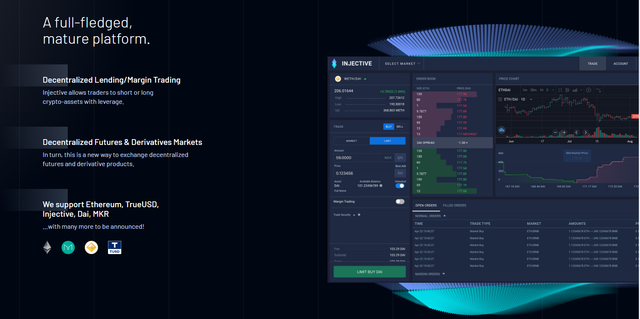

The injective protocol is an vital "evidence" of Injective. It is an open protocol that helps the improvement of open derivatives markets. It is additionally the world's first wholly decentralized P2P futures and perpetual swap contracts exchange, which helps easy get admission to to a range of markets.

According to the team, in contrast with different products of the equal type, Injective is the fastest, wholly decentralized derivatives buying and selling platform barring fuel charges in the Defi market.

Based on the Injective chain, Injective's buying and selling platform has additionally done a entirely open-source design, which approves it to be a definitely decentralized network.

It additionally offers a market-maker pleasant API interface, which is shut to the contemporary mainstream alternate interface, permitting the person trip to be comparable to that of a centralized exchange. Additionally, in the management.

Internet finance and the digital age

In this century, human civilizations have made huge development in digitizations. In simply two decades, the web has long gone via three ages: the age of the portal, the age of search/social, and the age of the internet. The non-stop improvement of the net has altered and revolutionized the methods that human beings think, behave, and interact.

Now as "data" continues to evolve as it receives produced, stored, organized, and utilized on higher levels, we begin to see a new machine with new policies slowly penetrating and seizing our world, that extra justice, fairness, cost accruals, and distributions have been demanded with the aid of all.

Given the above, that is why we are witnessing the "decentralization" of things taking vicinity and being facilitated extra passionately than ever through the universal populace.

Now as matters and human beings get related and built-in into an "unseen network," the traits of blockchain decentralization or then again you name it, have emerge as extraordinarily incentivizing for human beings to act and innovate upon.

Specifically, works have been performed on all layers of the net from, again, facts productions, storage, to functions (dApps), and of direction alongside with all the improvements come with modern commercial enterprise fashions and even "token economies."

Among the various functions of blockchain technologies, Defi, or decentralized finance has been one of the most hyped currently given the room of creativeness and schemes like liquidity mining.

Traditionally even although we did see the growth of web finance in the previous years ranging from payments, crowdfunding, neo-banks, P2P lending and more, however, non has furnished the present day anticipation of "evolution" however as a substitute simply "iteration," as they did now not trade the policies and systems.

The growth of exchanges primarily based on blockchain technology

With the software of blockchain science in asset tokenization and the buying and selling of it, many digital asset exchanges have emerged, such as Binance, Coinbase, Bitmex, etc. These accepted exchanges are additionally categorized as centralized exchanges in the blockchain and digital asset industry.

Centralized exchanges, as the title suggests, skill that the belongings deposited by using the customers are saved in the arms of the alternate owners, and matching of trades and even expenditures of merchandise are challenge to centralized controls operated on centralized servers. In different words, we, as users, do the whole thing on the platform based totally on our have confidence in the crew and group jogging it.

In comparison, the essence of decentralized exchanges is to permit customers belongings to be underneath decentralized custody, with each transaction report saved on the blockchain giving transparency and traceability. Simply put, this complete decentralization is intended to stop malicious human behaviors and to facilitate customers to have confidence in codes and technological know-how as an alternative of different human beings. Let's probe in addition in details:

Decentralized Exchange utility works

With the development of blockchain technological know-how and the emergence of greater public blockchains, there are now a range of decentralized exchanges. DEXes are extraordinary due to the fact of the numerous public blockchains they are primarily based on and their respective standards and technologies. Here we solely talk about the decentralized exchanges about the common traits.

One of the key factors of decentralized exchanges is that the change bills equate to clever contract accounts. In brief, storing property on DEX is to shop them in clever contracts which is to shop them in codes, and in codes you trust.

Generally, most DEXes will solely ask for registration some even require KYC, and it has been criticized for a platform to name itself a DEX even as asking for KYC and to deposit, withdraw, and trade:

Deposit

you credit score with the aid of transferring your property into the clever contract tackle assigned to you by means of the platform.Withdraw

withdraw from somewhere at once from the clever contract address.Trading

your asset is transferred from the clever contract address without delay to that of your counterparty. This switch can be checked on the blockchain thru the blockchain browser, and the complete switch procedure depends on the clever contract's automated execution by means of codes.

DEXes can be in addition divided into two focuses: spot and spinoff markets. Most of the DEXes in existence focuses on the spot markets, and are now not many derivatives DEXes given the complexity of economic designs improvement workloads.

However it has turn out to be palpably clear that derivatives markets have grown exponentially in the digital asset domain, and we are already seeing the next

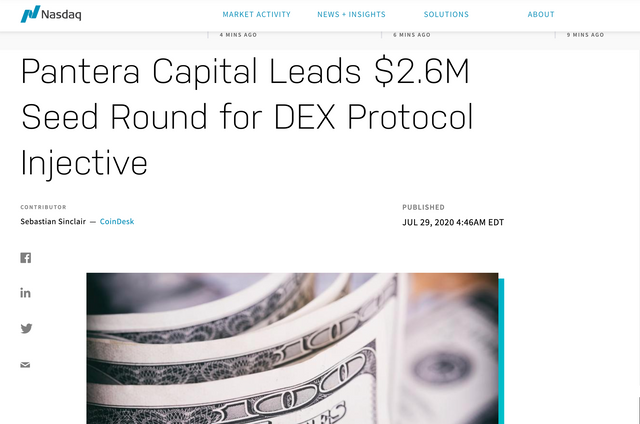

boom coming from derivatives trading. Few robust contenders that have emerged in 2020 consist of Injective Protocol, DerivaDEX, and Serum. Here let's discover Injective Protocol, which will be launched in August.

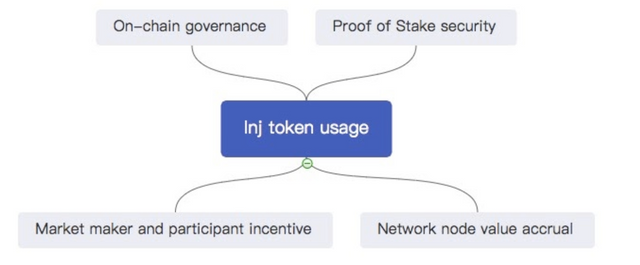

To get to the bottom of frequent problems confronted by means of DEXes such as user-friendliness, speed, and more, the Injective Protocol proposes a world solution: Injective chain, Injective derivatives protocol, and Injective DEX.

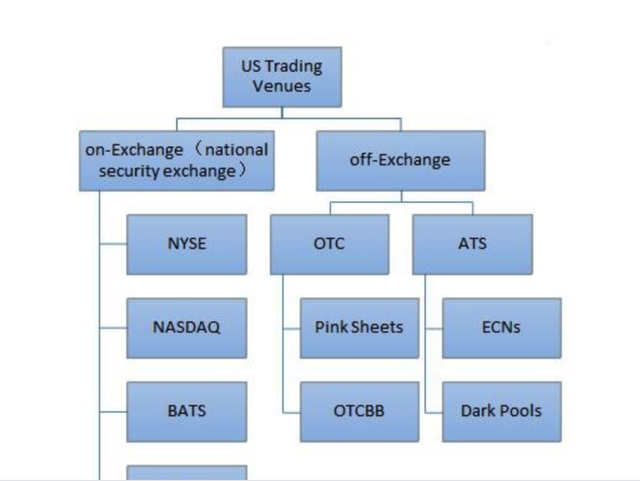

The improvement and modern-day fame of ordinary exchanges

An alternate is a buying and selling platform with various products, which presents fee discovery and liquidity for traded products. Technological developments have facilitated and effected additionally the commercial enterprise mannequin and infrastructure of the exchanges.

Not many human beings stand in offline market locations and shout out the expenditures of their items to appeal to customers nowadays, however attempt to get their items offered via digital buying and selling systems. In phrases of the commercial enterprise model, most exchanges in Europe and the United States have long past from membership-based to shape for-profit companies.

As the hub of economic activities, the improvement of exchanges is closely affected with the aid of regulatory policies. However, as science develops, guidelines loosen, and commercial enterprise competitions lift on, Alternative Trading System has emerged due to the fact that 1990 in the US Multilateral Trading Facility, including flexibility and variety to the economic world.

Official Website: https://injectiveprotocol.com

Bounty Link : https://bitcointalk.org/index.php?topic=5256993

Telegram: https://t.me/joininjective

Whitepaper Link: https://docsend.com/view/zdj4n2d

Github: github.com/InjectiveLabs

Twitter: https://www.twitter.com/@InjectiveLabs

Reddit: https://www.reddit.com/r/injective