Bitcoin Price Key Highlights......

Bitcoin cost is still in pullback mode and it would appear that bulls aren't prepared to drive it go down at any point in the near future.

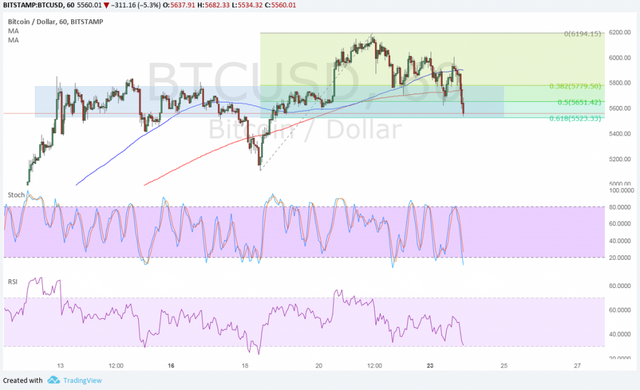

Cost is right now floating around the last lines of safeguard for the uptrend, and a break beneath this range could flag that bearish weight is back.

Nonetheless, specialized markers are as yet proposing that a skip is conceivable.

Technical Indicators Signals.....

The 100 SMA is over the more drawn out term 200 SMA so the easy way out is to the upside. This implies the uptrend will probably continue than to invert. The hole is still adequately wide to recommend that a descending hybrid or return in offering weight isn't impending.

Stochastic is progressing down yet is nearing oversold levels to demonstrate depletion among bears. RSI is likewise moving toward oversold region, so purchasers could assume control if venders enjoy a reprieve.

All things considered, bitcoin cost could in any case skip back to the swing high or make new record highs. There is as yet huge purchasing enthusiasm at this previous protection territory, which lines up with the 61.8% Fibonacci retracement level.

cool!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Follow me and vote me and will do the same to u let's help each other ok friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

why not you need to follow me and i do back

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit