In recent years, the success of cryptographically secured digital assets, Bitcoin in particular has had to grapple with more enlightened skeptics who in general might be consider mere critic thinkers. Noble price award winner Prof. Robert Schuller called Bitcoin the best example of a bubble, no one can be sure how long he would be wrong. Other renowned skeptics include Warren Buffet, Jimie Dimon, CEO at J.P. Morgan chase, and most recently Jack Bogle. Of cause you can’t under estimate the knowledge wealth these guys have amassed from studying and experience.

Jack Bogle in November, 2017 said;

Bitcoin has no underlying rate of return. You know bonds have an interest coupon, stocks have earnings and dividends, gold has nothing. There is nothing to support bitcoin except the hope that you will sell it to someone for more than you paid for it.This statement depicts Bitcoin like most other cryptographically secured currencies/assets has no intrinsic value. I'll love to start my argument from the ground-up, from the time period we started having nationally organised economic systems.

FROM ASSET TO IDEA

The first and second world wars were the greatest man-made plagues we've seen thus far in human history but they left us with a fundamental lesson we've never seem to grasp in our 6 thousand years monetary history. We were still recovering from the devastating impact of World War I, then came World War II. Economists estimated it to be the most expensive and economically unsustainable event in human history. Everyone was buying stuff from the U.S. (with gold) to front the war and so the Unites States enjoyed a staggering trade surplus. The U.S. then was still on the gold standard which every other country had dumped during World War I.

It’s 1944, the war is over. Nations had to meet to resolve many issues especially regarding foreign trade. This was called the Bretton wood conference. The resolutions of the meetup was simply. Since the United states was still on th gold standard and countries where too devastated to come back to the gold standard, every nation should the peg her currency to the U.S. Dollar. This led to the Dollar becoming the global reserve currency.

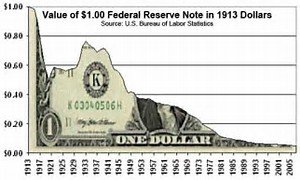

As other nation’s recovered from the war and their currencies began gaining value, the US dollar become so valued. This value didn’t last though as the U.S. got involved in debt due to the war in Vietnam and also balance of payment concerns. In early August, 1971 Charles De Gaulle (the then French president) cashed in France's U.S. Dollar holding at the New York Federal Reserve Bank bringing back French gold. Other Nations soon followed suite. Everyone cashing in their Dollar for gold. The U.S. was already in an economic recession, Nations now dumping the US Dollar would only worsen the situation. So U.S. President Nixon in August 15, 1971 took the U.S. of the Gold standard. This simply meant no one could redeem US Dollar for gold. So the almighty United States Dollars was now pegged to nothing but the free market.

Seeing the turn of event’s other Nations just remained on the U.S. Dollar standard it had been since Bretton wood. Today every other United Nation’s currency is redeemable for a certain amount of United States Dollar. This had it’s down sides as well. The gold standard was able to tame irresponsible expenses; trade and budget deficits. The United States for instance now lives way beyond its means through annual trade and budget deficits, piling to a nation debt of over $20 Trillion dollars. Infact there’s a live feed of US National debt here.

Well, the power of value creation wasn't really left to the free markets per say, it was left to the banks. Many people don't realise but the fact is the banks (private banks) create more money through interest rates than central banks. Of cause the repercussion was six recessions in the U.S. since Nixon dumped the gold standard. History is simply repeating itself but this time we are truly leaving the fiat standard or the bank standard in my opinion and truly according value to the free market.

VALUATION METHODOLOGY

Dumping of the gold standard by Nixon was the break down of an international treaty but a breakthrough in our ideology of value. The fact that value can be derived from use case and not necessarily a tangible commodity was a leap in the right direction in our valuation methodology.Value is simple what we all agree it is whether effort was put into it or not. The United states dollar is just piece of paper with numbers written on it but is redeemable for global currencies. Of cause we know those notes were produced with almost zero marginal cost unlike the cost and effort it took to mine gold. 88 year old genius Jack Bogle is still living in the days of the gold standard. For the first time in the human history, we are taking away the power to create value from the banks and leaving it to the free market.

The above series of event in world history has thought us one fundamental lesson; money is an idea not a “thing”.

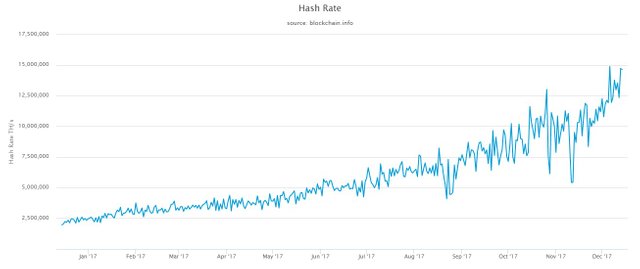

What gave gold it's value was the fact that it was scare and required so much resource to acquire and not necessarily because we could eat it. Gold's value is extrinsic. This is so similar to Bitcoin. As at the write up of this article, it’s taking 13,286,097,755 GH/s of computing power to mint 12.5 bitcoins. That harsh power using the US standard electricity bill of 12 cents per KWh would be $5.2 million daily (I stand to be corrected). This doesn't include the cost of the equipment. This in my humble opinion is value.

In summary, no medium of exchange from gold to fiat had any sort of intrinsic value. Fiat and Gold's supply can't be tamed. Bitcoin's supply is controlled and isn't subject to political affiliation or sentiments. The code is the LAW.