In spite of an officially half year chill period, for 2018 we see all the more sideways and drawback potential in the bitcoin cost because of slow retail request, faltering from establishments and a present market top that appears to be too high with respect to the action happening on accessible blockchains.

Numerous financial specialists and counsels are on record expressing that $5,700 was the base in bitcoin during the current year, and that higher costs lie ahead. While we are extremely bullish on bitcoin's long haul prospects, we do regard alert for all the more here and now value hopefulness.

To locate the beginning stage of the noteworthy allegorical rally in bitcoin that finished at $20,000 we need to go as far back as August 2015, when bitcoin exchanged at underneath $200. This past rally was a marvelous, notable move. Indeed, even in common positively trending markets, the group of monetary performing artists require time to assimilate the data implanted in its trademark high volume arouses.

As I've shown in my 2018 standpoint, I think chances are high during the current year to be recognized as a shakeout year: a lemon showcase in altcoins, controllers making up for lost time and framework developing agonies.

Bearish signs in short term period

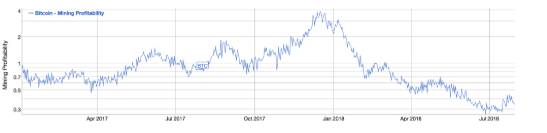

Since January, the bitcoin mining hashrate (total calculations every second made to anchor the system ) has tripled, which implies that a gigantic measure of new or more effective mining rigs have come on the web. In mix with declining costs, this implies diggers who couldn't update their machines or find less expensive power have been looked with a precarious decrease in benefit, a 90% drop in 7 months (altcoins have confronted comparative or more extreme decays).

With net revenues under overwhelming weight, it's not impossible that diggers are and will remain in charge of a lot of offering in the market.

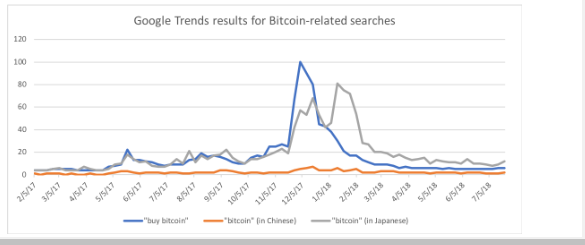

Next, trading volumes are not dead, but still below those seen during last winter and spring.

It's unclear how much of the recent pick-up in volumes are the result of a short squeeze and how much is coming from new long-term buyers coming in

Next, here are a few remarks we've accumulated from bitcoin experts, advertise creators and Wall Street insiders:

The primary bitcoin ETF will probably not be affirmed before 2019. So any expectation of endorsement by September will probably be met with dissatisfaction.

While institutional speculators are surely getting associated with bitcoin, most by far of the organizations are exchanging firms who are hoping to make advertises paying little heed to cost: they're similarly as glad to go up against short positions as they are to go long. Establishments who are known to be for some time one-sided, for example, shared finances and annuity reserves are not prepared to contribute on the grounds that they're not yet OK with the accessible care arrangements.

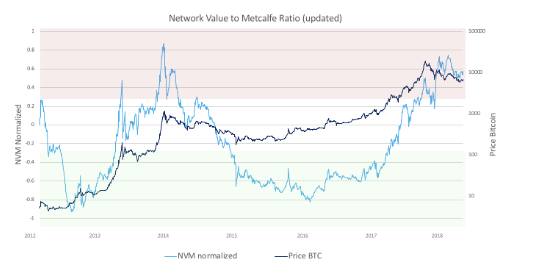

There's additionally the NVM Ratio, which is intended to reflect beginning period selection, now recommending that there's presently too little on-anchor action to legitimize bitcoin's present market top.

The assumption here is that bitcoin's market value is mostly derived from it being a network that connects users around the world: the more people and entities use the bitcoin blockchain to settle transactions, the more it acquires the liquidity and utility that we'd expect from digital gold.

The NVM ratio approximates that by measuring daily active addresses on the blockchain. Similar valuation models have been made for growth companies such as Facebook and Linkedin, where the number of monthly active users reasonably correlates with enterprise value.

(There are several objections one could raise against the NVM Ratio: it doesn't take into account transaction amounts nor the difference between old an new addresses, it doesn't discount spam attacks, it doesn't acknowledge limitations to the block size and neither does it consider institutions coming into the market who build derivatives on bitcoin that rely on a small amount of high-value cold storage addresses. More work is needed to refine valuation models. That said, even though bitcoin's core value proposition is as a store of value, we do think we're still in the early adoption phase, and hence using a valuation metric that reflects this adoption makes sense to us. In that context, we think the NVM's on-chain activity based valuation method has merit.)

The related NVT ratio, which tries to measure if the daily dollar value of all bitcoin transactions is relatively high or low versus the market cap, also suggests overvaluation.

Finally, in the past few months, we've also seen a number of macro events that would appear to be bullish for bitcoin as a safe haven: the North Korea debacle, a spike in volatility, Chinese stocks breaking down, etc. However, these shocks didn't move the meter for bitcoin.

Such an excess of being stated, bring down bitcoin costs ahead are not an inevitable end product:

The bitcoin cost has just descended by 62 percent since December.

Since March, the Chinese Yuan has dropped by 8 percent against the dollar. In the event that this slide proceeds with, Chinese capital could escape into bitcoin.

Bitcoin predominance is making strides, which we think demonstrates the market's moderate acknowledgment that there's an expansive channel around the bitcoin biological community now which will make it difficult to remove.

The 2015– '17 rally was noteworthy however not so much novel for this biological community: between late 2011 and April 2013, the bitcoin cost duplicated by 100x, and, following a six-month revision, it increased again by 10x.

Esteem financial specialists are as of now envisioning the May 2020 square reward dividing, which will chop down bitcoin's yearly supply expansion from 3.7 percent to just 1.79 percent.

A bitcoin ETF endorsement, regardless of whether it's deferred, would be an enormous arrangement since it makes the advantage to a great degree open for the retail financial specialist. After the main gold ETF went live in 2004, the gold cost aroused by 350 percent (it's as yet 200 percent higher today). The 2017 rally has likewise gotten under way a whirlwind of corporate movement on the bitcoin framework side, and the guarantee of built up banks, merchants, installment processors, and security suppliers offering their own answer suites is grabbing the eye of significant worth financial specialists.