Cryptocurrency market reproduces famous scams Wall Street style

When Pump and Dump Fraud schemes begin to be denounced - literally translated as "Inflate and Discard" - in the market of cryptocurrencies, the first association that emerges is the well-known film The Wolf of Wall Street, starring Leonardo Di Caprio, about the Real story of the rise and fall of the Jordan Belfort stock broker.

The scam, which focused on so-called penny stocks or shares of less than a dollar, was to inflate the price of a particular action through concerted purchases and promotion techniques among small investors (pump). Once the action in full rise reached a certain level, the scammers sold everything they had bought (dump), with significant profits. The massive sale of this action caused its price to plummet.

This type of scam is still practiced with the penny stocks despite warnings from the SEC, the US securities commission, which periodically posts on its website cases of pump and dump, including recent cases. However, after the market regulation of the so-called penny stocks, it is unlikely that a streak such as Belfort's will be repeated.

In the midst of the great rise of cryptocurrencies in 2017, there were many cases that reproduced this scam. These cases are mainly focused on little-known tokens with an important difference in methodology and lapses: the promoters of this scheme openly call for pump and dump sessions through the Telegram or Twitter messaging network, where they can count on thousands or tens of thousands of members. At the pre-established time, the coordinator reveals the name of the chosen token and the exchange house where the collective purchase will be made, announced sometimes several days in advance.

In one of these accounts, Telegram users @UltraaNY and @Insanepumps called a "megapump" on February 2, in which, according to the countdown calls, 100,000 enthusiasts divided into 30 Telegram groups participated.

In both accounts, one in Spanish and the other in English, the dynamics of the activity are appreciated. This starts after being supplied with the name of the token to inflate as a signal to begin the massive purchases and in a few minutes, the external purchases begin. In the case of the session of January 29, the designated token was MyBit (MYB), the exchange house used was Cryptopia, which is usually used by these groups.

The leaders are reporting in the chat rooms about the value of the token that goes up as the foam before the massive sale, which occurred after the token reached a volume of 17.6 BTC in the exchange house. The coordinators reported earnings of 10 times what was invested that day.

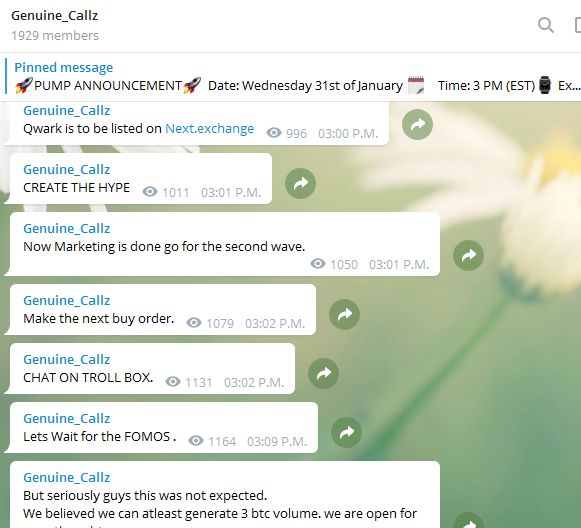

In the account of another Telegram user that seems to belong to another network of this type, @Genuine_callzadmin, the harangue of the administrator is appreciated to the almost 2,000 members of the group after giving the name of the token, Qwark, and the exchange house, Next.exchange.

There is also a second wave of purchases to stimulate potential victims. "Wait for the FOMOS" is the leader's order. External purchases come from those who, for fear of losing the opportunity offered by that promising token, acquire it at inflated prices. This is how the dump begins, spurred by online forums and key accounts on social networks.

All this is just the visible part of a huge iceberg that originated in the dark web and now shows no blushes. In the forums of bitcoin.com there is a subforum of groups of pump of Telegram with 17 pages of announcements and messages, some of them with hundreds of answers. A convincing sign that the pump and dump enjoys "very good health".

Another sign of this new group of scammers is that they do not see anything illegal in their practice, they assume it as a game or a source of adrenaline that gives stable profits. In an interview conducted by a specialized media to a "pumpeador", he confessed that he could acquire a Tesla and admits that he won "hundreds of thousands of dollars" through this fraudulent scheme. The interviewee also commented that it was not made through an unknown exchange house, but in one that is among the top ten in the CoinMarketCap ranking.

Despite how popular this activity has become in the cryptocurrency market, it is worth noting that it is an illegal activity in the stock market and that it can be punished with fines and jail. However, the legal vacuum on which the use of cryptoactives and their markets still rests has given the promoters of these schemes an opportunity to generate tremendous profits easily.