While research has shown correlation based on market structure, has the market really 'bottomed out'?

Source: pixabay

Year 2019 has been marked as a period of recovery and in the latest Binance report made a premature conclusion that the market has reached its bottom. However the report has also made several observations with regards to market trends which are critical decision factors for investors.

Cyclical movements between Cryptoassets

What has been known as market irrationality or the 'herding effect', Bitcoin prices and altcoins (below Top 10) continue to be strongly correlated. Almost 25 percent of the time, Bitcoin and altcoin prices are highly correlated at more than 0.8.

The cumulative duration of these periods totaled 513 days, or more than one-quarter of the entire sample range from 13 February 2014 to 14 March 2019, indicating that the crypto market is prone to show extreme correlations.

Source: Binance, 11th April 2019

Such trends tells us that the crypto market alongside Bitcoin continues to be associated as one single entity, often when the market reaches an all-time low. This trend is much different after Bitcoin's peak and drop in Dec 2017 where altcoins experienced a delayed price drop.

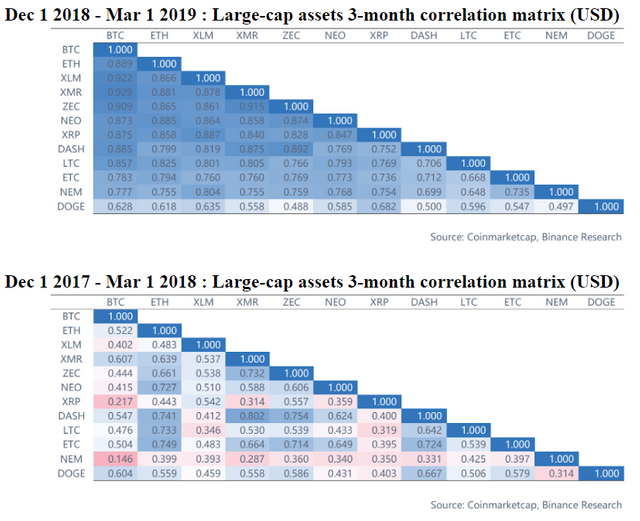

A previous report that investigated the trends show that Bitcoin's correlation to the Top 10 altcoins fluctuates. Top altcoins: ETH, XRP, BCH, EOS and LTC have seen much more fluctuations in gains and losses in the last year in the 3-month snapshots (shown below):

Source: Binance, 20th March 2019

It is a challenge to find actual a causal relationship with the lack of more data and comparisons.

Source: pixabay

High proportion of retail investors

Having only an estimated 7% of institutional investors, the small $10 billion crypto market stands out as the 'People's Market'. Most of the stock markets consists of more than 60% of institutional investors. However one of the unique stock market is China, having only 40% institutional investors.

Among the main traditional equity markets, only the structure of the Chinese stock market is somewhat similar to the cryptoasset market——in 2017, retail investors accounted for more than 99.8% of the Chinese stock market by number of accounts, more than 40% by market value, and more than 80% by trading volume.

Source: Binance, 11th April 2019

High retail investors meant higher market turnover rates. Non-institutional investors are known be more 'emotionally charged', often making decisions based on the news and media and holding positions for a shorter time. However, retail investors tend to be "more active and attentive to new market developments".

It is an exciting time for crypto investors because the market represents a group of individual investors with a voice of their own. Participation has never been simply so easily summed up in the actual prices reflected on a market. While traditional markets with a large influence from institutional investors dominate, is the people's market strong enough to represent ourselves?

This is a larger question to be unraveled in the future.

Regards appreciated @tysler

I consider your analysis very interesting.

Totally agree. I think major investors are thinking about capitalizing. While the non-institutional are trying to get the most benefit in the shortest time. We buy a small amount of some crypto expecting it to increase its value and then sell and re invest.

To achieve this, adoption levels should reach ciphers never seen before. We are 7 K million people on the planet. Only a small percentage should adopt crypto to change the reality we know.

Yours, Juan.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @juanmolina, yes I truly hope the small percentage of crpyto investors can make a larger difference in the future!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent analysis. Thanks for this post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @tysler

Although there may be a trend that in turn is registered. I think that this tendency will always be marked by man and his ambition.

That makes the difference. In any transaction of any financial nature.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @tysler

Does that mean that from now on the cryptocurrencies are going to increase their prices and have less volatility?

It has been seen that the coin that sets the tone over the others is the Bitcoin.

I didn't know that retail investor market turnover-er...

I realize that we are witnessing an era of change at all levels and cryptocurrencies are likely to become the solution of the near future. I have not yet lost hope in them.

Thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

traditional market also used to have much more turmoil and volatility in the past and through the years they have learnt to stabilize the prices and the market.

same goes for crypto or any emerging market, it takes time for take off :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's great news

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit