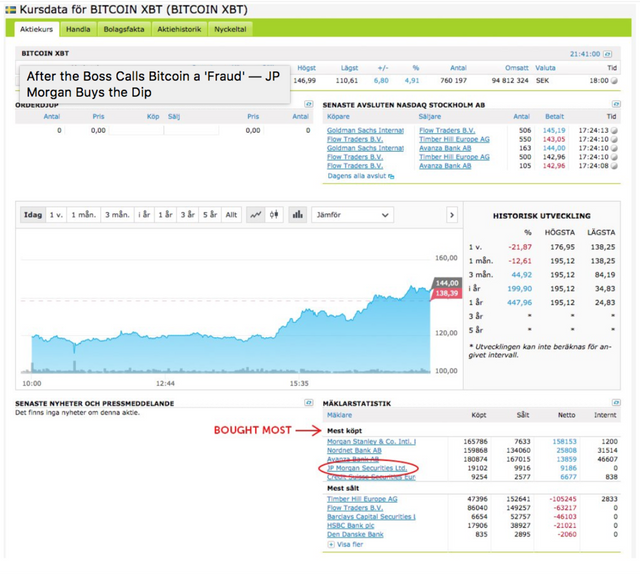

And once this occurred, something happened that nobody would have ever seen coming: JP Morgan Securities Ltd., along with other large banks such as Morgan Stanley & Co., bought the dip.

Image via @IamNomad on Twitter.

According to the public records of Nordnet trading logs, the two associated financial institutions JP Morgan Chase and Morgan Stanley together bought roughly 3 Million Euro’s worth of XBT note shares, also known as Bitcoin ETN’s or Exchange Traded Notes. Bitcoin ETN’s are popular investment vehicles among mainstream investors and financial management firms that want to be involved with Bitcoin.

A few institutions offer Bitcoin ETN’s, such as the Denmark-Based Saxo Bank, which offers notes called the “Bitcoin Tracker”. These XBT notes track and follow Bitcoin price movements alongside the Euro and US Dollar. Considering Bitcoin’s substantial year-long price increase, these ETN’s have done extremely well over the course of 2017.

What do you think of JP Morgan’s CEO calling Bitcoin a “fraud”, and then supposedly purchasing millions of dollars worth of Bitcoin note shares as soon as the price hit $3000? Leave your comments down below!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@TheCoinEconomy/ceo-of-jp-morgan-jamie-dimon-calls-bitcoin-a-fraud-and-then-buys-the-dip-c56796ca4456

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit