Before I start introducing some of my preferred indicators for TA (Technical Analysis), I would like to point out that you don't need to use them to achieve successful trades, notwithstanding, they can be helpful to your analysis and add more depth to it.

There is a plethora of indicators you can choose from and add to your arsenal, but it is always better to have few weapons you truly master than having plenty you can't use.

Considering the cryptocurrency markets operate 24/7 you will need to adjust your indicators and their inputs accordingly.

Bollinger Bands

Bollinger Bands (BB) are a widely popular technical analysis instrument created by John Bollinger in the early 1980s.

Bollinger Bands consist of a band of three lines which are plotted in relation to security prices. The line in the middle is usually a Simple Moving Average (SMA) set to a period of 20 days ( you can change the type of trend line and period, however a 20 day moving average is by far the most popular).

The SMA then serves as a base for the Upper and Lower Bands which are used as a way to measure volatility by observing the relationship between the Bands and price. Typically the Upper and Lower Bands are set to two standard deviations away from the SMA (The Middle Line), however the number of standard deviations can also be adjusted.

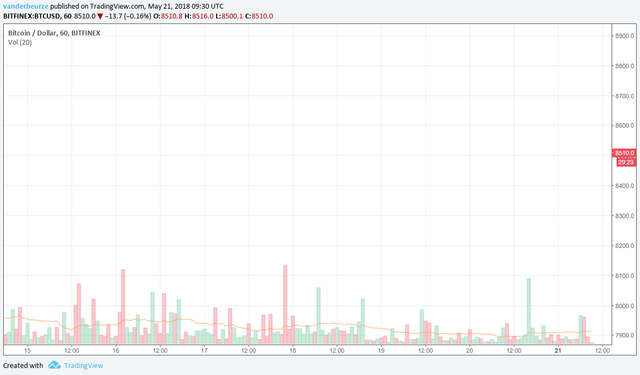

Volume

Volume-based indicators give information about the amount of traded contracts or lots. It is one of the few types of indicators that base their value not solely on price.

Volume obviously depends on the selected period. The amount of a security that is traded at any given time can give an indication as to whether the trend is likely to continue or might reverse. It shows at which prices traders open their trades. An increase in volume usually precedes an emerging trend and a drop in volume usually precedes an ending trend.

Interesting situations are created when the price makes new highs or lows while the volume drops. This price - volume divergence could point to a trend reversal.

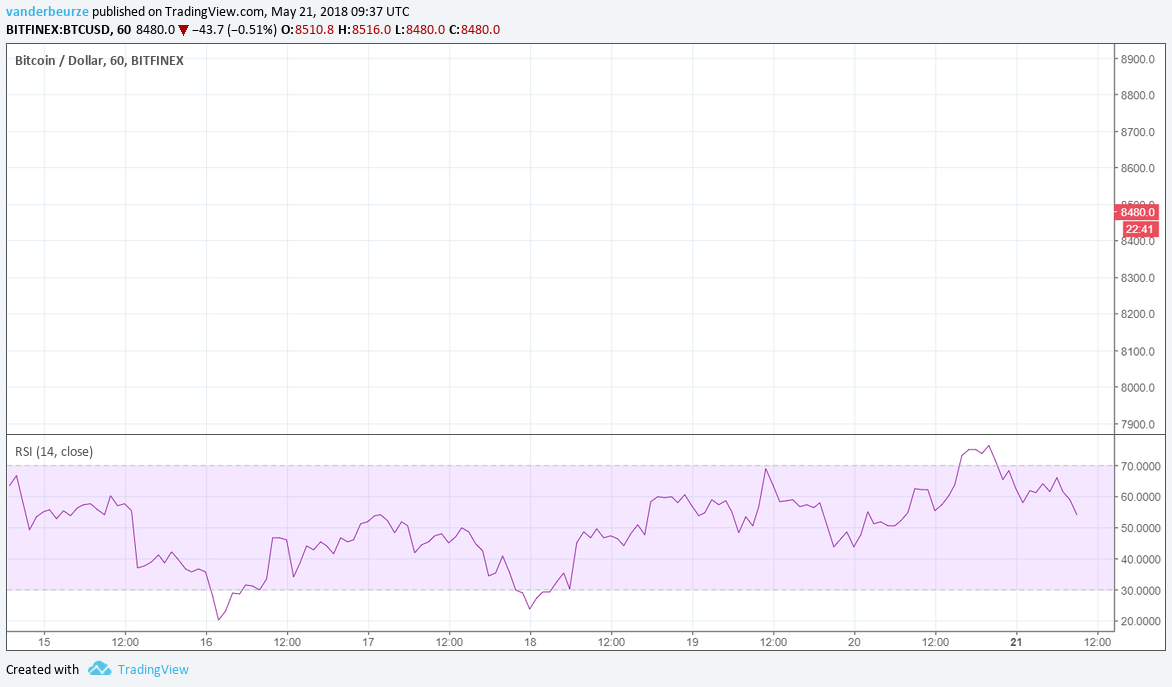

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a well versed momentum based oscillator which is used to measure the speed (velocity) as well as the change (magnitude) of directional price movements.

Essentially the RSI, when graphed, provides a visual mean to monitor both the current, as well as historical, strength and weakness of a particular market.

The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. Given the popularity of cash settled instruments (stock indexes) and leveraged financial products (the entire field of derivatives); RSI has proven to be a viable indicator of price movements.

Thank you for reading my article and I hope you’ve found it instructive.

Source: Trading View

I would appreciate your feedback and your vote very much.

Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment.

For Educational Purposes Only.