If you don't want to read the whole article, just glance at the charts and see if you can (a) spot the similarities and (b) guess the time periods!

A lot of folks view the cryptocurrency revolution as this generation's chance at huge success. If I had to bet, I'd say they're right. But before I go mortgage the house and put it all on the Bitcoin, I must consider a couple unfortunate things that have recently occurred to me.

1. You can't Predict the Price of the Bitcoin

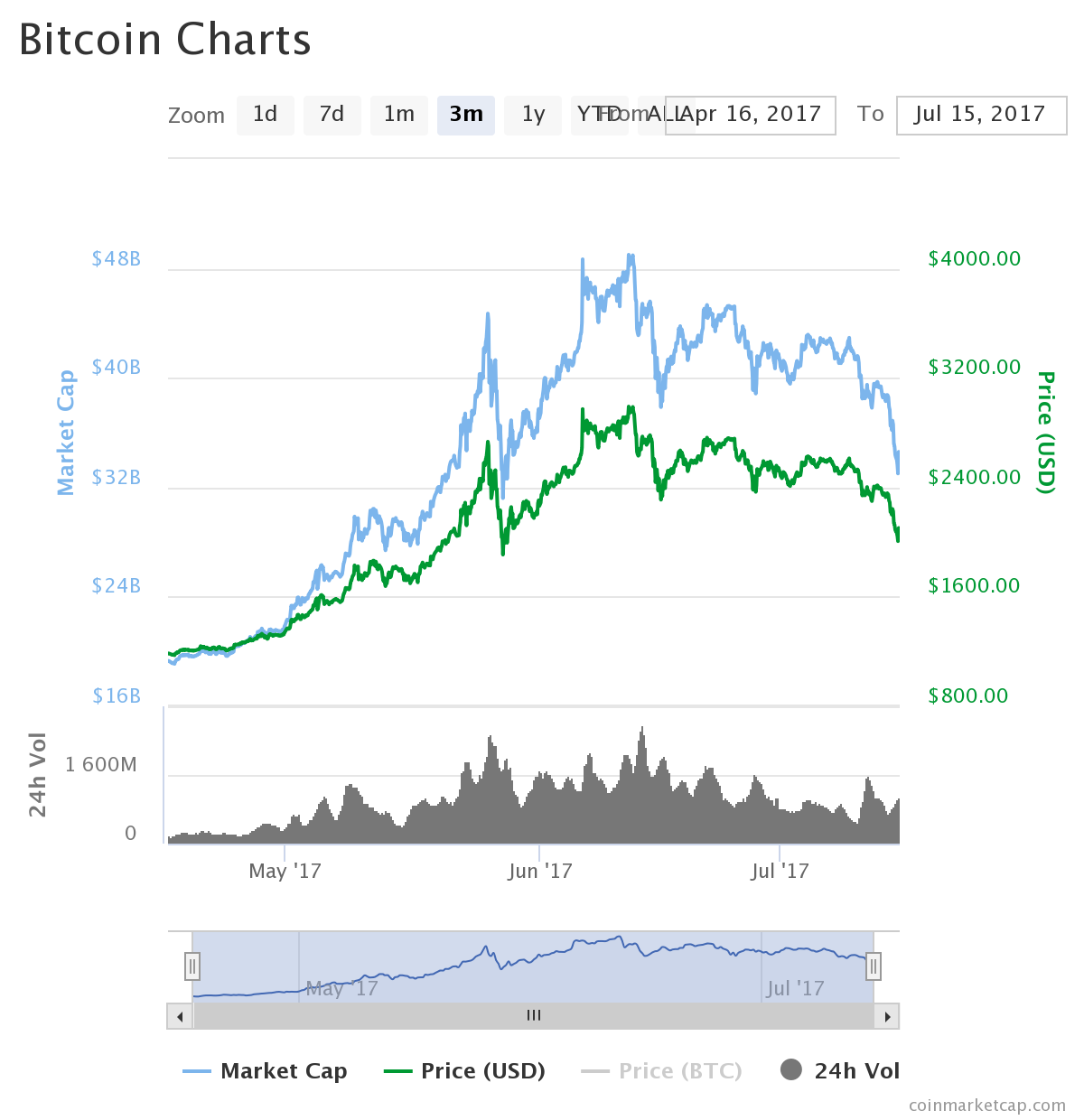

This chart is a 3-month period starting in mid-April and ending in mid July. The rise from about $1100 to about $3000 is a 170% increase spanning from the beginning of the chart to the chart-high. What follows is a 35% fall to about $1900.

Check it.

.png)

From that roughly $1900 spot to it's next all time high the Bitcoin increased by 160% to $4900. Then fell again by 40% to about $3000. This next chart is also a 3 month period. Visually, it is easy to find the similarities. But with a little math, the numerical similarities are even more striking.

.png)

This pattern developing is not hard to find and might lead me to think I know what's coming next. But here is a principle of investing that I am beginning to incorporate into my wisdom base: once I identify the pattern, the pattern goes away. I am personally not expecting this to repeat again. (That's not to say I know what will happen. I'm just not expecting this.)

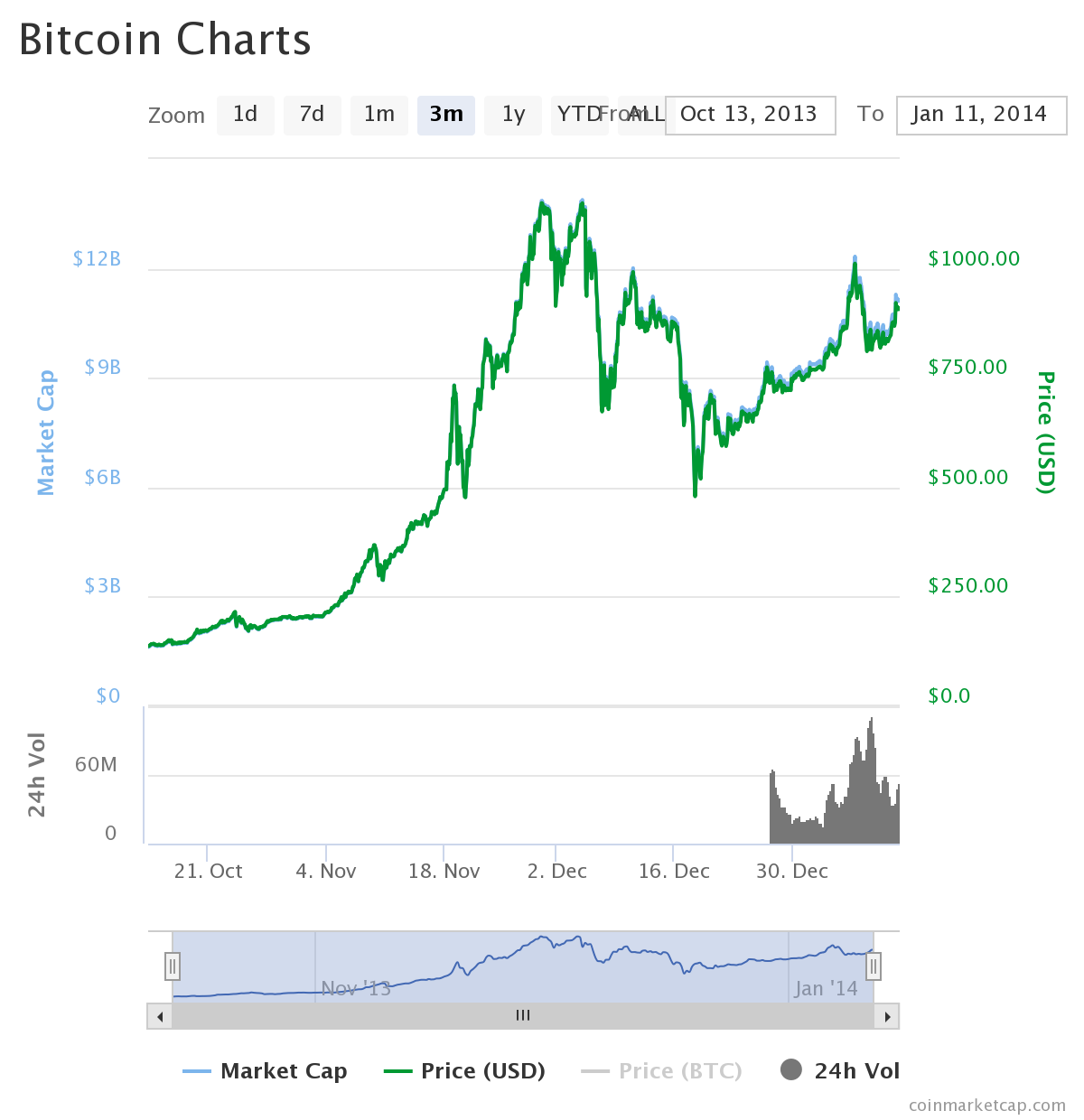

Let me explain why. Look at this snapshot of the same interval starting all the way back in mid-October of 2013. It's visually pretty similar. Mind you the percent changes are exaggerated when compared to the previous 2 charts (+450%, -55%).

.png)

Anyone that expected an iteration of the same was instead met with a nearly 2-year bear market. OMG, guys. Would you have the fortitude to hodl for the next two years losing 75% of your USD valuation on the Bitcoin? That idea is unpleasant.

Which brings me to my next point which is more of a mental exercise than a chart analysis so get ready for paradigm shifts.

2. Bitcoin is Not Bear-Proof

I can obviously tell the numerical difference between a $13B market cap and $92B market cap. But can I really provide any conceptual difference? Can I make the case that one of these numbers is bear-proof while the other is not? What's a good frame of reference here?

If Bitcoin was a company, it wouldn't be one of the top ten largest companies in the world. It wouldn't be one of the top 20 or top 50 (this being written in 4Q 2017 will change of course so please do your own homework). If the Bitcoin was a company it would be ranked at about #84 globally by market cap (according to this report). When I look through the list of companies between #1 and #83, I can't say I would be shocked to learn that many of them had slowly shrunk to nothing. So I guess could the Bitcoin. How can I prove it won't?

I hope it keeps going up just as much as anyone else. But I can't offer a non-biased rationalization why it will. If you have some reasoning to support a bullish prediction, please share. But all I've heard so far is wild-ass guessing.

I'm not trying to sway anyone against investing in crypto here. It's just a matter of expecting crazy things to happen. And finding ways to be ready.

I'm no expert on most of the things I write about, but I think you'll appreciate the perspectives I offer as I blog about cryptocurrencies, emergency response, raising children, farming, art, web development and freaking whatever else comes to mind. Thanks for reading!

Congratulations @tylr! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Even though Bitcoin has been around for more than 7 years, it is still young as a fiat alternative. With a global adoption rate of cryptos around 1%, it is still a tiny market comparing to gold, silver, and the traditional fiat systems. In a short term, the Bitcoin price will continue to remain volatile.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this comment. I agree. I think most crypto speculators like the volatility so long as the overall direction is up. How concerned are you that Bitcoin will soon see another 2-year bear market?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit