Today I share smart money strategies on how to trade altcoins for bitcoin and make profit stress-free.

For the purpose of this article, altcoins will refer to any tokenized crypto currency other than Bitcoin (BTC) so basically every token listed on Coinmarketcap.com at the exception of BTC.

I’ve tried to make this trading guide as user friendly as possible by putting myself in the shoes of a beginner trader and presenting the tips in logical order but any feedback and/or question is greatly appreciated.

Let's get into it.

Trade altcoins for BTC not fiat.

My number one reason for trading altcoins is to accumulate more Bitcoin.

Why Bitcoin?

First, because I believe that BTC will continue to grow in value in the future (especially since we activated Segwit). and eventually make me rich, simple as that;

Second because Bitcoin is currently the most stable crypto-currency in the cryptoverse thanks to high volume of trading and market cap so it’s unlikely we see BTC go from gold to garbage on a whim unlike most other altcoins.

- Third, investing in fiat money sucks and I hate paying banking fees for just having my cash just sitting on a bank account while inflation is eating away at its value.

Trade on reliable exchanges.

Trading is a risky enterprise because it involves trusting exchanges with your funds. The problem is that most exchanges are unsafe because of hacking (btw, make sure you have 2FA activated on your exchange accounts), however, there are internal threats as well as some exchange have built a reputation for being unsafe and negligent with their customer service and funds (looking at you POLONIEX). Right now these are the exchanges I trust for my trading:

BITFINEX (best trading engine on the market for BTC/altcoins trading; best BTC/USD volume in the market);

BITTREX (the biggest ERC20 tokens exchange today, lists most ERC2 tokens shortly after their ICO, very good interface and fast trading engine);

KRAKEN (which I use to send and receive fiat from my traditional bank account, horrible trading engine though);

LIQUI (new exchange specialized in ERC20 tokens, they have excellent customer service).

I should complete this list by saying that under no circumstances you should send any funds to POLONIEX, for more on why you can check out this article I wrote.

Don’t FOMO-buy.

Fear of missing out (FOMO) buy means buying a coin which has entered its FOMO stage.

You know a coin has entered the FOMO stage when:

- The price is going straight up vertical on the chart;

Suddenly, Youtube can’t shut up about it (BUY NOW OR WEEP LATER, IS IT TOO LATE TO INVEST IN (shitsmartcoinplus)) ;

Newbies on YouTube and Reddit start asking if now is a good moment to invest in it (lol);

- The coin shows over +100% gain and top volume on the dashboard of the exchange(s) where it trades.

Why is FOMO-buying bad?

FOMO is bad because it is irrational and based on emotion instead of reason;

FOMO is bad because it tempts traders into buying a coin which is about to hit its distribution phase.

- FOMO is bad because buying high will make you nervous, stressed, prone to loose sleep over your “investment’ and you'll very likely end up panic-selling out of your trade at the first sign of blood on the chart which will translate into a net loss of BTC.

Therefore,

Controlling FOMO is key to profitable trading and ideally you should always avoid buying into FOMO.

FOMO is a time to sell, not a time to buy.

The problem is that exchanges need FOMO to create volume (and harvest fees) and so deliberately use tricks to create it.

Fortunately there are a few ways in which you can beat FOMO which I am about to address.

Buy low in accumulation.

The most important strategy to be a profitable (and stress-free) altcoin trader is to know when to buy and when to stay away from a market.

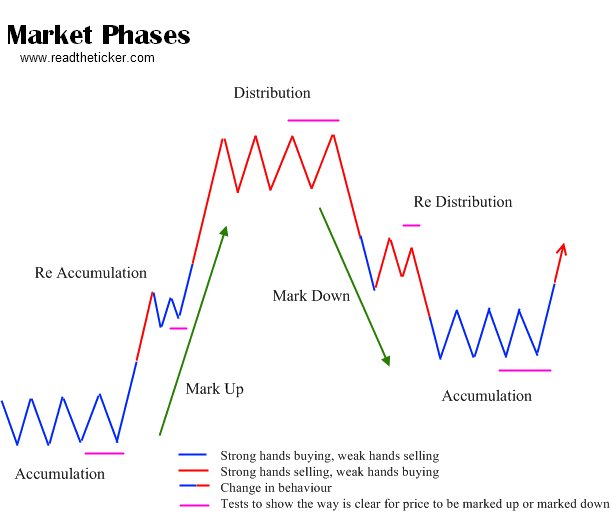

My favorite time to buy a market is to buy in accumulation. Accumulation is a market phase characterized buy low volume and flat-ish, stable price action. This is what accumulation looks like on a chart:

Typically, accumulation happens after a long, grindy bearish phase, followed by a break out and a double bottom, followed by a flat price action.

Accumulation is the ideal time to buy into an altcoin because it indicates that whales are loading up on a coin for later sell-off once the token will reach FOMO stage.

Therefore, if you want to trade with the smart money you should always buy in accumulation and sell during FOMO.

Be patient.

Buying low into an altcoin is not necessarily going to translate into a good trade if you don’t have patience.

Patience basically means ignoring the noise (smaller price moves) to focus on the bigger price moves.

Altcoin markets are very volatile, especially those with low liquidity. For example most markets on BITTREX aren’t very liquid and can typically experience +50%/-50% oscillations in value; even in accumulation. The biggest mistake you can make during accumulation is to:

panic sell at the first sign of blood;

get impatient and sell your bags too early only to have the coin moon on you a few days/hours later:

My SNT trade: got a great entry, sold too early, made 40% instead of 140%, lesson learned.

Personally I think the best way to avoid panic selling is to transfer your coins out of the exchange onto a Ledger or a MEW (for ERC20 coins) or a desktop wallet (for NEO for example).

As for selling too early, the last section of this guide is going to adress this problem.

Scale out of winning trades.

The idea here is not to go all out of a winning position but rather to sell it incrementally and let some ride either as long term investment or to sell higher in case the price keeps climbing:

Example:

- You buy for 200$ of ETH early in accumulation at $10/coin (20 ETH)

- ETH is now up to 200$/coin,

- Sell 5 ETH for $1000 (risk capital: $200 + profit: $800) and let 15 ETH ride;

- Take your risk capital and some profit out of the market (sell it for fiat or BTC);

- ETH is now up to $350/coin you sell 10 ETH for $3500;

- Take the profit out of the market (fiat account or BTC);

- You have 5 ETH left, put them on a LEDGER as long-term investment;

- Reinvest your risk capital (augmented with some profit) into a different coin.

That's it for today guys, hope this guide will help you make loads of profit in your altcoin trading and I wish you the best :)

#bitcoin #cryptocurrency #trading

Trade safe guys, and please follow, resteem and upvote if you like the content.

Dan @tradealert

Exactly and I would add that you should only invest in coins in which you actually understand the value proposition. That way it'll be harder to get shook out if and when s*** hits the fan.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed @imrane, check out this article mate:

https://blog.neufund.org/economics-of-entangled-tokens-9fc5b084e2d2

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit