A lot of people who are new to the investment community are looking for how soon they can start getting their returns back. They want the big check, the quick flip and they want it right now. They want to cash out.

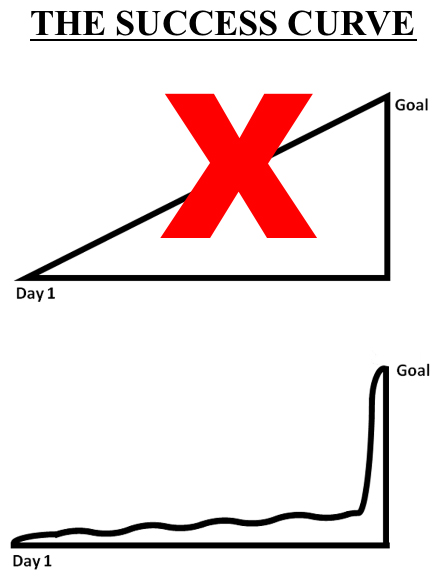

This is the reason why a lot of people have issues with the bitcoin dip, this is why people in the investment club leave early. They didn’t enter the opportunity with the right mindset. They are investing with the consumer mindset not the owners mindset. They start looking at all the things their money can buy, they start looking at people around them doing what they want to do while they are stacking and being patient.

Big money goal

One thing you learn as you invest over time is that you don’t make big money investing until you invest big money. This is why the early goals for the club were to accumulate as much principal cash as we can. This is why the goal for the real estate side is to infuse as much cash as we can into buying deals and then using our deals to buy more deals. You have to increase the size of your position so that the wins on your position are worth your time.

If you hit big on a small position you earn $100 bucks. Congrats, you put a week worth of thought energy into making $100 bucks. You could have earned that $100 in less than an hour of working but you chose to be baby Gordon Gekko and predict the movement of the stock only to make pennies. Spoiler alert, it takes just as much thought energy to predict a stock will move up 10% and make $100 bucks as it does to make $100,000. The only difference is the amount of money you have invested. I hope I am making myself clear. It is useless to be right with little money on the line. The trade off doesn’t make sense. Stop being lazy, put money away, forget about it and go make money on your job instead of waiting for that passive 100 bucks. Then forget about the 100 you have saved until its enough where your capital gains are more than your working gains. That is how the game is played.

Invest to own don’t invest to consume (ownership is generational, consumption is temperamental)

If you throw a few bucks at an investment and start pulling money out you then reduce the money pile you have to earn money on. An example is the investment club that has $50,000 in invested cash with $20,000 in capital gains. Now we have $70,000 to throw at deals instead of $50,000.

Keeping it real, people wanted to pull money at year one when we had about $20,000-$30,000 invested. If I had listened to them we wouldn’t have the $70,000… if you listen to me and chill on pulling your little money out we can get to a half a mil reinvesting our gains. Your inability to delay gratification is the reason you only have 25 a month to invest. You have to take time to unlearn all your habits and re learn the habits of the wealthy.

A consumer invests to consume. An owner invests to own. I prefer ownership over constant consumption. It is very difficult to invest with your mind on consumption. It makes you pull funds early, it makes you take unreasonable risk, it makes you lose money.

Millionaire mentor

I work with a man worth multiple hundreds of millions of dollars. This guy takes forever to do everything. Projects that we could quickly turn over, he waits on and stalls. Properties we can sell and be done with, he holds waiting for the right number. Human Resources suits that should be settled and over and done with, he fights to the end, he pursues, her perseveres.

For the longest time I thought this was just flat out crazy. I thought he was just old and naive. The slow drag of everything around here was really starting to piss me off. I wanted action, I wanted movement, I wanted to move onto the other deals.

Well, this month a lot of things have been hitting for him. People who balked at his offers a year and two years ago are circling back around. People who fought and fought in Human Resources suits are coming to their knees. They are tired of fighting. He ended up getting what he wanted.

The same is true for the investment club. We laid the trap, we had the cash and we walked into a 40% gain on the portfolio. (40% gains aren’t common folks). The same will be true with TREF. If folks put their money in and leave it for the long haul, not running for the exits at year one they can begin to flip and flip and flip the funds. Your 8% compounds, your profit compound, your power compounds. That is how the game is played.

Whats a lot on a little

Everyone wants to know what their return is. Everyone wants to know how much they are making. Well no matter what return you get on a little bit of money that is still not going to be a lot of money. If you put up 500 and expect to get rich you can double your money and still be poor. This is why I try to tell people to get in the habit of ending consumption and instead of putting all your money into bull, you put all your money into assets and paying off debt on an asset. Instead of setting and forgetting 500, put up 500 then start contributing 500 every month or 100 every month. Years later, with the accumulated and compounded principal and the interest you will be very wealthy. It is a lifestyle it is not a one off even where you throw a few bucks at something and boom, you hit the lottery. Investing is not the lottery.

It is a lifestyle. Frugality is a lifestyle. Living below your means is a lifestyle. OR you can max out life and complain to the government. Just as long as you realize that is a choice.

Wear them down

When you have patience you get what you want by wearing people and opportunities down. You lean on them, you don’t waver, you press your agenda and wear them down. When you wear them down its even easier to get what you really want. They are tired, they want it to be over with, you get what you want.

Things change

The most important thing is that market conditions change. What is in poor condition now wont always be in poor condition. What is hot now wont always be hot. If you have patience to let the market and people come to you they will do so on your terms.

Back to the club and Bitcoin

In the investment club, in Bitcoin, in any other venture, the key is patience. Businesses fail because owners are trying to cash out before the business is ready to cash out. The fail because when it is ready to cash out they go in a little too hard on the cash and they kill the tree. This is why landlords sell property, they pulled all the cash out, get behind the eight ball and before you know it they can’t afford to keep and maintain the property.

The thing with investing small is that even if you win big you still win small. This is why when we start these clubs the runway can be seen as long and boring and not as ballerific as people though real estate investing would be. This is a business though and most businesses don’t hit their stride until about year five. Treat your investments like a business. Push cash, time and energy over there and don’t expect to pull out money for a long long time. Just forget about the concept of pulling out money and continue to focus on the work required to put away money.

Major key alert

For those that think that investing is the key to solving their financial woes, think again. You are the key to ending your financial woes. Investing won’t save you until you save you. This requires that you immerse yourself in study, deferred gratification and even self denial, for a long long long time. Just get rid of the idea of comfort for a long time.

Stop trying to cash out on your investments, go back to work and make more money. Take your gains and double down. Stay broke and don’t touch your investments. I promise you that the short term high you get from buying a bag isn’t as important as how you can live in five years when you are cash flowing off that large sum you built up over the years.

If you are interested in investing with our club on either the stock or real estate side we would be happy to welcome you into the partnership. email [email protected] today to join.

Be great, invest well,

Tony Trillions

Nice. Show the light.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by tonytrillions from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post!

Thanks for tasting the eden!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit